Can Bitcoin (BTC) Price Continue Its Recovery In Coming Week?

On November 22nd, the Bitcoin price witnessed its second reversal from $15600 support within a month. Thus, the coin price rebounded twice from the same support validating its level as a strong accumulation zone. The bullish reversal triggered a new relief rally aiming to surpass $17700.

Key points:

- The post-retest tally may drive the Bitcoin price 2.7% higher to hit the $17700 mark.

- The 50-day EMA wobbling near $17700 increases the resistance power of this level.

- The intraday trading volume in Bitcoin is $18.8 Billion, indicating a 4.32% drop.

The recent recovery in Bitcoin surged the prices by 10% and breached two crucial resistance levels of $16200 and $16900. Furthermore, the coin price went sideways after this rally, trying to sustain above the newly reclaimed support the $16900.

The post-retest rally indicates the buyers have obtained a suitable launchpad to climb up the higher levels. However, the daily candle backed by decreased volume indicates some weakness in bullish commitment.

Today, the Bitcoin price is $17222, with an intraday gain of 0.7%. If the buying pressure persists, the price should rise 2.7% to reach an overhead resistance of $17700, followed by $18500.

However, if the price fails to follow up the bullish path in the upcoming trading session, a prolonged consolidation above will dampen the bullish momentum.

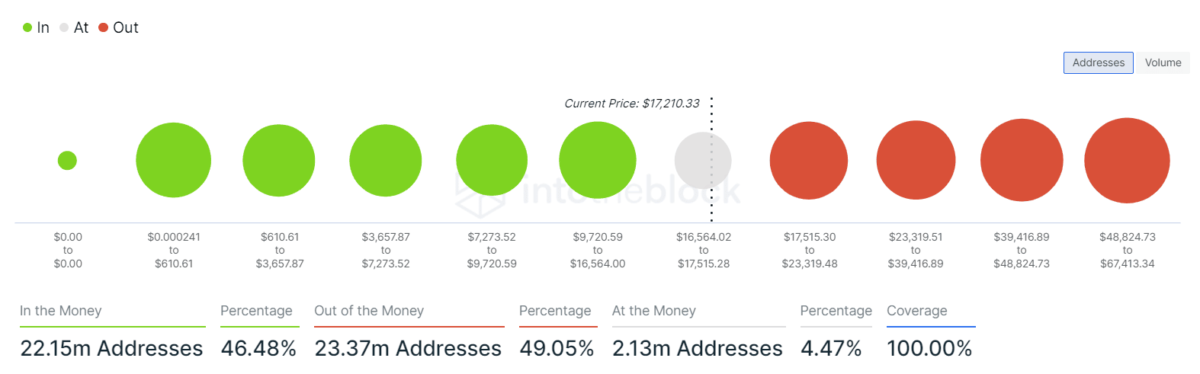

Global In/Out of the Money metric

The Global In/Out of the Money (GIOM) on chain metric suggests a neutral stance among BTC holders; 46.48% are in-the-money addresses and witness profits, whereas 49.05% of addresses are out-of-the-money and show losses.

Furthermore, the nearest green cluster with a mean value of $12633 indicates a significant Area of Interest(AOI) and could assist buyers in a bullish reversal.

On the flip side, the red cluster with a mean value of $202530 accentuates an important supply zone.

Technical Indicator

Relative Strength Index: the daily-RSI slope on the verge of entering the bullish territory indicates the improving market sentiment.

EMAs: The rising BTC price recently reclaimed the 20-day EMA slope, which now acts as a significant support to carry the ongoing recovery.

Bitcoin Price Intraday Levels

- Spot rate: $17222

- Trend: Bullish

- Volatility: Medium

- Resistance level- $17700 and $18500

- Support level- $16900 and $16200

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs