ETH Price Prediction: Crucial Levels to Watch as Ethereum Price at Risk of Further Downfall

ETH Price Prediction: The increasing broader market sell-off and the recent fake breakout from $2000 psychological market caused a significant correction in Ethereum price. In the last ten days, the ETH price lost 15% as it plunged from a $2138 high to the current price of 1822. With no major sign of price reversal, this altcoin is likely to prolong its downfall to a lower level this week

Key Points:

- The Ethereum price correction to 50% FIB level will still be considered a healthy and higher probability for buyers to resume the prior uptrend.

- The 100-and-200-day EMAs wavering near 50% FIB at $1700 create a strong accumulation zone.

- The intraday trading volume in Ether is $8.1 Billion, indicating a 1.58% gain.

A V-top reversal in Ethereum’s daily time frame chart indicates aggressive selling pressure in the market. Amid this correction, the coin price also breached 26.3% Fibonacci retracement indicating a high possibility of downtrend continuation.

With sustained selling, the ETH price may tumble another 8% and plunge to the combined support of $1700-$1675, 38.2% FIB level, and 200-day. Interested buyers should keep a close watch at the aforementioned level as its support strength could undermine the current selling pressure and resume the bullish recovery.

On a contrary note, a breakdown below $1675 will invalidate the bullish these and prolong the ongoing correction.

Also Read: Top 6 Liquid Staking Platforms On Ethereum

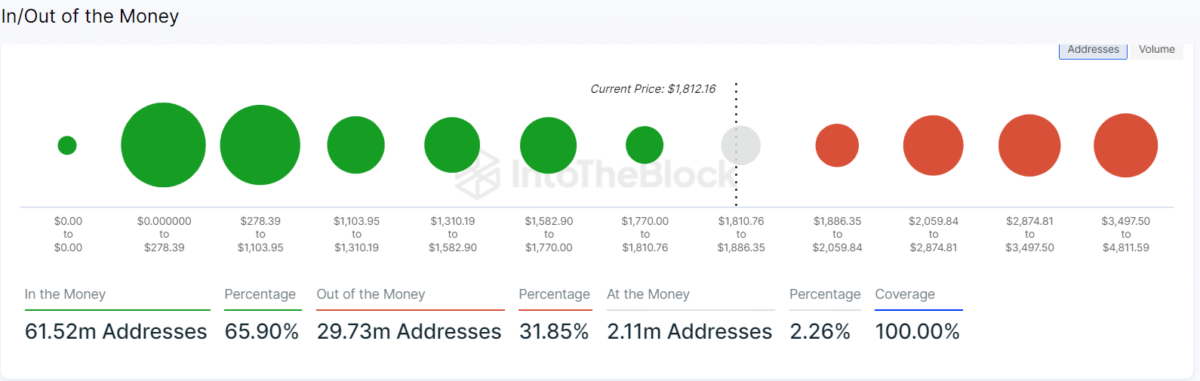

Global In/Out of the Money Metric

Concerning the current price of Ethereum, the Global In/Out of the Money (GIOM) on-chain metric indicates that 65.9% of DOGE addresses are in the money or realizing profits, whereas 31.85% are out of the money addresses witnessing losses.

Therefore, the major portion of the holding addresses is in profits, decreasing the possibility for investors to sell the holding anytime soon.

Technical Indicator

Relative Strength Index: The daily RSI slope dives deeper into the bearish territory reflecting the negative sentiment in the market is rising.

Exponential Moving Average: With today’s price drop, the Ethereum price plunged below the 50-day EMA after six weeks offering an additional edge for short-sellers.

Ethereum Coin Price Intraday Levels-

- Spot rate: $1815

- Trend: Bearish

- Volatility: Low

- Resistance level- $1920 and $2000

- Support level- $1700 and $1500

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs