Dogecoin Price Prediction: Grayscale ETF Move Aligns With Cycle Breakout

Highlights

- Dogecoin price mirrors its 2017 and 2021 cycles, hinting at another major breakout.

- Grayscale files to convert its DOGE Trust into an ETF under ticker GDOG.

- Binance data shows 77% of accounts long, signaling strong speculative optimism.

Dogecoin price currently trades at $0.2641 after a 4% daily decline, with its market cap near $39.89 billion. Market structure shows the asset continues to mirror the cyclical behavior observed in 2017 and 2021, where extended consolidations were followed by strong rallies. With the 2025 cycle displaying a similar setup, analysts are watching whether the same pattern could unfold again.

Dogecoin Price Action: Cycle Retests Signal Breakout Potential

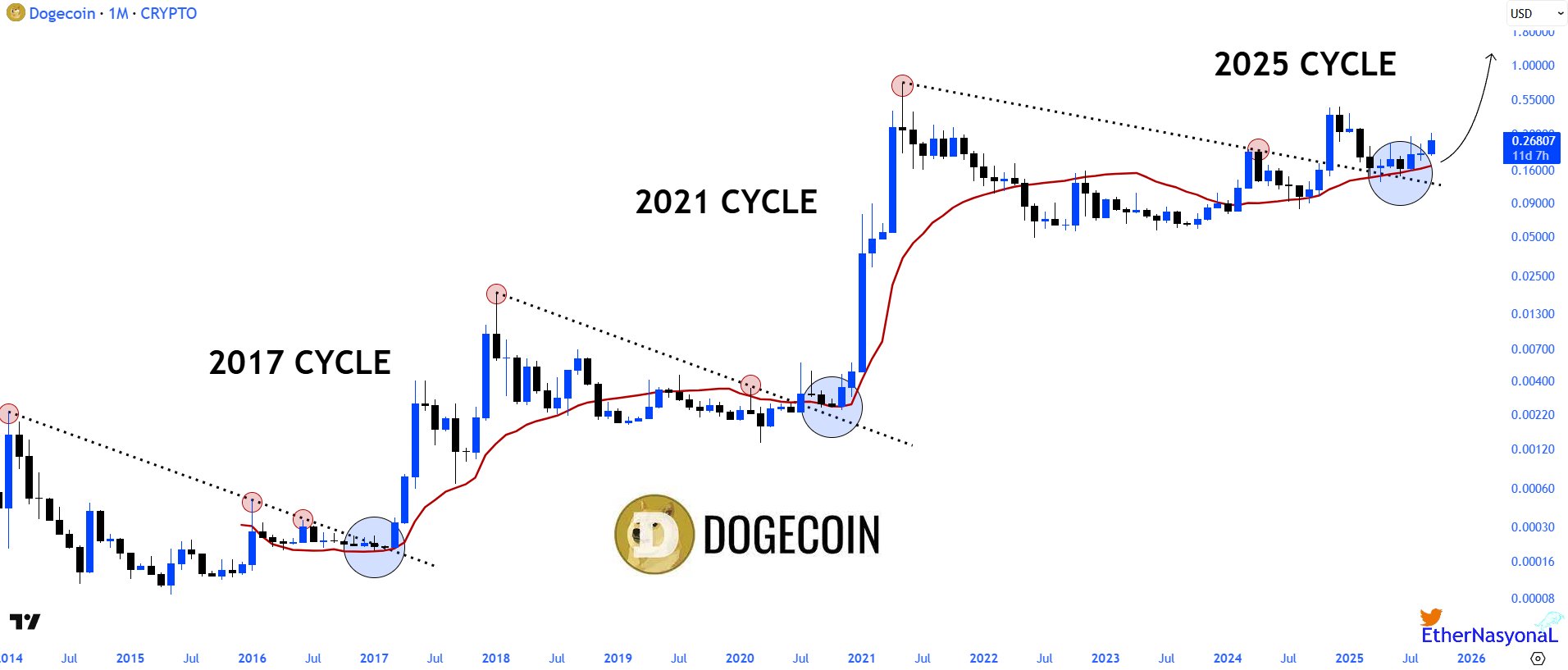

Dogecoin price continues to move in recognizable long-term cycles, with 2017, 2021, and now the emerging 2025 cycle marking major turning points. According to an analyst on X platform, the 2017 rally began after consolidation and pushed DOGE from under $0.0002 to a peak near $0.017.

