January Fed Rate Cut Odds Fall to New Lows After Strong U.S. Q3 GDP Report

Highlights

- There is now only a 13% chance that the Fed will cut rates in January.

- This follows the stronger-than-expected U.S. GDP report.

- The first rate cut of the year is expected in April.

Market participants, including crypto traders, have further pared their bets on a January Fed rate cut following the release of the U.S. GDP report today. This is significant considering how the rate cuts this year sparked massive rallies to new highs for Bitcoin, which is now undergoing a liquidity squeeze as the year comes to an end.

January Fed Rate Cut Odds Fall To 13%

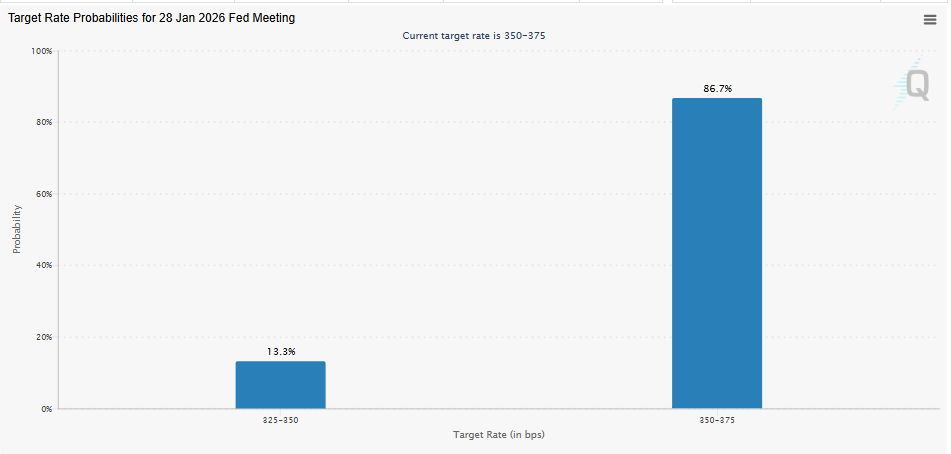

CME FedWatch data show a 13.3% chance of the Fed lowering rates by 25 basis points (bps) in January. Meanwhile, there is an 86.7% chance that the Fed will keep rates unchanged at the January FOMC meeting.

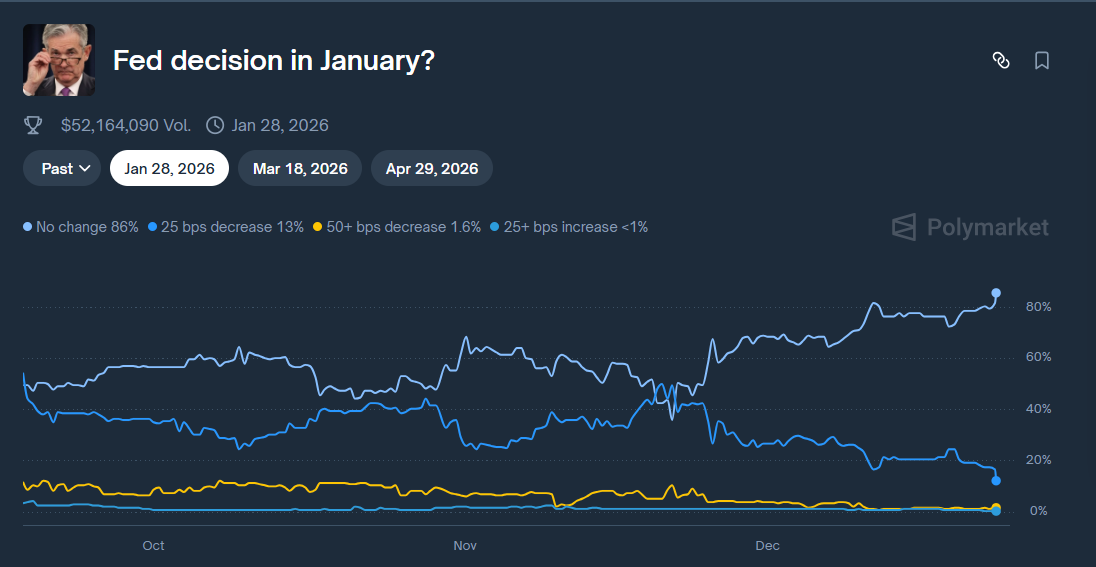

Polymarket data also shows that crypto traders are currently betting against a January Fed rate cut. There is currently only a 13% odds on Polymarket that the Fed will lower rates by 25 bps, while there is an 86% chance that interest rates will remain unchanged.

This development follows the release of the U.S. Q3 GDP report, which came in stronger than expected. The GDP rose to 4.3% in the third quarter of this year, higher than estimates of 3.3% and the 3.8% recorded in the second quarter.

This suggests that the U.S. economy is strong and that there is no reason for another Fed rate cut for now to stimulate the economy. However, Fed Governor Stephen Miran recently urged his colleagues to make more cuts in 2026 to avoid a recession.

Meanwhile, the drop in the odds of a January cut comes after the Fed cut rates three times this year, and the U.S. central bank is now likely to adopt a wait-and-see approach to incoming data. New York Fed President John Williams stated that the three cuts this year have put them in a good position, and so, he doesn’t see any urgency to make more cuts soon.

First Cut To Come in April

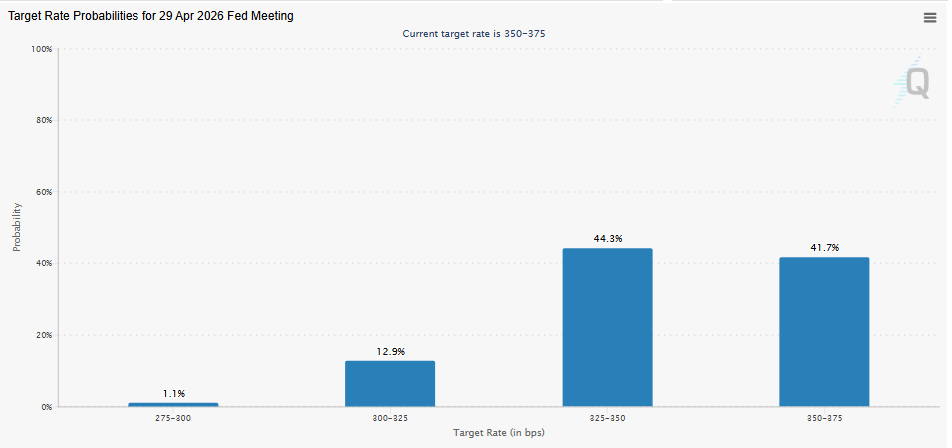

CME FedWatch data shows that the first Fed rate cut is likely to come in April. There is a 44.3% that the Fed will lower rates by 25 bps, with interest rates falling from between 3.5% and 3.75% to 3.25% and 3.5%.

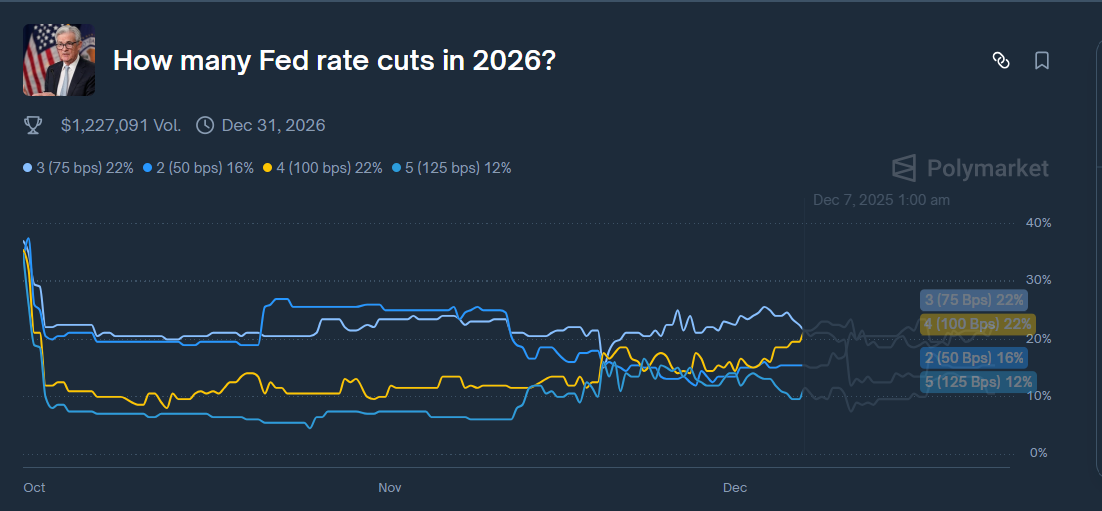

However, there is a 41.7% chance that the interest rates could remain unchanged at the April FOMC meeting. Meanwhile, crypto traders on Polymarket are betting that the Fed will make three or four rate cuts next year. There is a 22% chance of 3 or 4 rate cuts in 2026, while there is a 16% chance of 2 cuts.

Fed President Austan Goolsbee said he is optimistic about additional Fed rate cuts in 2026, projecting more than the median projection of just one cut. However, he would like to see inflation come down before they make more cuts.

U.S. Treasury Secretary Scott Bessent has proposed that the Fed revise its inflation targets from 2% to between 1.5% and 2.5% or 1% and 3%. This comes as the Trump administration continues to push for larger cuts.

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Stripe Eyes PayPal Acquisition Amid Stablecoin Expansion

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card