Bitcoin Price Prediction Ahead of FOMC Minutes

Highlights

- FOMC minutes reinforce macro support without altering Bitcoin’s near-term structure

- Analyst Ted emphasizes consolidation as a setup rather than trend exhaustion

- Structural compression favors upside continuation unless demand fails

Bitcoin price continues trading within a tightening range, with BTC price holding between $88,000 and $90,000 after multiple failed expansion attempts. This action is a sign of balance as opposed to weakness because of the way consumers and vendors react to structure rather than narrative.

Meanwhile, the macro conditions start to correlate with the risk assets after new policy signals of the Federal Reserve. This merging exerts pressure on the price, but not direction. The analysis below evaluates how macro context, analyst positioning, and price structure shape the next Bitcoin price outcome.

FOMC Minutes Strengthen the Floor Without Forcing Breakout

The latest FOMC minutes confirmed a 25-basis-point rate cut approved by a 9-3 vote, with inflation near 2.8% and rising downside risks to employment highlighted. Bitcoin price absorbed this information without volatility expansion, which signals that BTC price had already priced in gradual easing.

Rather than cracking higher, the price stood at over $88,000 and respected a resistance at about 90,450 and again validated that liquidity conditions remain to dictate the execution.

Expectations of a lower rate will help in decreasing the real yield pressure in favour of demand at a price below the current price. This dynamic explains why Bitcoin price continues to defend higher lows despite repeated resistance rejections.

But since the minutes did not represent a surprise to the markets, but did confirm expectations, the price was in structure. Thus, the macro conditions have strengthened the floor of the downside but moved the upside continuation till the technical acceptance formed above the resistance.

Analyst Flags Range Stability Heading Into Q1

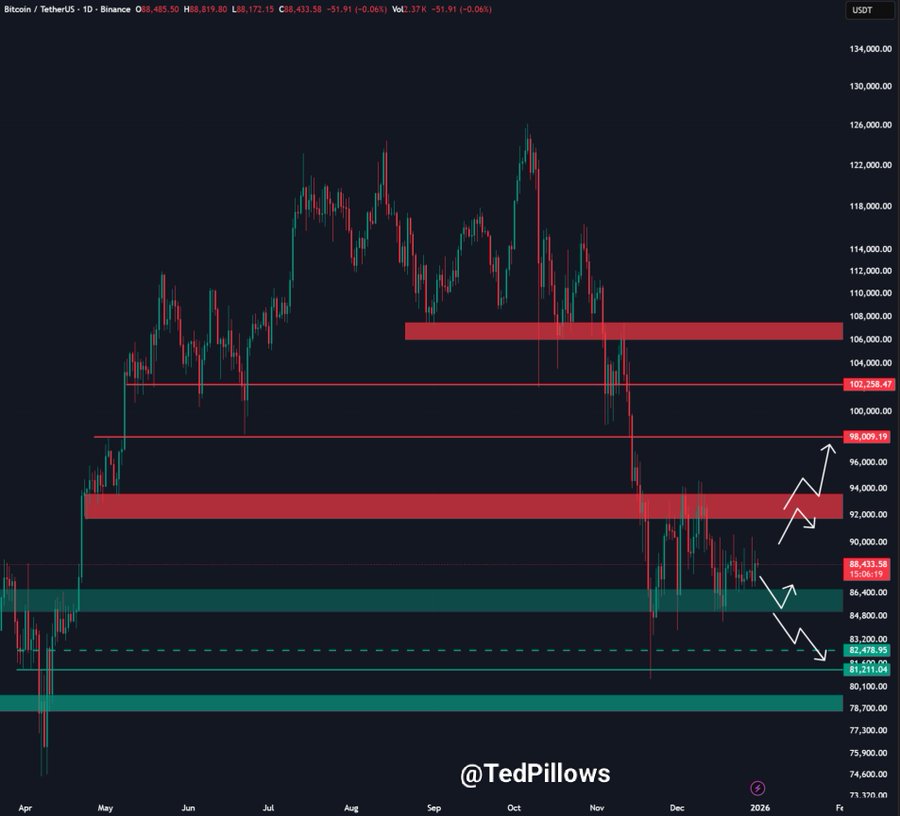

Analyst Ted Pillows notes that Bitcoin price remains range-bound between $88,000 and $90,000, while the yearly candle likely closes red. Despite this, the expert points toward constructive BTC price behavior into Q1 2026.

Bitcoin market value stands at approximately $88,700 at the time of press, trading above the demand zone of $86,000-87,000. This area has received several sell offs, which proves that it has been accumulated and not supported.

The supply is spread at once above price between $93,000 and $100,000, over which distribution has been quickened in the past. Repeating defense of demand indicates buyers taking in the stress and not compelling growth. As long as Bitcoin price holds above $86,000, upside potential remains intact.

Bitcoin Price Presses Triangle Apex as Demand Holds

Bitcoin price continues compressing inside a symmetrical triangle, defined by descending resistance near $90,450 and rising support anchored at the $86,000 demand zone. Since mid-December, each corrective move has produced a higher low, which confirms that buyers step in earlier with every pullback.

BTC price rebounded decisively from $86,000, validating this zone as active demand rather than incidental support. This action is a compression accumulation and not a distribution. Price is now closer to the triangle apex and this enhances the probability of breakout because the volatility is narrowed.

The MACD indicator supports this setup. After +DI crossed above -DI on December 25, Bitcoin price began holding intraday recoveries more consistently, while an ADX reading near 13 signals trend construction rather than exhaustion. That is why the grind higher is gradual rather than impulsive expansion.

If BTC price secures acceptance above $90,450, structure opens toward $93,760, followed by a broader liquidity objective near $100,000 into early 2026, strengthening the long-term BTC price outlook. However, a sustained breakdown below $86,000 would invalidate this bias and shift control back to sellers, before any recovery.

To sum up, Bitcoin price remains structurally constructive despite muted volatility. Macro conditions now support risk assets, while BTC price behavior confirms sustained demand above $86,000.

Until this base is lost, the overall result is upside resolution to higher resistance areas. This bias would be nullified by a decisive loss of demand, and would prolong consolidation.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How do FOMC minutes influence Bitcoin market structure?

2. Why do analysts focus on consolidation phases?

3. What confirms a valid structural breakout in Bitcoin?

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs