Bitcoin Price Analysis: This Descending Trendline Breakout Is Must to Keep Bitcoin Bull Run Intact

The continuous sell-off in the crypto market has wiped off more than $1 trillion in value. The BTC price has also dropped below the $40000 support, threatening more fall in the upcoming session. El Salvador president Nayib Bukele has purchased more 410 Bitcoin at around $36500 price, which is worth $15 Million.

Key technical points:

- BTC price faces strong resistance from the 20-day EMA

- The daily-RSI slope enters the oversold territory

- The intraday trading volume in the BTC coin is $30.79 Billion, indicating a 38.9 % fall.

In our previous coverage on Bitcoin price analysis, the correction rally in the BTC/USD pair was trying to sustain above the $40000 support level. The coin price stayed above this level for around two weeks; however, the accumulating negative news for the crypto market like Russia’s central bank called crypto ban and Fed hiking interest rate prompts the ongoing selling.

On January 21st, the BTC price gave a massive bearish breakout from the $40000 support of around 10%, indicating the price might continue its correction. However, so far, the coin price has lost almost half of its value(50%) from the November high of $68,789.2.

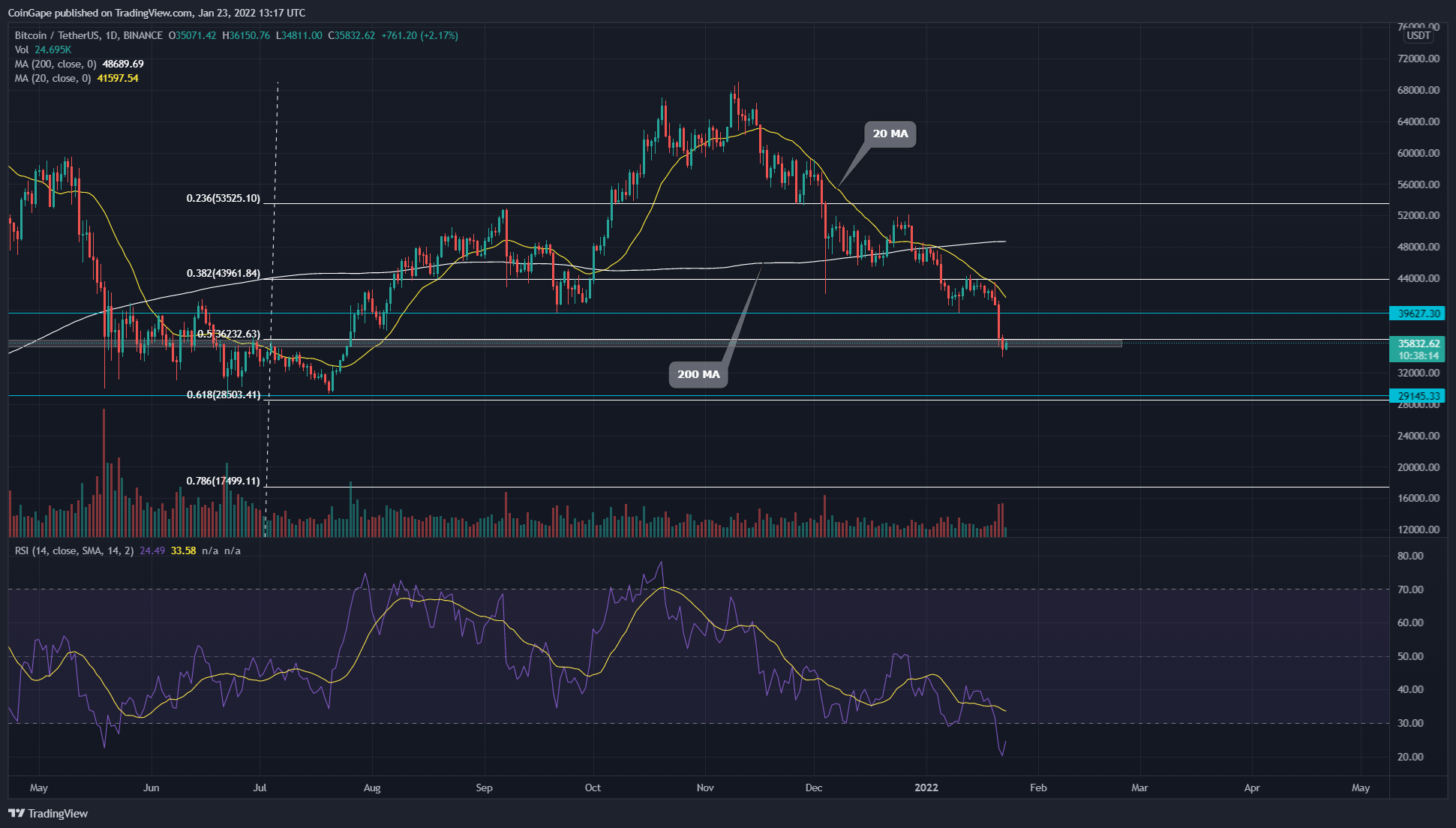

The BTC price steadily lowering below the 200 MA line indicates a bearish trend. Moreover, the 20 EMA line provides dynamic resistance to the BTC price.

