BONK Price Rally Ahead? Open Interest Jumps as TD Buy Signal Flashes

Highlights

- BONK price forms a bullish pennant flag, backed by a TD Sequential buy signal.

- Open Interest surges 10.46% to $27.24M, showing stronger positioning in BONK.

- Tuttle Capital ETF filing boosts BONK’s credibility, fueling broader market optimism.

BONK price has drawn attention once again as its chart structure hints at renewed interest from market participants. The setup highlights a potential recovery move, with recent signals aligning to suggest further gains may be achievable. Importantly, technical conditions remain supportive, giving BONK price the spotlight as one of the tokens to watch this season.

From Support to Breakout: How BONK Price Gains Strength After Buy Signal

The current BONK market value sits at $0.00002006, reflecting attempts to build momentum from the highlighted support zone. The chart forms a bullish pennant flag structure, suggesting that continuation to the upside could emerge.

Analyst Ali Charts’ TD Sequential indicator recently issued a buy signal, adding weight to this setup. Importantly, this signal historically aligns with potential trend reversals in several assets.

Meanwhile, the support range near $0.00001850 has held firmly, preventing deeper pullbacks in recent weeks. A sustained move above $0.00002775 would further confirm a bullish breakout structure.

Significantly, a long-term BONK price prediction remains positioned beyond $0.00004000 if the bullish formation completes. Therefore, the technical picture offers reasons for optimism, backed by both chart patterns and external confirmations.

Open Interest Growth Reinforces Bullish Structure

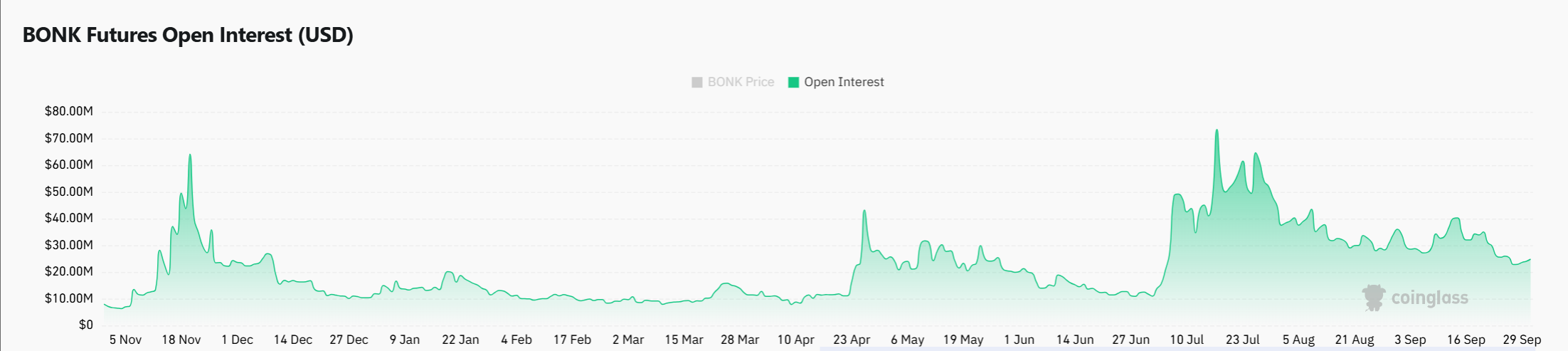

Open Interest has surged by 10.46%, now sitting at $27.24 million, highlighting renewed market participation in BONK price positioning, according to CoinGlass.

This increase reflects greater capital commitment in derivatives markets, often amplifying directional conviction. Specifically, rising OI alongside a bullish pennant pattern strengthens the argument for a breakout scenario.

Meanwhile, higher OI during consolidation phases can be a signal of accumulated leverage, preparing for a potential directional swing. Importantly, the shift in OI aligns with the bullish TD Sequential confirmation, creating a layered case for upside.

Notably, BONK also gained spotlight after Tuttle Capital filed an ETF application targeting the token with the U.S. SEC, boosting investor confidence. Overall, BONK price stands to benefit if this heightened leverage aligns with continued upward spot market pressure.

Buy Now?

BONK price currently combines a bullish pennant flag, a TD Sequential buy signal, and surging Open Interest. The recent ETF filing has further boosted its credibility, adding a new layer of confidence to the setup. These factors together create strong conditions that favor an upward breakout toward long-term projections. Therefore, BONK presents itself as a compelling buy opportunity at this moment.

Frequently Asked Questions (FAQs)

1. What is the significance of the TD Sequential buy signal for BONK?

2. Why is Open Interest growth important for BONK?

3. How does the ETF filing impact BONK?

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?