Just-In: Crypto Funds Record Another Week Of Inflow, Bitcoin Monthly MACD Turns Green

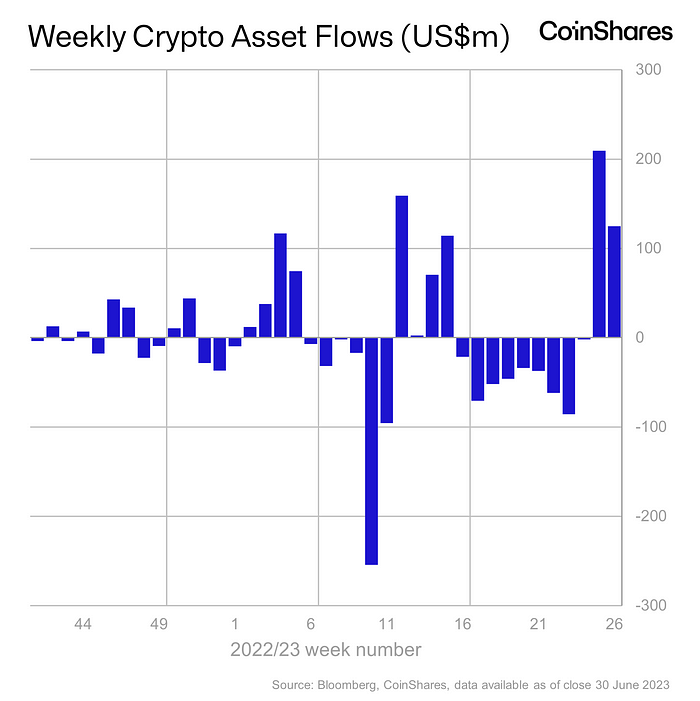

Institutional and retail investors remain bullish on crypto as digital asset investment products saw a second week of massive inflows. Crypto funds recorded a total of $334 million of inflow in the last two weeks, a $199 million inflow an earlier week and a $125 million inflow last week. Bitcoin again remains the favorite of investors, recording $123 million in inflows.

Bullish Sentiment on Crypto Continues

According to CoinShares data, crypto asset inflow for the week ending July 2 was $125 million. Another week of inflow brings the total inflows in the last two weeks to $334 million, almost 1% of total assets under management (AUM).

Bitcoin again recorded the largest share of inflows worth $123 million. However, short Bitcoin investment products saw a 10th week of successive outflows despite a recent price jump, with this week’s outflow of $0.9 million.

“Bitcoin remained the primary focus of investors, seeing inflows of US$123m, with the last 2 weeks inflows representing 98% of all digital asset flows. Bitcoin investment products are now back to a net inflow year-to-date having been in a net outflow position of US$171m just 2 weeks ago.”

Investors were also interested in top altcoins including Ethereum, Litecoin, XRP, and Cardano. ETH led with inflows worth $2.7 million. Meanwhile, blockchain equities also saw inflows of $6.8 million following a 9-week run of outflows amid positive sentiment.

ProShares ETFs, Purpose Investments, ETC Issuance GmbH, and CI Investments recorded the most inflows last week.

Also Read: Shiba Inu Official Predicts BONE Price At $3 As Shytoshi Kusama Hints At Shibarium Launch

Bitcoin Price More Bullish As Monthly MACD Turns Green

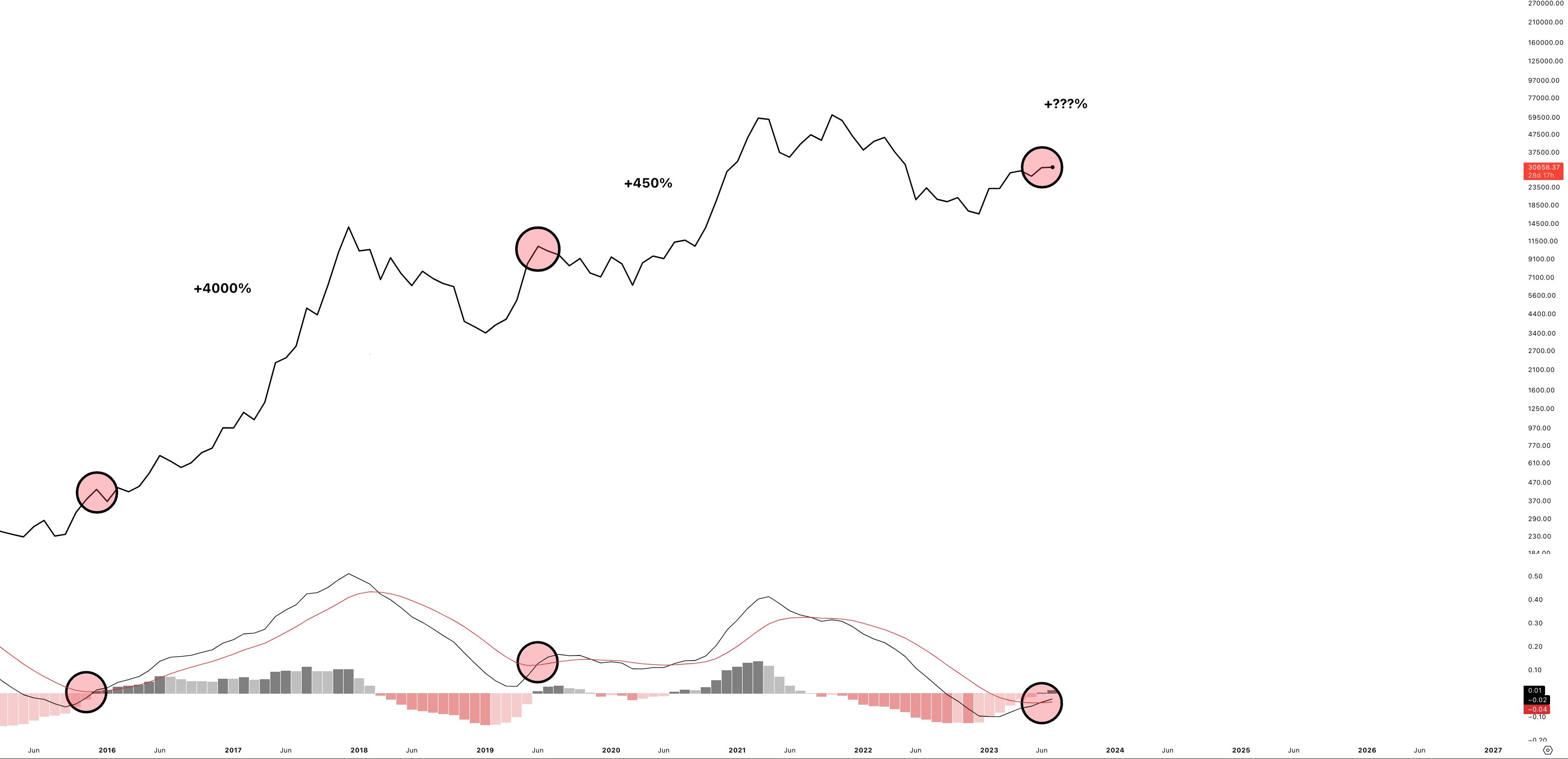

Bitcoin MACD indicator has turned green in the monthly chart, indicating massive upside moves in the next few months. It also confirms the start of a bull market.

Historically, this signal has triggered bull markets in the last two incidences, recording 4,000% and 450% gains. Crypto experts and Bloomberg’s analysts are already bullish on Bitcoin price hitting $40,000.

BTC price moving sideways in the last few days, with price currently trading at $30,637, up 0.5% in the last 24 hours. The 24-hour low and high for Bitcoin are $30,264 and $30,789, respectively. Meanwhile, ETH price jumps more than 2% in the past 24 hours, currently trading at $1962.

Also Read: Terra Luna Classic Community Passes Three Crucial Proposals

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- UAE’s Second Largest Bank Eyes Bitcoin Allocation, Backs Tokenization

- Crypto Group Proposes Tax Rules To Boost Innovation As CLARITY Act Talks Progress

- XRP News: SBI Ripple Explores XRPL for Cross-Border Payments in Strategic Research

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

Claim Card

Claim Card