Here’s Why ApeCoin Price May Drop Below The $4.26 Support

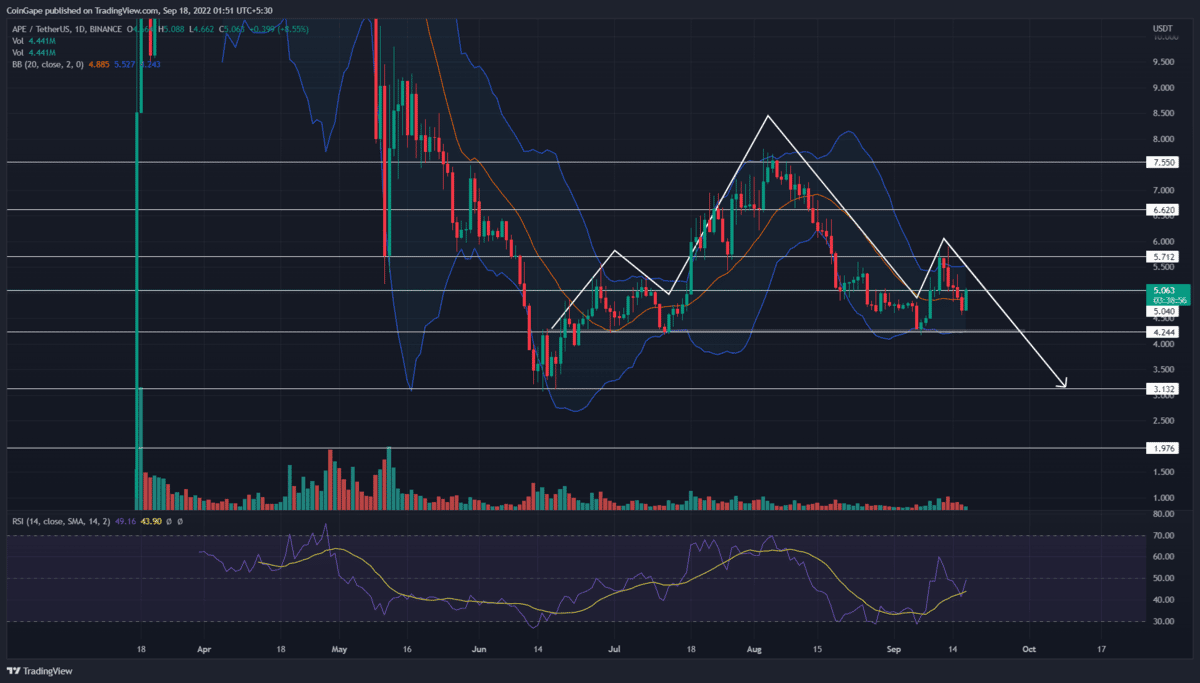

The V-Top reversal from the $5.7 resistance plummeted the Apecoin price below the $5 support. The altcoin is currently in a retest phase, and the post-retest fall may pull the prices to $4.42 support. Moreover, this level also acts as neckline support for head and shoulder pattern.

Key points Apecoin price analysis:

- The post-retest fall may plunge the price by 15%

- The 20-day EMA offers dynamic resistance to Apecoin priceApecoin price

- The intraday trading volume in Apecoin is $157.6 Million, indicating a 20.8% gain

Source-Tradingview

The Apecoin daily technical chart shows the formation of a head and shoulder pattern. This bullish pattern is often found in market tops as the prices display a trend reversal, switching from higher high formation to lower low formation.

Amid the recent sell-off in the crypto market, the altcoin turned down from the $5.7 resistance and bolstered the right shoulder portion of the pattern. The four-consecutive red candles registered a 19% loss and plug prices to $4.57 marked low.

Also read: Just-In: ApeCoin (APE) Community Gets Its Separate BAYC NFT Marketplace

Furthermore, the falling prices break a 20-day EMA and the local support of $5, indicating the sellers aim for another leg down. However, today, the coin is 7% and retests the breached resistance of $5.7.

However, the bullish candle aligned with lesser volume indicates weakness in bearish momentum. Thus, if the selling pressure persists, the Apecoin price may revert from the $5.5 resistance and breach the neckline support of $4.24.

A bearish breakdown from this pattern would accelerate the bullish momentum and challenge the June bottom support of 4.2%. The Apecoin price could reach the $2 mark per technical set-up.

On a contrary note, a daily candle above $5.7 will undermine the bearish pattern.

Technical Indicator

Bollinger band: the coin price breach the pattern’s midline from below, suggesting the buyers are looking for trend control. This mean line may also act as a dynamic resistance.

RSI indicator: the daily-RSI slope nosedived below the neutral line indicates the bearish sentiment building up among market participants.

- Resistance levels: $5.4 and $6

- Support levels: $4.2 and $3.2

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral