Kevin Warsh’s Fed Chair Odds Rise as Trump Implies Hassett Isn’t Powell’s Successor

Highlights

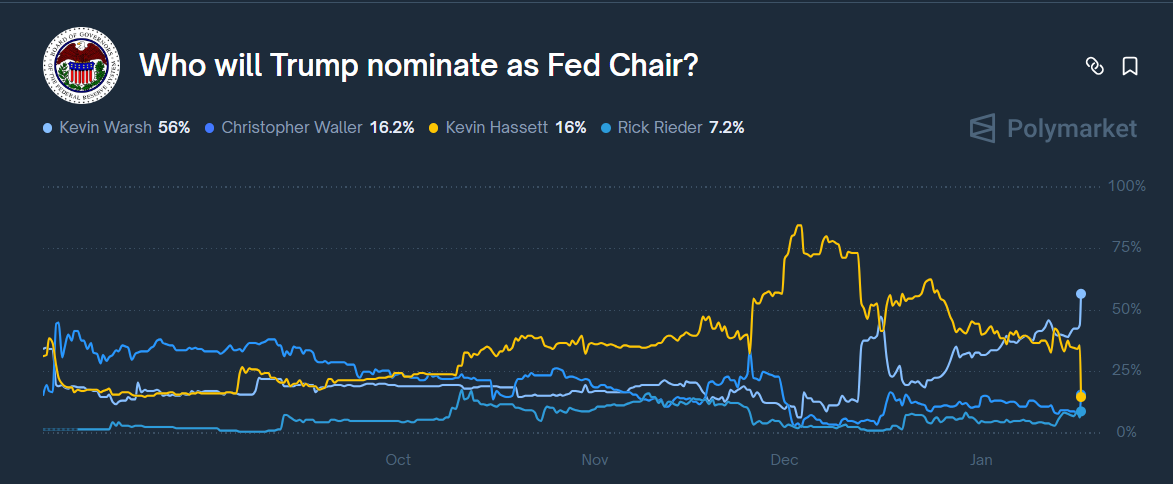

- Kevin Warsh's odds of being the next Fed Chair has surged above 50%.

- This followed Trump's statement that he wants to keep Hassett as the NEC Director.

- Hassett's odds dropped from around 35% to below 20% following Trump's statement.

Former Federal Reserve Governor Kevin Warsh is now the clear favorite to become the next Fed chair. This follows U.S. President Donald Trump’s statement suggesting he won’t pick his advisor, Kevin Hassett, to succeed Jerome Powell.

Kevin Warsh’s Fed Chair Odds Rise After Trump’s Statement

Polymarket data shows a 56% chance that Trump will nominate Warsh as the next Fed chair. This development makes the former Fed governor the clear favorite to succeed Powell as the head of the U.S. central bank.

The surge in Warsh’s odds follows Trump’s statement at the Rural Health Roundtable event, in which he cast further doubt on nominating National Economic Council (NEC) Director Kevin Hassett for the role.

“I actually want to keep you where you are,” the U.S. president said about Hassett. While referencing his Chief of Staff, he added, “We don’t want to lose him, Susie, but we’ll see how it all works out.”

The president also indicated that he would like to keep Hassett at the White House because of his communication skills. He noted that the current Fed officials don’t talk much, but that his advisor is good at talking.

Turnaround In The Race To Succeed Powell

This marks a huge turnaround, as Hassett had been the clear favorite to replace Powell up until the start of December last year, when his odds rose above 80%. However, the Fed chair race began to tighten towards the end of the year, when Hassett’s odds fell before 50%.

Notably, crypto traders are even favoring Fed Governor Chris Waller to get the nod ahead of Hassett following Trump’s comments. There is a 16.2% chance that the U.S. president could nominate Waller, while Hassett has a 16% chance.

Meanwhile, there is a 7.2% chance that Trump will nominate BlackRock’s CIO, Rick Rieder, to replace Powell. Rieder’s Fed chair odds rose following his statement in support of the Fed lowering rates to 3%.

It is worth noting that Hassett, Waller, and Rieder have all stated their support for lower interest rates, which aligns with Trump’s vision. However, Warsh has remained relatively silent and has not addressed his stance on rate cuts, although Trump stated that the former Fed governor largely agrees with him on lower rates.

The markets reacted to Trump’s statement, as crypto traders priced in the possibility of a less dovish Fed under Warsh’s leadership. The BTC price dropped below $95,000, down almost 2% on the day.

Other assets also dropped, with gold, silver, and the Nasdaq dumping following the development.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs