A Christmas Rally And Other Major Factors Tailwind Bitcoin Price To New ATH

Bitcoin price has rallied nearly 70% in two months as bulls strongly push prices above key support levels, making the YTD rally to 175%. Traders are now anticipating another upside move and closing this year near $50,000 as BTC price is now down 39%. Santa Claus Rally and other major factors confirm that Bitcoin and the crypto market will reach a new all-time high (ATH) in a few months. A Christmas Rally And Other Major Factors Set Bitcoin Price ATH

Bitcoin Price Set For New ATH

Fed Plans Three Rate Cuts in 2024

Firstly, Traders, retail investors and institutional investors are now confident about their next move as the U.S. Federal Reserve kept interest rates unchanged in the FOMC meeting. Fed Chair Jerome Powell announced the intention for three rate cuts in 2024, as inflation cools gradually towards the 2% target.

Crypto expert and BitMEX co-founder Arthur Hayes suggests there is no excuse not to be long on crypto. He reiterates that Bitcoin price will hit $1 million and cited a Bloomberg report on traders going all in response to the monetary policy pivot in 2024.

“How many more times must they tell you that the fiat in your pocket is a filthy piece of trash. Believe in the Lord, and he shall set you free,” said Arthur Hayes.

US Treasury Yield and Dollar Fell

Secondly, 10-year US Treasuries yield fell below 4% for the first time since August, renewing the bullish sentiment. Moreover, the US dollar index (DXY) fell to 102.28 as the central bank turns dovish despite inflation still above the 2% target.

Bitcoin price moves in opposite direction to US Treasuries yield and US dollar. Thus, the sentiment for $50k remains higher.

Bitcoin Halving and Coinbase Premium Gap

Bitcoin halving is now just few months away and investors are bullish enough to take every buy-the-dip opportunity. According to the NiceHash countdown, the Bitcoin halving is estimated to happen on April 12, 2024. The mining reward will be reduced to 3.125 BTC. Matrixport Research predicted BTC price hitting $60,000 before Bitcoin halving.

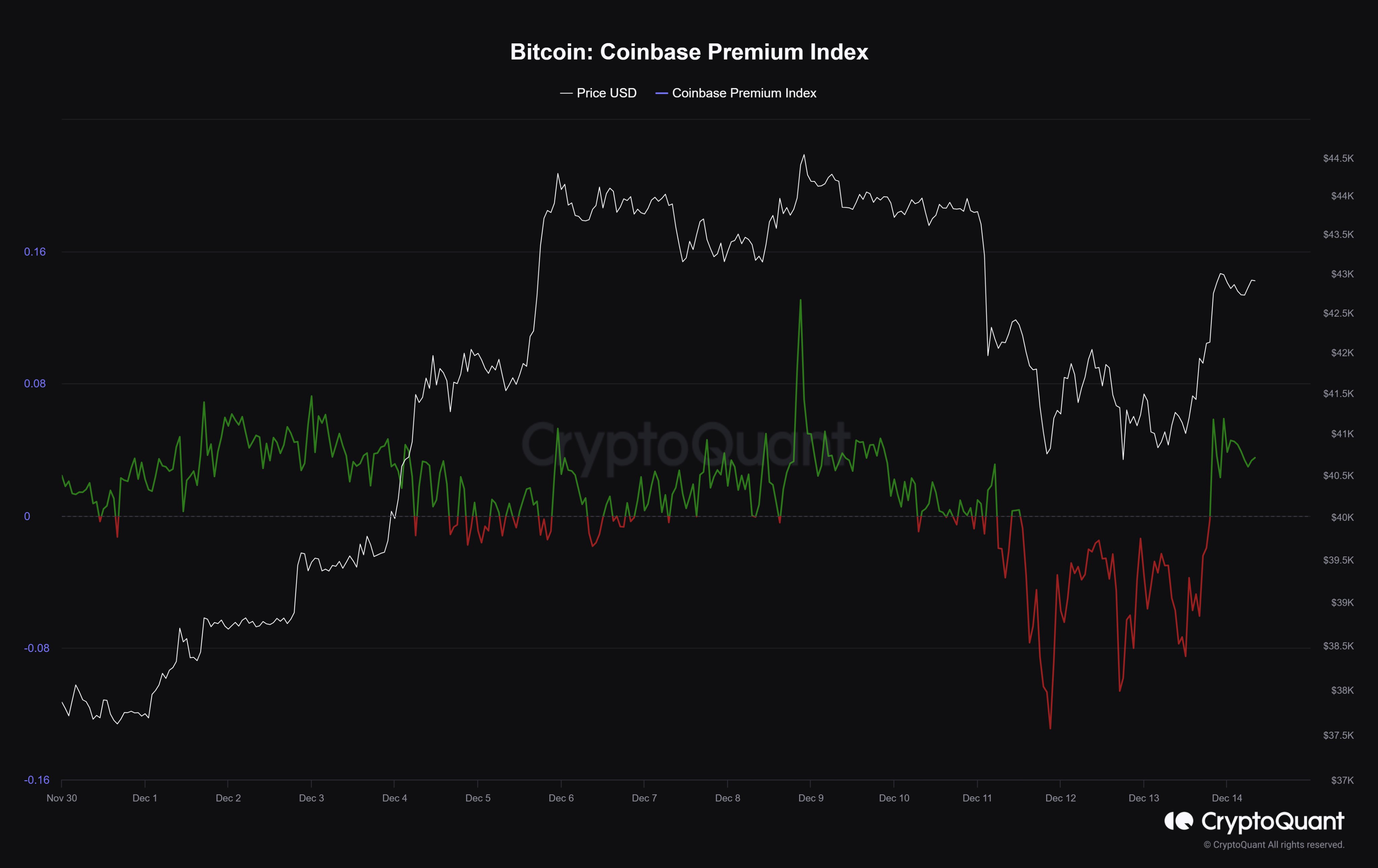

On-chain data is bullish and crypto exchange volumes are also rising. Bitcoin Coinbase Premium Index indicates strong buying pressure on Coinbase. Also, Bitcoin open interest (OI) on top derivatives exchanges CME and Binance are rising again. Traders are going long on cryptocurrencies. However, traders can expect volatility in the coming days.

Spot Bitcoin ETF Hype And Institutional Buying

There’s high anticipation of Spot Bitcoin ETF approval by the US SEC in January as the deadline nears. Moreover, rising digital asset inflows confirm a massive buying by institutional investors, assuring an upcoming rally in Bitcoin price.

The crypto market could also see improving regulatory clarity, lawsuits and other conflict will fade gradually. The SEC Chair Gary Gensler revealed that they are in talks with Bitcoin ETF issuers.

Also Read:

- Ripple CTO & XRP Lawyer Red Flag SEC Gary Gensler ‘Crypto Asset Security’ Propaganda

- Solana Flips Ethereum DEX Volume As Saga Mobile Gets Sold Out & BONK Price Rally

- US SEC To Inspect Binance.US Technical Infrastructure, Systems And Software

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Stripe Eyes PayPal Acquisition Amid Stablecoin Expansion

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card