Bitcoin (BTC) Price Prediction: BTC Combats Near $38k, Can It Bounce Back From Here!

Bitcoin’s (BTC) price edges higher on Tuesday in a surprise move as the global risk and volatility refuse to subsides. However, still, with the gains, BTC dropped near to two-week lows. The largest cryptocurrency earlier fell for the sixth straight day with a devaluation of 20%.

- Bitcoin (BTC) price trades higher on Tuesday.

- A decisive close above $40K could see an upside of 20%.

- BTC trades near two-week lows as the truce between Russia and Ukraine escalates.

In today’s session, BTC briefly falls below the crucial $38 mark but manages to sustain the gains in quite volatile trade.

As of press time, BTC/USD trades at $38,081, up 2.80% for the day. The market capitalization of the most popular currency reads near $720,325,633,216.

BTC looks for an upside reversal

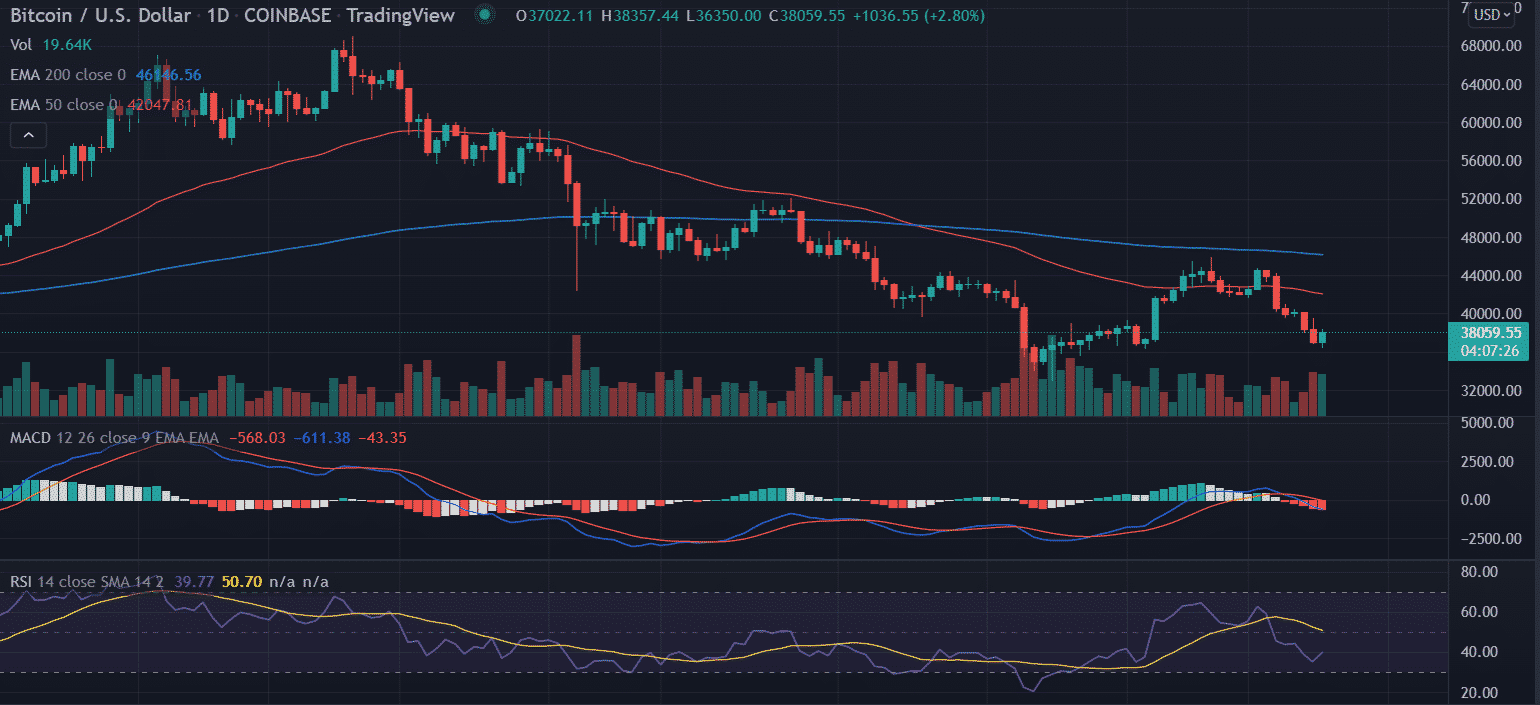

On the daily chart, Bitcoin’s (BTC) price has been consistently falling since 2022 begins extending the fall that begins in late November. So far, BTC has declined nearly 20% in 2022. From the record highs at $69,000, it tagged in November the asset has lost 46%.

As BTC/USD rallied 45% from the January lows of $32,933.33 the price faced multiple hurdles near 50-day and 200-day EMA (Exponential Moving Average) respectively. As a result, BTC retraced nearly 25% to the current levels.

Now, if bulls show some strength with renewed buying pressure then BTC must capture the psychological $40k first, and then a jump toward the $48k level.

On the flip side, a daily close below $38k would invite sellers to once again retest the January lows near $32k.

Technical indicators:

RSI: The Daily Relative Strenght Index (RSI) hovers near the oversold zone with a neutral bias. Any uptick in the indicator could strengthen the bullish outlook for the pair.

MACD: The Moving Average convergence Divernfece (MACD) slipped below the midline with a bearish momentum on the side.

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15