MakerDAO’s Bold Move Into Traditional Assets Fuels MKR Token Surge

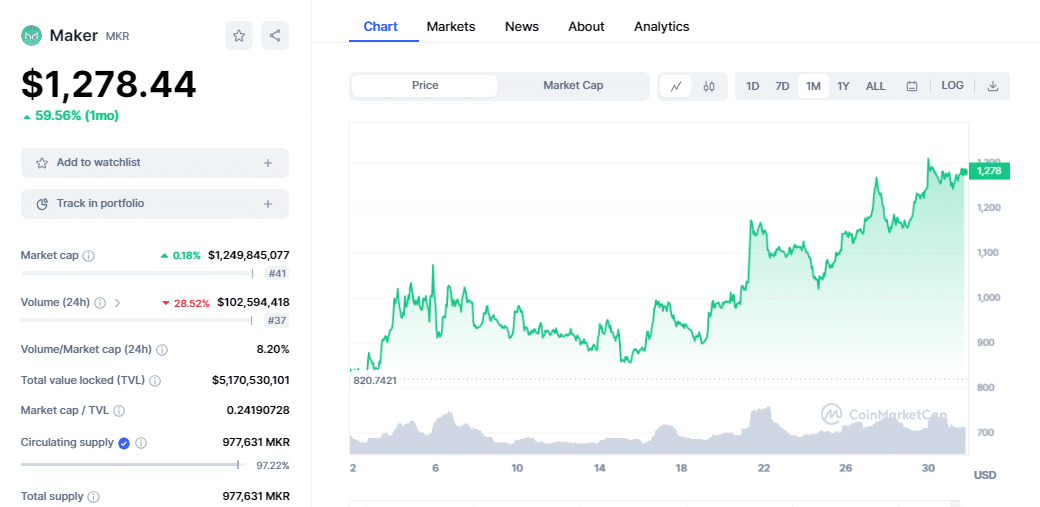

MKR investors, who invested in the governance token of decentralized lender MakerDAO in June 2022, are now profiting from a cautious risk. Amid the cryptocurrency market’s turbulence, MakerDAO decided to back its DAI stablecoin with conventional assets like short-term US Treasuries and corporate bonds. This unusual strategy has produced excellent results, Bloomberg reported. The token has surged 55% in July alone this year and is trading at $1278,82, at the time of writing.

Traditional Assets Fuels MKR Price

MKR’s remarkable success in a volatile market might be attributed to MakerDAO’s deliberate choice to diversify its investment holdings. MKR’s value has more than doubled since mid-June, increasing along with the lender’s preference for conventional assets.

According to Dune Analytics’ dashboard, MakerDAO currently has a sizable $2.5 billion in traditional assets or just over half of its overall holdings. Given that it doesn’t charge interest on its dollar-pegged stablecoin DAI and that 10-year Treasury yields are now hovering around 4%, MakerDAO is benefiting from an expanding net interest margin.

This surplus, according to Messari research analyst Kunal Goel, has made it possible to purchase back MKR tokens worth about $7.5 million per month. In his quote, he emphasizes that “MakerDAO pays no interest on most of the DAI supply, but its portfolio of real-world assets and productive crypto loans are generating yields of around 4%.”

Also Read: Curve Finance Hackers Exploit Vyper Vulnerabilities, Could State-Sponsored Hackers Be Involved?

Will MKR Continue Bullish Momentum?

Investors keep a careful eye on Maker’s governance decisions as it continues to develop the DAI ecosystem, as well as how the market reacts to the improved interest rate mechanism. The success of the Enhanced Dai Savings Rate (EDSR) proposal could spur additional DAI price and adoption and increase the market’s overall liquidity. If the bullish sentiments continue, the MKR token could break the $1,300 point.

Also Read: Nigerian SEC Calls Binance Operations Illegal in the Country

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs