Keep These Two Altcoins on Radar for Coming Months, Where’s Bitcoin (BTC) Positioned?

Over the last week, the broader cryptocurrency market has seen a strong bounce-back adding over $100 billion to investors’ wealth. Bitcoin (BTC) has been leading the market rally with over 13% gains on the weekly chart with altcoins offering strong support.

The macro headwinds in recent times have kept investors confused about where the market is heading further. However, as per the technical charts, two altcoins seem to be poised to deliver strong gains ahead.

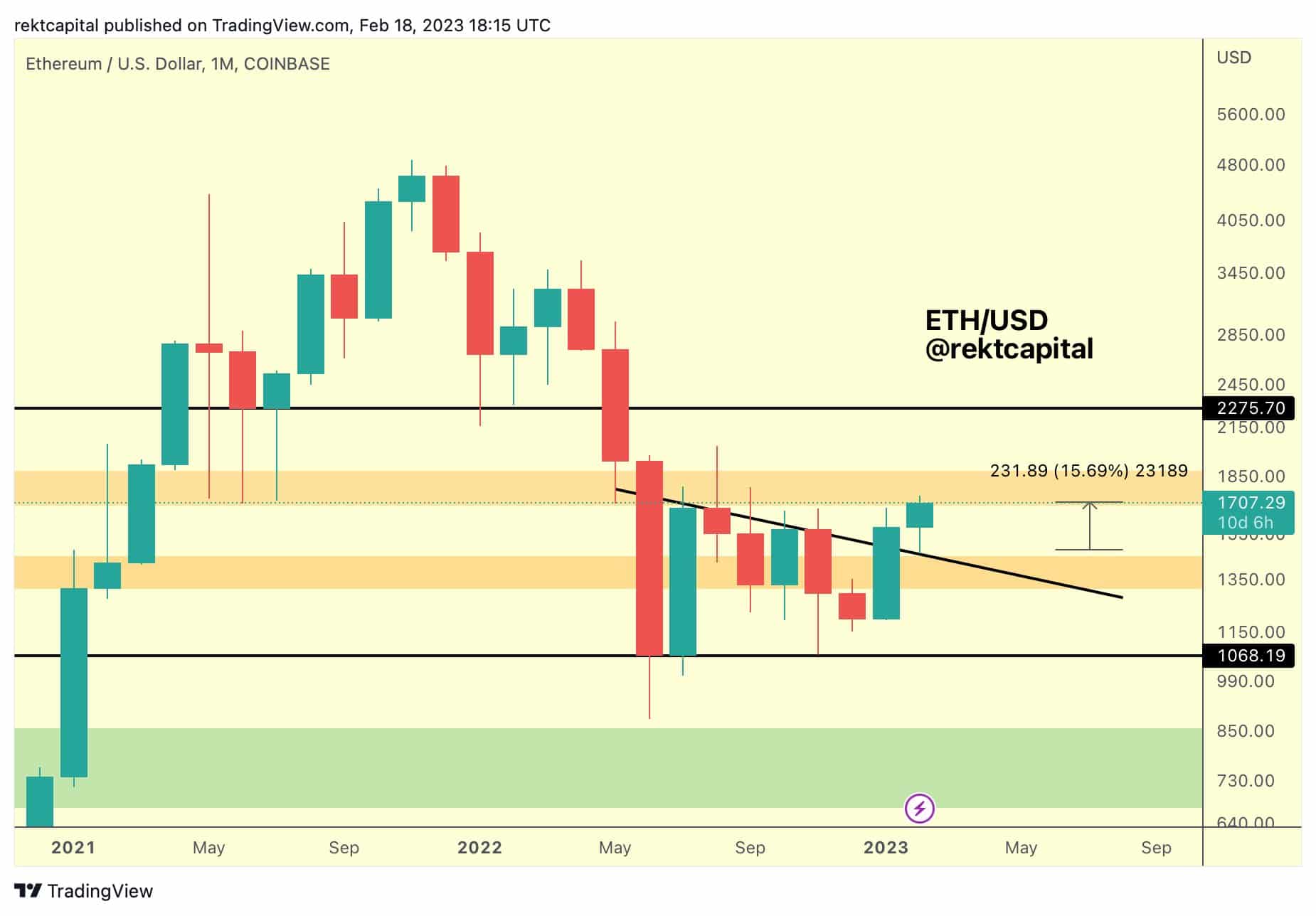

Earlier this weekend, the ETH price gave a strong move above $1,700 with on-chain data showing strong accumulation from sharks and whales. As of press time, ETH is trading at $1,704 holding above the crucial support. Popular crypto analyst Rekt Capital noted that with the recent move, ETH has given a multi-month breakout. As the multi-month downtrend ends, ETH is likely to resume its multi-month uptrend ahead.

Another altcoin that’s showing strong moves recently is Chainlink (LINK). Over the last week, the LINK price has surged by more than 17% showing strength. Rekt Capital notes:

LINK has rallied +26% since its successful retest of the Range Low area as support LINK is now positioning itself for a bullish Weekly Close As long as price holds just like this, it could even overextend to the red diagonal resistance above.

Another popular crypto trader Michael Van de Poppe writes: “Opportunity of a lifetime. Slightly breaking out, if we get a retest around $7.80 I would be happy to long, resistance around $8.50-9.00, before we continue towards $15-20”.

Where’s Bitcoin Positioned With These Altcoins?

The world’s largest cryptocurrency Bitcoin is holding firmly to its weekly gains, however, a close above $25,000 could set it up for the next upside move. As of press time, Bitcoin is trading at $24,831.66 with a market cap of $479 billion.

Thus, it is just marginally higher than its 200-day moving average of $24,774. If BTC manages to give a weekly close above this, it will turn bullish.

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards