Jerome Powell Signals More Fed Rate Cuts As Labor Market Weakens, Bitcoin Jumps

Highlights

- Powell stated that nothing much has changed since the September Fed meeting.

- This indicates that they are still likely to make more cuts due to the weakening labor market.

- Bitcoin rose above $112,000 as Powell gave his speech.

Federal Reserve Chair Jerome Powell adopted a dovish tone on monetary policy, citing growing risks in the labor market. His remarks signaled the likelihood of another rate cut at this month’s FOMC meeting, sparking a rebound in Bitcoin price.

Jerome Powell Signals More Fed Rate Cuts, Bitcoin Rebounds

Speaking at the Annual Meeting of the National Association for Business Economics, the Fed Chair said that the outlook for employment and inflation does not appear to have changed much since their September meeting, based on the data they have. This suggests they are likely to make another cut at the October meeting, given the Fed’s concern about growing risks in the labor market.

As CoinGape reported, the FOMC minutes showed that the committee made the first cut last month due to the weakening labor market. During his speech, Jerome Powell again reiterated that the downside risks to employment appear to have risen.

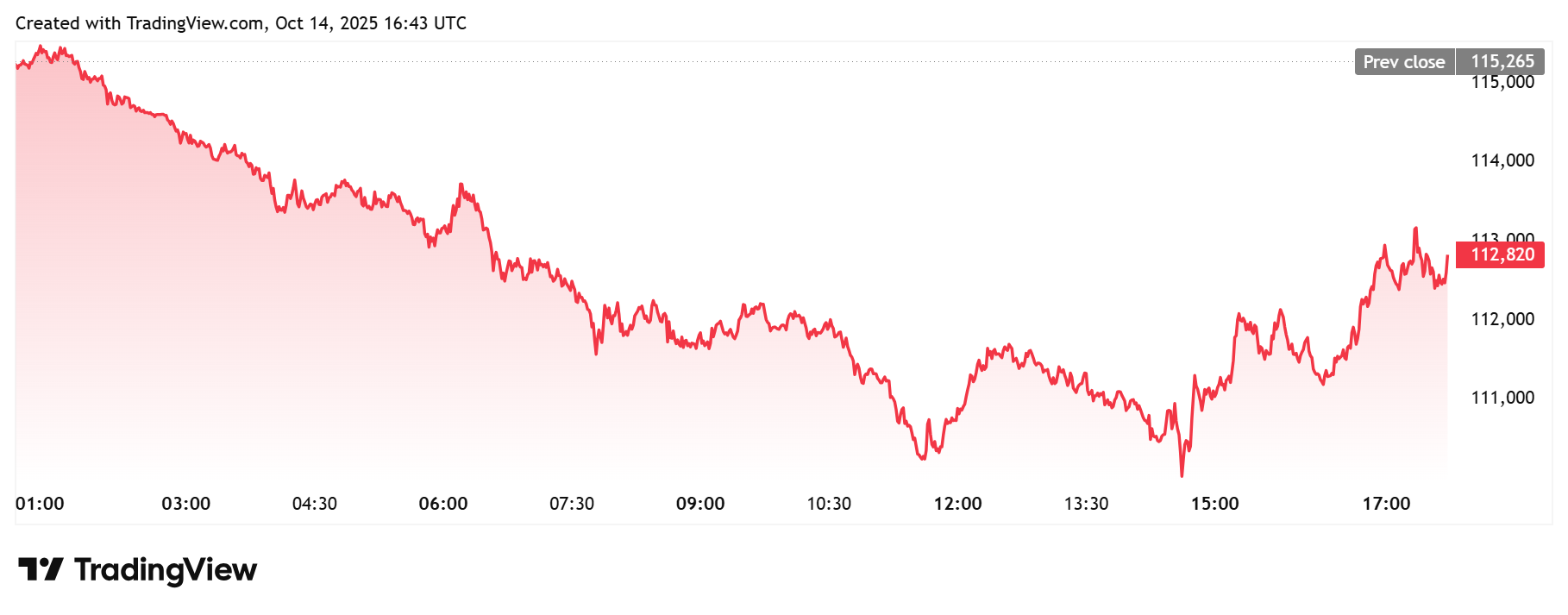

The Bitcoin price rose amid the Fed chair’s speech, as market participants continued to price in another rate cut amid the dovish shift. TradingView data shows that BTC has broken above $112,000 and is currently trading around $112,800 at press time.

The BTC price had earlier in the day dropped to as low as $110,000 as market participants awaited Jerome Powell’s speech. The flagship crypto has also suffered this downtrend due to concerns about a potential trade war between the U.S. and China.

However, the Fed chair’s dovish tilt is a positive for Bitcoin, as another rate cut could further boost liquidity in the market. It is worth mentioning that BTC had already rallied to a new all-time high (ATH) above $126,000 earlier in the month as traders began to price in an October cut.

Another positive was that Jerome Powell indicated the Fed may soon stop shrinking its balance sheet, signaling a shift from quantitative tightening to easing. He stated that they may approach that point in the coming months where they stop the balance sheet runoff.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Joins Mastercard Crypto Partner Program to Advance On-Chain Payments

- Breaking: Crypto Prices Jump As IEA Members Agree To Release Record 400M Barrels Of Oil

- Breaking: U.S. CPI Holds Steady at 2.4% as Iran War Raises Inflation Concerns

- Bitget Launches GetClaw Agent as Exchange Integrates AI Tools For Crypto Trading

- Breaking: Binance Sues WSJ For Defamation Over Iran Sanctions Article as DOJ Opens Probe

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?