Is XRP Selling Pressure Easing? Here’s What On-Chain Data, ETF Flows Signal

Highlights

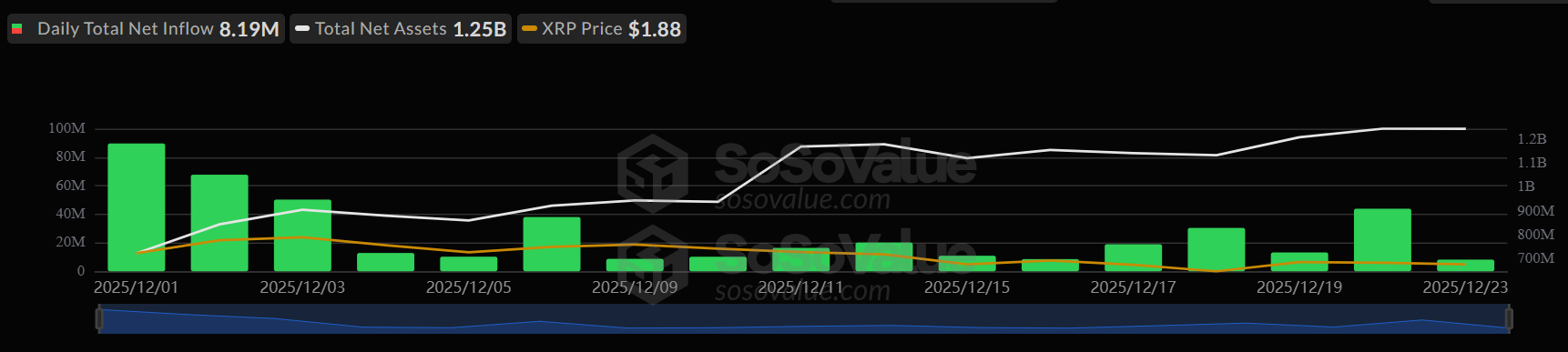

- Spot XRP ETFs inflow streak continues, with $8.19 million in inflows on Tuesday.

- Steep decline in XRP Exchange Reserve on Binance signal potential end of selling pressure.

- XRP price needs to hold $1.80 to prevent a crash to $1

XRP price has remained in a downtrend for nearly 6 months amid massive selling pressure from whales and long-term holders. However, recent on-chain data and continued inflows into XRP ETFs suggest the intense selling pressure may likely subside, which is in contrast to technical charts.

Spot XRP ETFs Continue Inflows Streak

US-listed Spot XRP ETFs have recorded no outflow yet since last month’s launch. The total net inflow reaches $1.13 billion, with the total assets under management (AUM) hitting $1.25 billion.

XRP ETFs saw net inflows of $8.19 million on Tuesday, marking the 28th consecutive day of inflows since launch. According to SoSoValue data, only Franklin Templeton’s XRPZ saw inflows, while others recorded no inflows due to low trading amid the holiday season.

Until now, Canary Capital’s Spot XRP ETF (XRPC) leads with net inflows of $384 million, followed by Bitwise and Grayscale XRP ETFs.

Meanwhile, CoinShares flows data signaled institutional investors’ rotation to XRP ETF from Bitcoin and Ethereum ETFs amid favorable developments and the community’s sentiment.

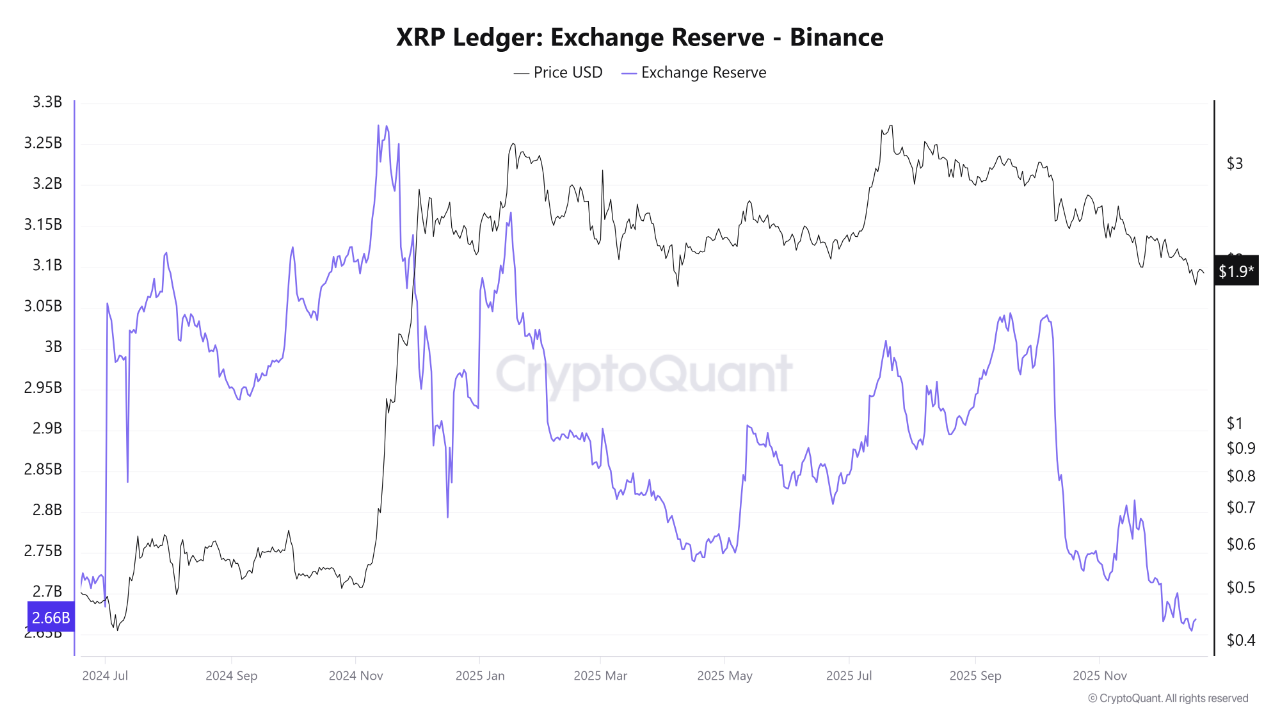

Price to Rebound on Fall in Exchange Reserve on Binance?

CryptoQuant’s XRP Exchange Reserve metric shows a decline in Binance’s reserves to 2.6 billion. This marks the lowest exchange balance on the largest crypto exchange Binance since July 2024.

It signals a potential end of selling pressure and paving the way for a bullish reversal. Typically, a significant decrease in exchange reserves indicates investors and whales are moving assets off exchanges into self-custody, creating a supply shock.

The XRP Whale Flows 30-DMA also shows easing of whale selling pressure. However, it still remains in the negative territory.

Bulls need to hold the crucial demand zone between $1.80 and $1.90 will preserve the broader bullish structure. Meanwhile, the Relative Strength Index (RSI) is hovering in its lower range, but a clear bullish reversal is yet to be confirmed.

As CoinGape reported, veteran trader Peter Brandt expected a bearish double-top pattern on the weekly chart to fail if XRP price bounces from oversold RSI levels. If buyers fail to defend the $1.80 level, it would invalidate the bullish on-chain and technical narrative and cause a crash to $1.

At press time, XRP price is trading at $1.85, down more than 1% in the last 24 hours. The intraday high and low are $1.90 and $1.84, respectively. Trading volume has decreased by 19% over the past 24 hours.

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards