Is the Crypto Sell-Off Just Starting? Raoul Pal Flags US Liquidity Crisis From Govt. Shutdown

Highlights

- Raoul Pal says the ongoing crypto sell-off is driven by a U.S. liquidity crunch, not crypto-specific weaknesses.

- He links the market downturn to repeated U.S. government shutdowns.

- Bitcoin continues to slide amid heavy spot ETF outflows.

The crypto sell-off currently seen in the market could still get a lot worse amid weakening market fundamentals. Raoul Pal shared his concerns about the current liquidity crisis in the United States due to the government shutdowns.

Raoul Pal Links Crypto Sell-Off to Liquidity Drought

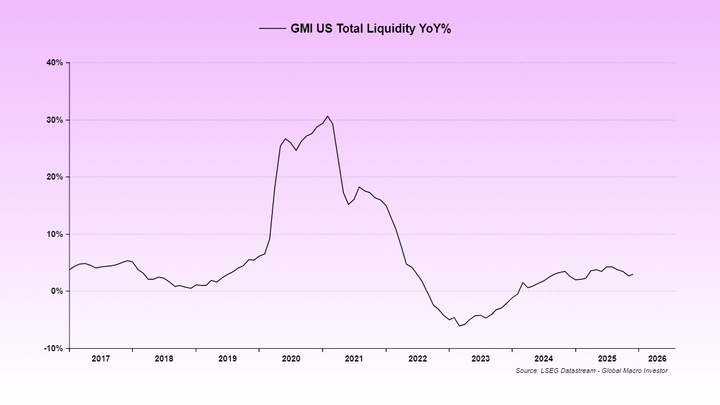

In a recent X post, Raoul Pal, CEO and founder of Global Macro Investor, shared that the current market crash is not related to any crypto-specific issues. He said the market should be on an upward trajectory, but the current U.S liquidity crisis is a major reason why it is being held back.

He specifically highlighted the two U.S government shutdowns as major causes for the crypto sell-off. Pal, however, maintained positivity that this could end this week and solve one of the issues affecting liquidity.

“That factor is that US liquidity has been held back due to the 2 shutdowns and issues with US plumbing (the drain of the Reverse Repo was essentially completed in 2024),” he said. “However, the signs are that this shutdown will get resolved this week and that is the FINAL liquidity hurdle out of the way.”

The U.S government went into another shutdown last Friday despite the Senate reaching a deal on its funding bill. The passing of the bill needed to be approved by the House, which was not going to be in session till later this week.

Additionally, the founder dismissed the narrative that the crypto sell-off is happening because of Trump’s Fed chair pick, Kevin Warsh. Some experts claimed that Warsh would not cut rates as expected, labeling him hawkish. However, Pal highlighted that the claims are absolutely baseless.

“Warsh will cut rates and do nothing else. He will get out of the way of Trump and Bessent who will run liquidity via the banks.”

BTC Continues Downtrend Amid Bitcoin ETF Outflows

At press time, the BTC price has added another 2% to its losses, now trading at around $76,000. This is a sharp change from its initial upward momentum seen about two weeks ago. The coin is also trading below the average cost of spot Bitcoin ETFs after it saw one of its biggest crypto ETF sell-off weeks in January.

In the last two weeks, the ETFs recorded at least $2.8 billion in outflows. This sell off from institutions further added to the bearish sentiment in the market. The total assets under management have now dropped by 31% since October.

However, Raoul Pal ended his analysis on a bullish note. He shared that the factors holding the market back are almost over, and the bull market for 2026 would kick off soon.

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible