Chainlink Price Eyes Breakout as Whales Scoop 150K $LINK

Highlights

- Whales accumulate 150K $LINK, signaling potential price rebound.

- Chainlink price struggles near $14.00 support, potential breakout remains uncertain.

- Technical shows slight bullish momentum in the near term

Chainlink price has recently shown signs of a potential breakout, although it remains in a bearish phase. The cryptocurrency has dropped by 1.89% in the past 24 hours and has experienced a significant 14.5% weekly decline.

Chainlink is still gathering strength at the upper end of its recent price despite these losses. Whales have accumulated 150,000 $LINK, which is a strong indicator of a possible rebound in price.

A significant support trendline, which had sustained for more than two years, has been penetrated by the price. The trend has changed within the context of the market in general, that is, worries about U.S. tariffs impacting the world economies and lower expectations for a Federal Reserve rate cut in December.

The dip is part of the overall bearish market that has been affecting even the largest cryptocurrencies like Bitcoin, Ethereum price, and Solana.

Chainlink Whales Accumulate 150k $LINK: Is a Breakout Imminent?

Chainlink’s whale activity has been gaining attention recently as major wallets have accumulated approximately 150,000 $LINK tokens in the past few sessions. The recent activities of the whales have led to the assumption that $LINK can be on the verge of a new breakout.

It has been reported that the major wallet holders have greatly expanded their holdings, which is a sign of strong interest in the market.

The increase in whale activity has given rise to the question amongst traders if Chainlink is going to be a price high. Along with the massive growth in whale holdings, LINK price has also shown a rapid upward trend, which is a strong indication that the coin might soon enter a breakout period.

CHAINLINK WHALES SHIFTING GEARS!!! 🐋

Major wallets accumulated ~150k $LINK in recent sessions.$LINK READY FOR THE NEXT BREAKOUT?? 🚀 pic.twitter.com/bqo8wHj4M8

— Altcoin Buzz (@Altcoinbuzzio) November 17, 2025

Could Chainlink Price Break Past $16.00 or Continue to Fall?

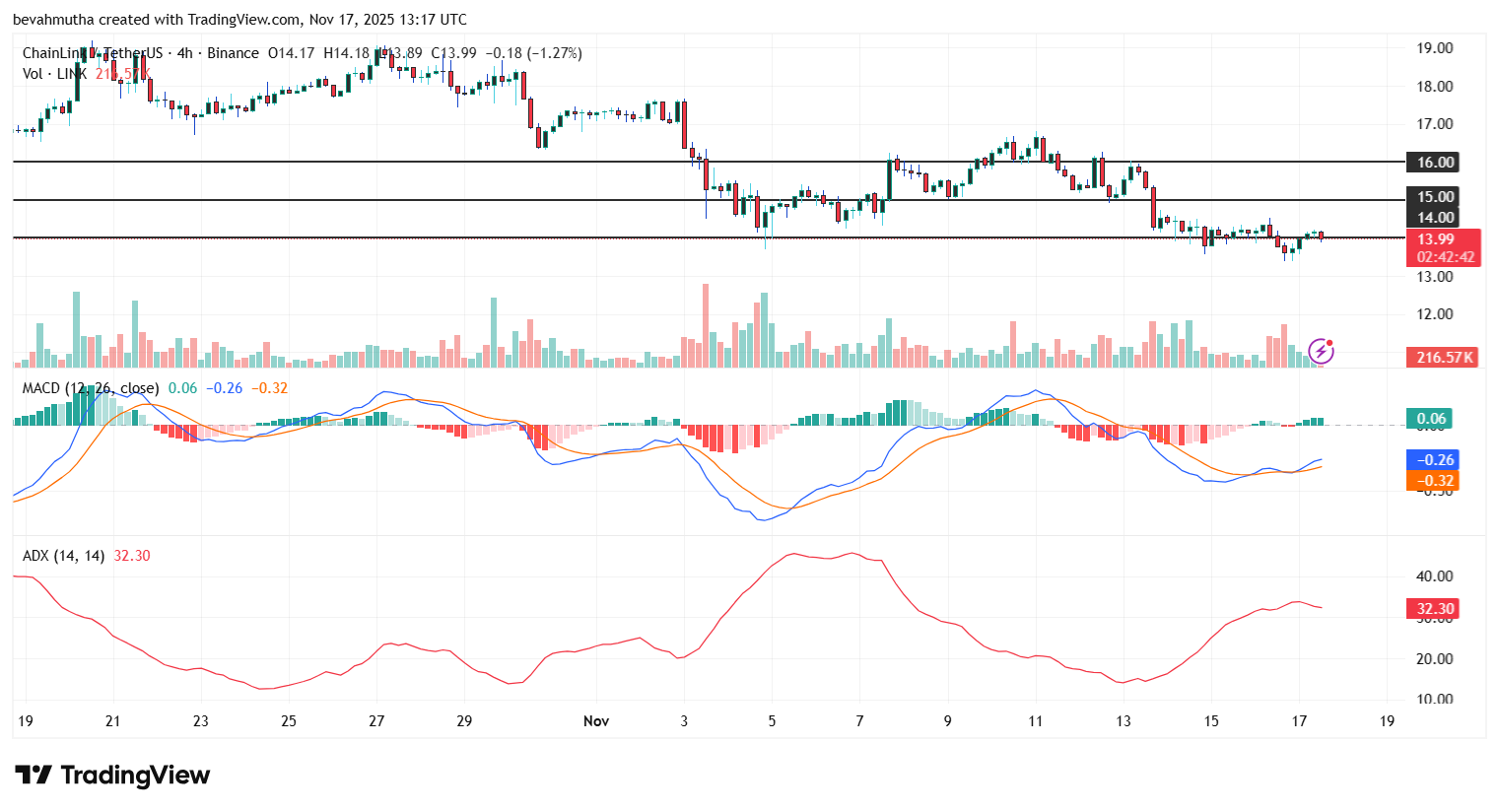

As of the reporting time, the price of LINK plunged to $14.11, marking a bearish sentiment with a 15% decrease over the past week. This drop is the result of a continuous decrease that started at the beginning of the month.

The LINK price had a hard time remaining at $15, constantly facing the resistance from the sellers and not managing to go past the important resistance of the sellers around $16.

The MACD has indicated a minor bullish momentum as the blue line is slightly above the signal line. However, the overall bearish trend still prevails, as evidenced by the negative histogram values that relate to the waning selling pressure.

The MACD line hovers near the zero line, which suggests the market’s indecision. The ADX has a value of 32, which implies that the trend is still strong but not extreme.

The current price action points to the possibility of more selling pressure in the market during the coming days, which could lead to the $14.00 support level being tested. If the Chainlink price crash does not manage to stay above this level, it may drop down to $13.00 or lower.

Traders will be on the lookout for reversal signals during the next few days, especially if the price moves back to $15. Another touching of this level could offer prospects of a more lasting rally heading for resistances around $16.

Frequently Asked Questions (FAQs)

1. Is Chainlink poised for a breakout?

2. What level should traders watch for a potential breakout?

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?