Moreover, the RSI(24) slope has slipped into the oversold region due to the intense sell-off in the crypto market.

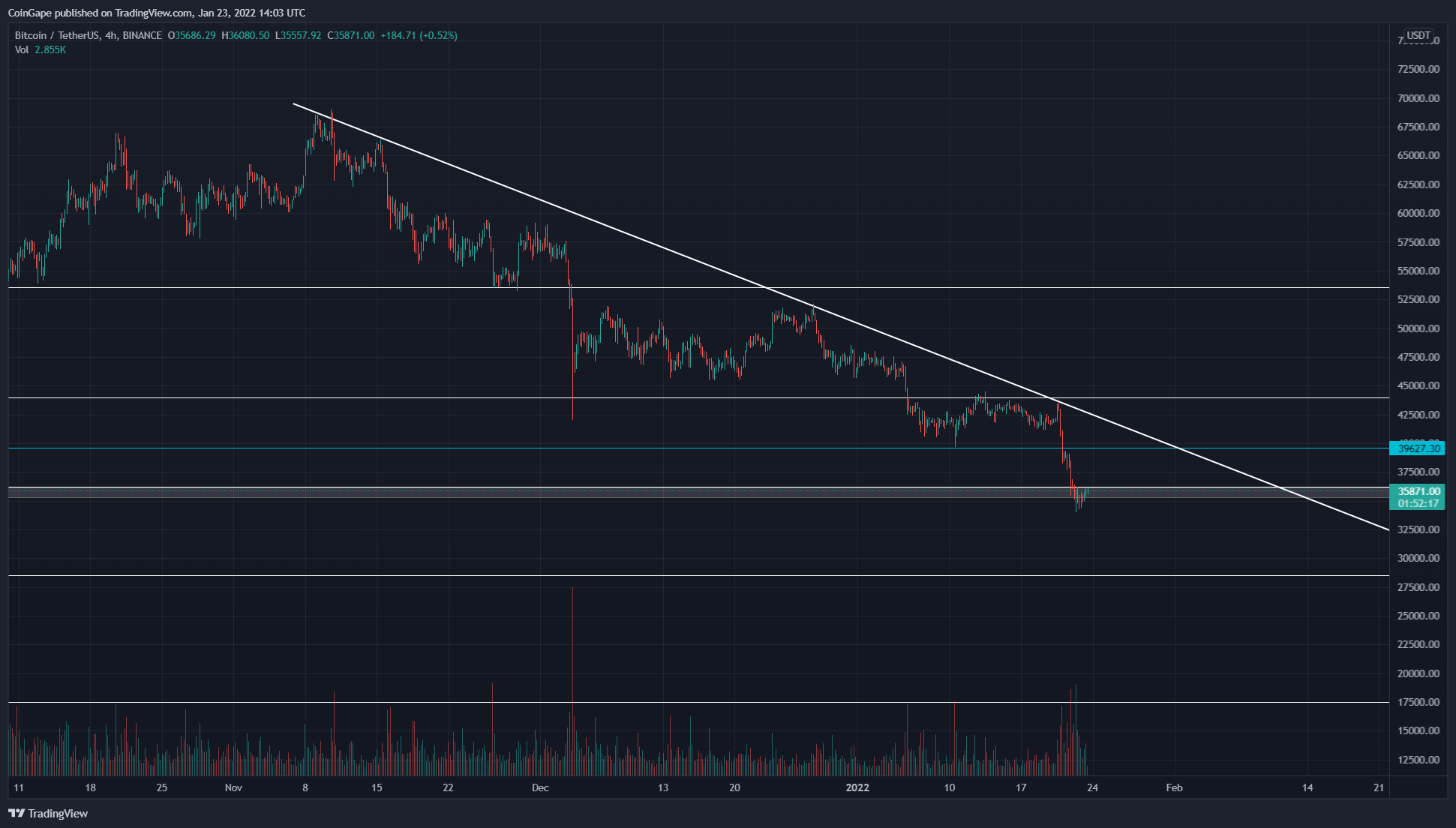

The Descending Trendline Remains As A Troublesome Resistance

The BTC price is currently trading at $35841, indicating a 2.21% intraday gain. The coin price is currently wavering at the support region around 0.5 Fibonacci level and $35000 psychological support. If the price violates this support level, the next crucial support for Bitcoin price will be the May-June 2021 accumulation support of $30000.

However, in case of a bullish reversal, the coin price has to face the descending trendline before it could initiate a proper rally.

- Resistance levels- $40000 and $45000

- Support levels- $35000 and $30000

Bitcoin On-Chain Analysis

- As per Santiment, large Bitcoin wallets have recently added almost 40,000 coins to their holdings.

- BTC.com estimates that the network difficulty will reach another all-time high of 26.80 trillion in the next 11 days.

- The short-term Holder(STH)-SOPR indicator shows a bullish divergence concerning the rising 12-hour average and BTC price, suggesting a bullish reversal in the near future.

- Wall Street Giant Signals XRP Price ‘Long Winter’ After Cutting Target By 65%

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 63% of Tokenized U.S. Treasuries Now Issued on XRP Ledger: Report

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano