Bitcoin Price Prediction: Will $BTC Recovery Surpass $50000 in December?

Bitcoin Price Prediction: After witnessing uncertainty for the major portion of November, the Bitcoin price started picking up momentum in the last week. Starting from $35,682 low the recovery surged 17.12 to reach a current trading price of $41,743. However, a look at the technical chart shows this upswing is still confined within an expanding channel pattern, which could significantly alter the near future trend.

Also Read: Recession 2024 Fears: Bitcoin vs Gold Set For An Epic Battle This Time

Is BTC Heading to $50000?

- The BTC price rising for four consecutive days with a substantial increase in volume indicates sustained recovery

- The expanding channel pattern leads to the current recovery trend.

- The intraday trading volume in Bitcoin is $36.9 Billion, indicating a 101% gain.

In the last seven months, the Bitcoin price trajectory has been characterized by a gradual yet consistent recovery, guided by a rising expanding channel pattern. The repeated rebounds from the two ascending trendlines of this pattern underscore its significant impact on market participants.

Notably, on November 22nd, Bitcoin experienced a reversal from the lower trendline, leading to a robust recovery that touched a 19-month high of $42,200 at the upper trendline. Historical observations of this pattern indicate that reaching the upper trendline often triggers increased selling pressure, typically resulting in a reversion back to the lower trendline.

However, it’s important to note that this pattern generally signifies growing market uncertainty, as evidenced by the large price swings within the pattern. Therefore, a breakout above the pattern’s upper trendline would be a more convincing indicator of a strong recovery, potentially driving the price up by 15% to reach around $48,175, and possibly extending to the $50,000 mark

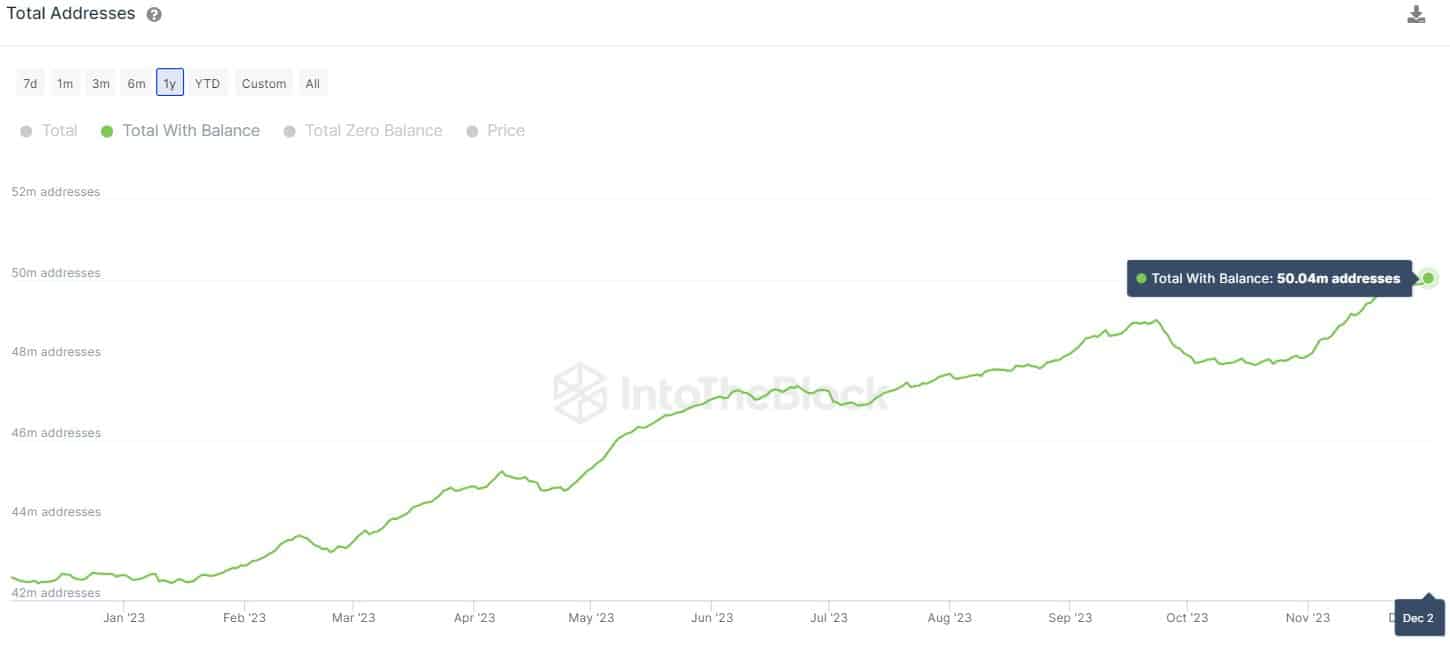

Bitcoin Wallets Surpass 50 Million as BTC Price Rally Fuels Growth

The Bitcoin (BTC) recovery surpassing the $40,000 psychological level has brought notable changes within its ecosystem, particularly in the growth of active wallets. Data from IntoTheBlock, a prominent on-chain data provider, reveals a significant increase in the number of Bitcoin wallets holding a balance. Surpassing the 50 million mark, this growth represents an impressive increase of over 17% since the year’s start, highlighting a rising interest and participation in the Bitcoin network.

- Bollinger band: An upswing in the upper boundary of the Bollinger band indicator reflects the buyers are currently having an upper hand.

- Vortex indicator. A bullish crossover state between the VI+(blue) and VI(-) pink indicates a recovery trend in action.

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible