Litecoin bulls regaining control after crucial support, but on-chain metrics reveal immense resistance ahead

- Litecoin rebounded from crucial support between $68 and $70 but has stalled under $75.

- LTC/USD is likely to settle for consolidation between $68 and $75 ahead of a potential breakout.

Litecoin price hit a barrier marginally under $80 following a 23% spike in just two days. The sixth-largest cryptocurrency retreated to establish and confirm support between $68 and $70. A reversal is underway, and Litecoin seems poised for another breakout to $80.

The current trend is bullish after the initial support mentioned above encouraged more buyers to hold ground. An increase in trading volume suggests that volatility could continue to swing in the bullish direction.

Meanwhile, Litecoin is trading at $74.4 amid a developing bullish momentum. A step above the immediate key resistance at $75 might boost the price even further towards $80. The upward moving simple moving averages also validate the uptrend and reinforce the bullish control over the price.

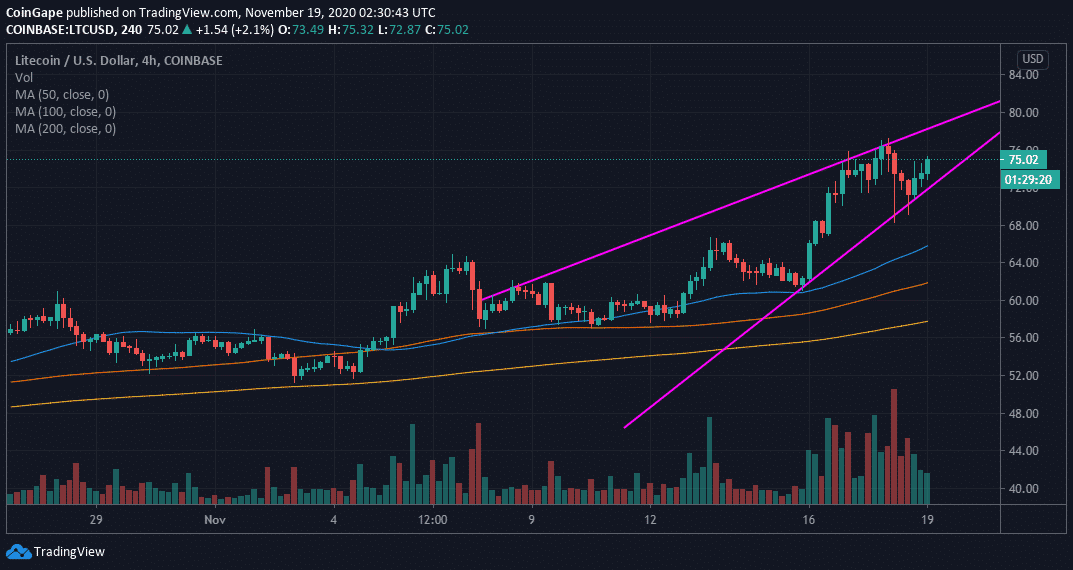

LTC/USD 4-hour chart

Despite the bullish outlook, a zoomed out 4-hour chart reveals an ascending wedge pattern. These patterns are common in technical analysis and highlight a decreasing buying pressure and a potential correction. If Litecoin is rejected at $75 or the recently traded monthly high of $77, losses likely to come into the picture could revisit the 50 SMA at $65.

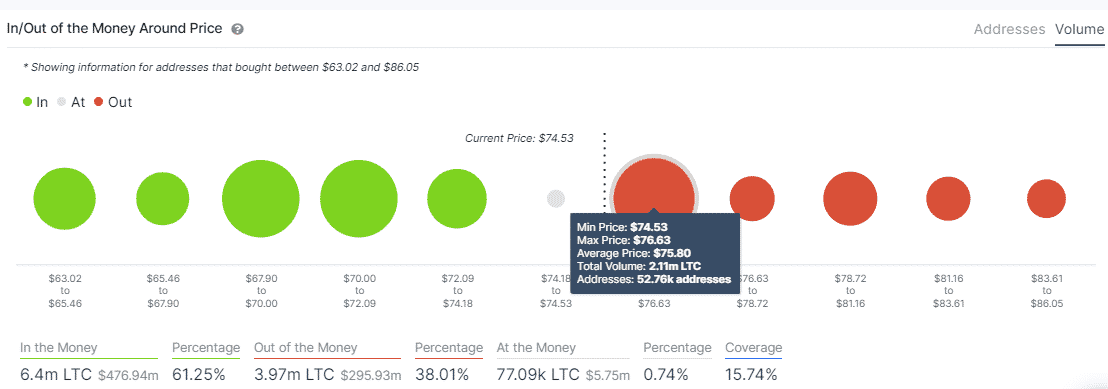

Simultaneously, IntoTheBlock’s IOMAP model shows that Litecoin is heading into a region of immense resistance between $75 and $76.6. Here, about 52,800 addresses had previously bought roughly 2.1 million LTC.

On the flip side, the technical support between $68 and $70 has been confirmed by on-onchain metrics. In other words, Litecoin might stay in the range between $68 and $75 a while longer before a significant breakout takes place, which calls for consolidation.

Litecoin Intraday Levels

Spot rate: $74.7

Relative change: 1.3

Percentage change: 1.7%

Trend: Bullish

Volatility: Expanding

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- BTC Markets Moves to Offer Tokenized Assets as RWA Market Hits $26.5B Peak

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stocks Market Crash Amid U.S- Iran War Tensions

- Why Crypto Market Is Falling Today (March 8, 2026)

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs