Cosmos Price Prediction: ATOM Price Tests Weekly Lows Near $21.0; Is $15.0 Possible?

ATOM price continues to trade lower with a negative bias as the fresh trading session begins. The price hovers near the multi-week support area at around $21.30. In the April series, ATOM’s price remains the down rill with a descent of nearly 36% so far and still faces further downside risk.

- ATOM price continues to trade lower since September 2021.

- More downside could be expected as the price remains vulnerable near the crucial support zone.

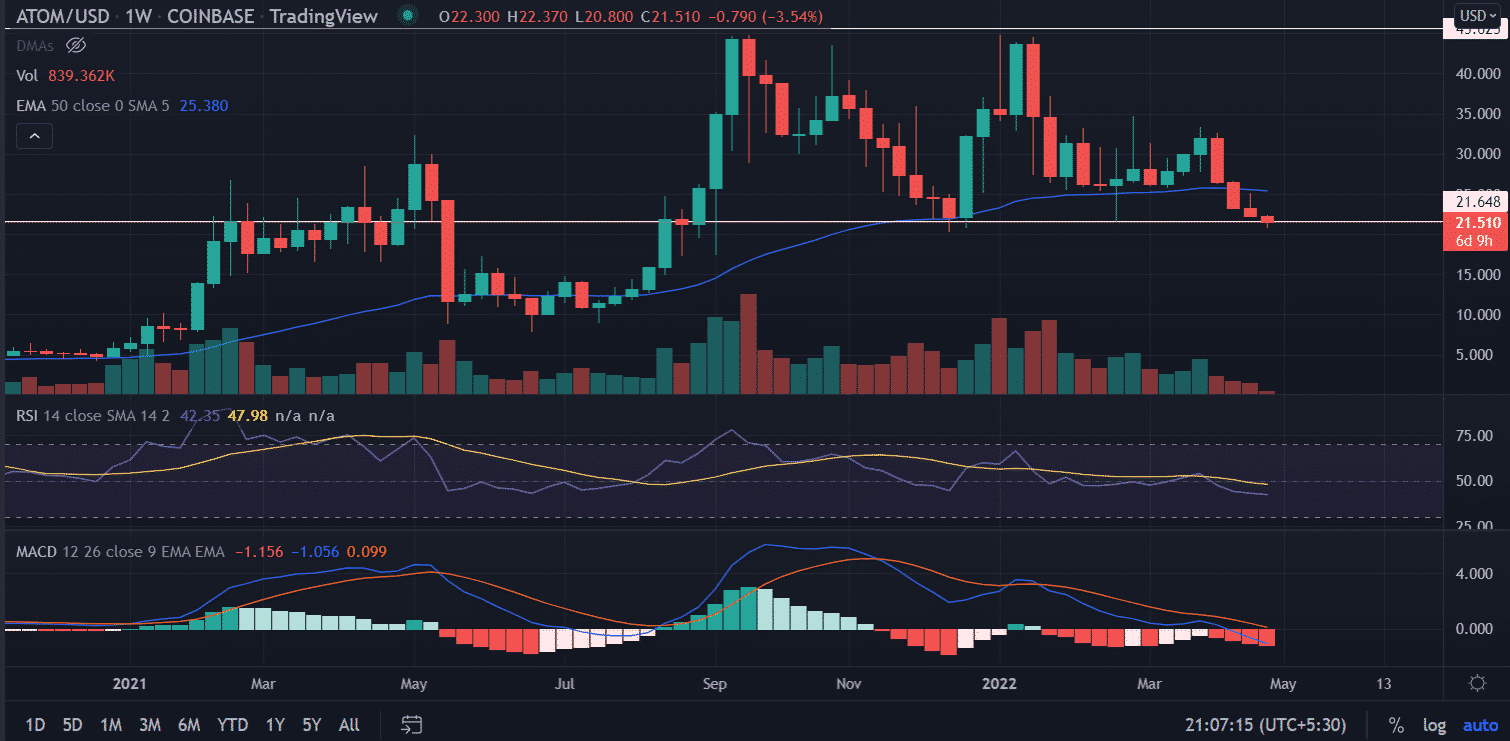

- The ascending trend line from the lows of $4.93 since November 2020.

ATOM price slides into a consolidation

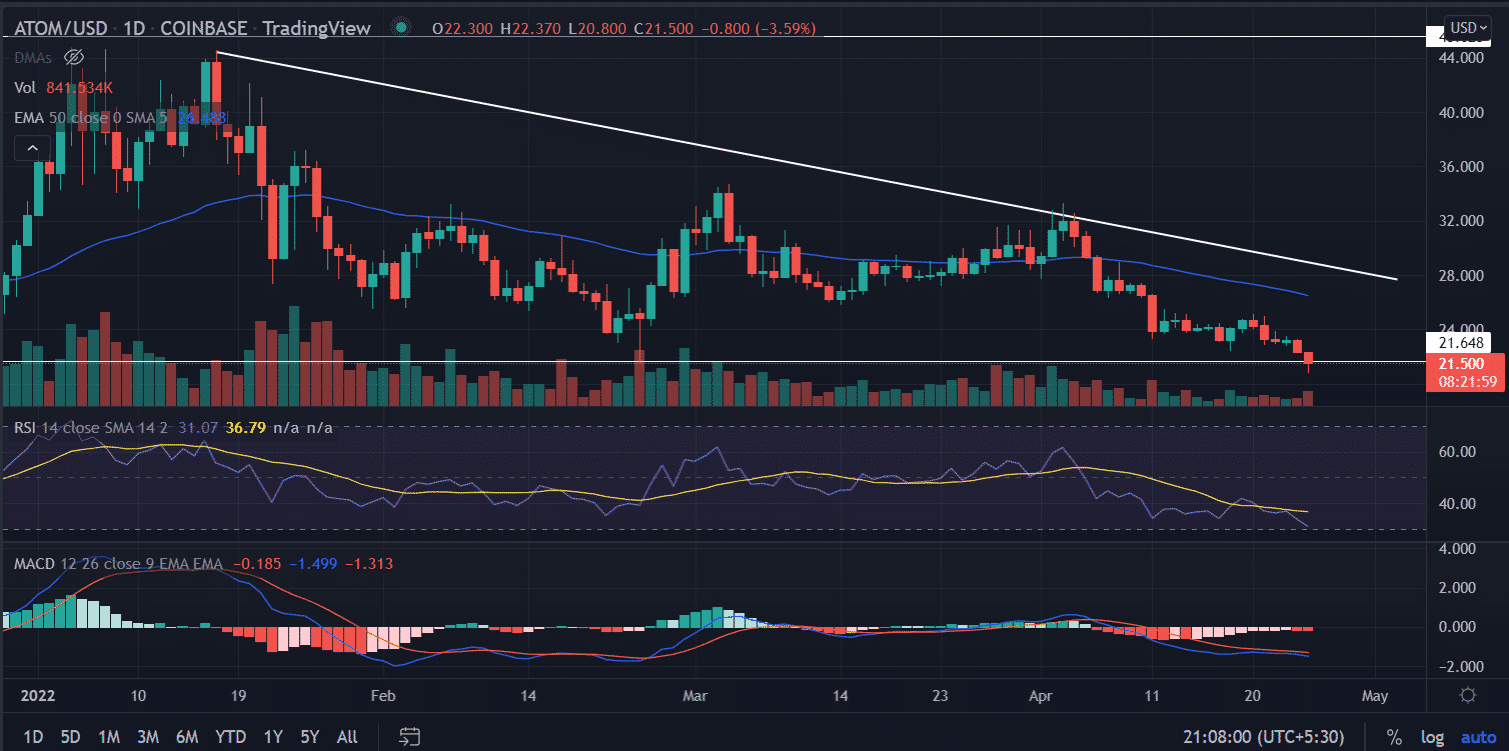

On the daily chart, the descending trend line from the highs of $44.55 acts as a strong resistance barrier to the bulls. Further, the price attempted to challenge the trend line on April 4 but failed to do so. A renewed selling pressure dragged the price to test the horizontal support around $21.40

By analyzing the trend on the weekly chart, we found ATOM harboring a strong support zone around $21.0. The slump is the result of the entire crypto market meltdown. In addition to that, the price slipped below the 50-day EMA fueling the downside momentum. A break below the support zone would amplify the selling pressure toward the lows last seen in August near $15.0.

While things look pessimistic for ATOM so far still a spike in the buying orders could reverse the prevailing trend. The price would jump back to recapture the moving average at $25.37.

The Relative Strength Index (RSI) is trading near 54. The indicator slips below the average line on March 28.

The moving average convergence divergence (MACD) hovers below the midline with increasing bearish momentum.

As of press time, ATOM/USD reads at $21.64 with a loss of 3.34% for the day.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs