Just-In: Indian Central Bank Head Bashes Crypto After Latest Crash

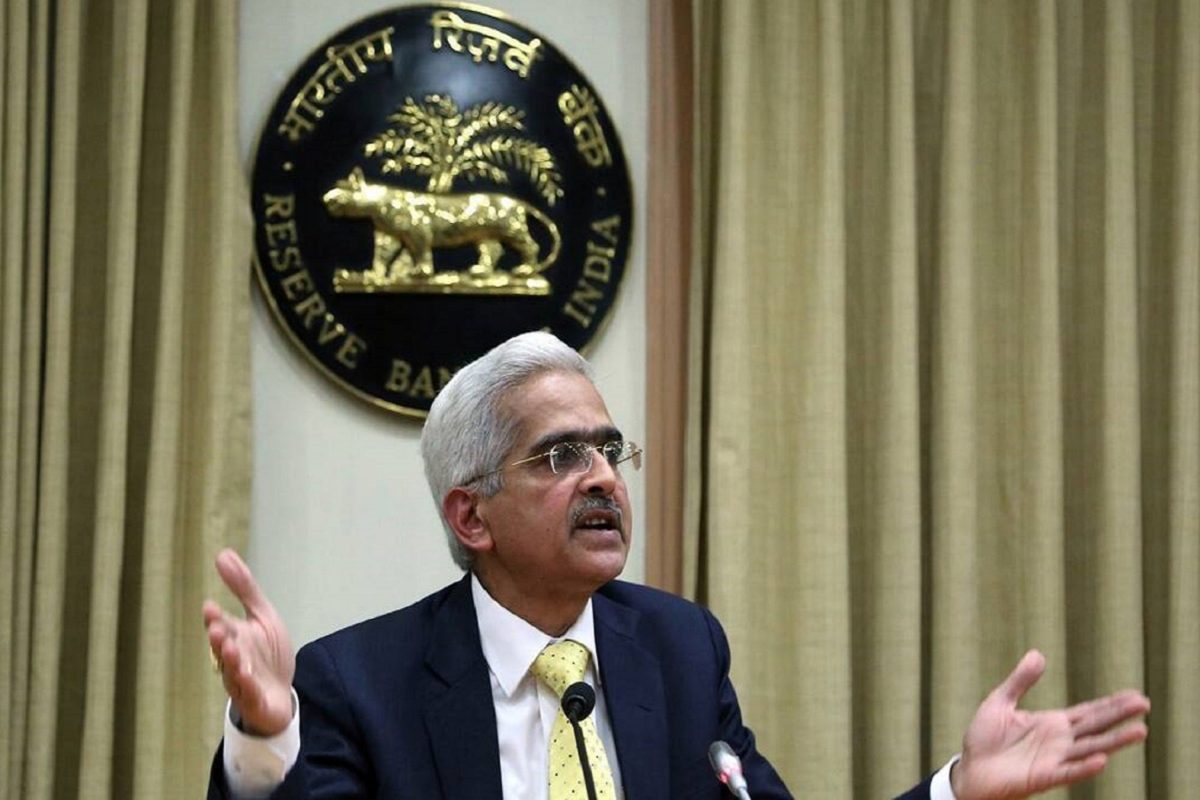

Reserve Bank of India’s (RBI) Governor Shaktikanta Das on Monday has reaffirmed his negative stance on crypto. RBI had always raised concerns that cryptos will undermine the monetary, financial, and macroeconomic stability of India. In fact, investors and the government had been warned against cryptocurrencies, which have now crashed immensely.

In addition, RBI Governor hints at announcing an interest rate hike in the next monetary policy meetings in June.

“Crypto Lacks Value” – RBI Governor Shaktikanta Das

In an interview with CNBC-TV18 on May 23, RBI Governor Shaktikanta Das said investors were warned against volatility in the crypto market, which has now made several investors lose money.

“We have been cautioning against crypto and look at what has happened to the crypto market now. Had we been regulating it already, then people would have raised questions about what happened to regulations.”

Furthermore, he thinks regulating cryptocurrencies is a difficult task as they have no underlying value. Recently, Indian Finance Minister Nirmala Sithraman also made a strong case for regulating cryptocurrencies at a global level to mitigate risks such as money laundering and terror financing.

The Indian government and RBI seem to agree over cryptocurrencies hold no underlying value. The concerns of RBI and the Indian government are rising amid increasing crypto adoption in India.

“We have conveyed our position to the government and they will take a considered call. I think the utterances and statements coming out from the government are more or less in sync.”

Meanwhile, Deputy Governor T. Rabi Sankar had also attacked crypto. He claims to ban crypto trading as it is worse than Ponzi schemes. However, RBI has not imposed any shadowban on crypto exchanges after the Supreme Court in 2020 turned down RBI’s ban on cryptocurrencies.

U.S. and European Union Stance on Cryptocurrencies

The regulators and financial bodies worldwide have turned cautious as the crypto market crashed and stablecoins destabilized. In fact, U.S. SEC Chair Gary Gensler expects more crypto turmoil could undermine confidence in traditional markets. The crypto market requires more oversight. Meanwhile, European Central Bank’s President Christine Lagarde asserts crypto is worthless and needs regulatory oversight.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?