The 2021 cycle mirrored this explosive run, with the price surging from around $0.0022 to highs above $0.70. Both rallies unfolded while the 50 EMA traded below price, reinforcing strong upward conditions during breakouts. In the current 2025 cycle, Dogecoin has already retested a descending trendline near $0.26 while again holding above the 50 EMA.

This structural alignment mirrors the foundations that preceded earlier parabolic surges, strengthening the case for continuation. The same analyst suggests the anticipated breakout could extend toward $1 and beyond if the pattern holds.

With Dogecoin ranked among the top meme coins, its cyclical rhythm offers a long-term DOGE price forecast that points toward another historic move. Therefore, current conditions echo the setup of previous runs and raise expectations for the months ahead.

Grayscale’s DOGE ETF Bid: Institutional Interest Meets Rising Optimism

Grayscale’s amended S-1 filing to convert its Dogecoin Trust into an ETF under ticker GDOG has fueled new debate around the asset’s future. If approved, the ETF would trade on NYSE Arca, with Coinbase serving as prime broker and custodian.

This step comes as the SEC recently eased listing standards for crypto funds, potentially streamlining approvals. The move could significantly expand access, offering a regulated pathway for investors who avoid direct exposure through exchanges.

The filing also comes shortly after REX-Osprey announced the official launch of their Dogecoin and XRP ETFs, to offer institutional investors spot exposure to these altcoins.

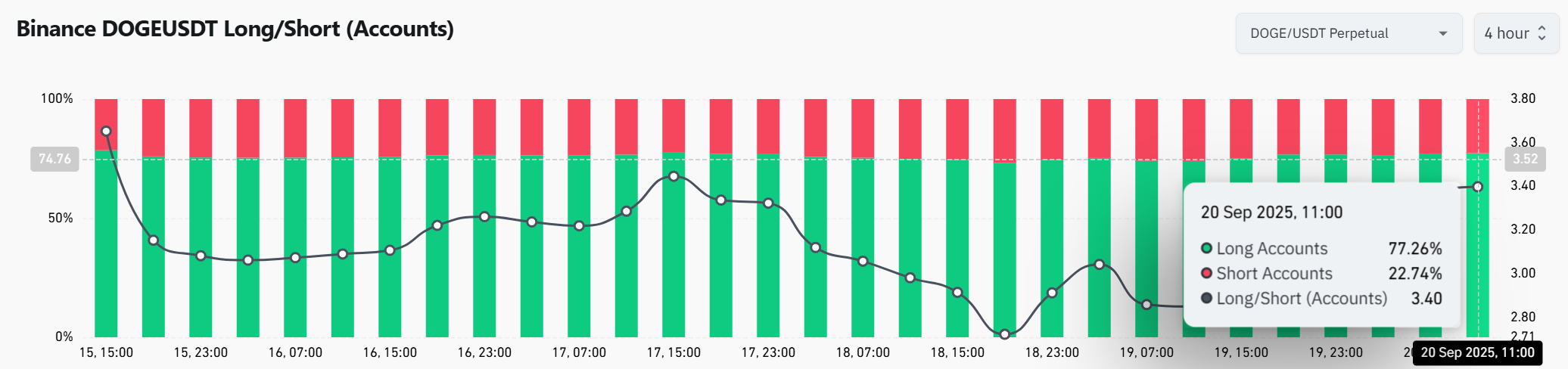

At the same time, CoinGlass analytics shows that 77.26% of accounts are long while only 22.74% are short, reflecting strong speculative optimism in alignment with the ETF narrative. Therefore, Grayscale’s effort reflects an attempt to institutionalize Dogecoin precisely when historical cycles suggest another surge is nearing.

To sum up, Dogecoin price cycles and EMA alignment reinforce the possibility of a powerful breakout ahead. With the 2025 retest already completed, the structure mirrors conditions that drove past rallies. Grayscale’s ETF bid, combined with strong long positioning, supports the case for broader adoption and stronger credibility. Together, these factors point toward a decisive DOGE price move that could challenge $1 and beyond.

Frequently Asked Questions (FAQs)

1. What is the significance of Dogecoin’s cyclical market patterns?

2. Why is Grayscale’s DOGE ETF filing important?

3. How do long/short ratios affect Dogecoin sentiment?

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?