LUNA Price Prediction: Regains Upside Traction Near $95.0; Attempt To Revisit Record Highs Above $104.0

LUNA price extend the previous session gains and started the fresh trading week on a higher note. Although the price faces some upside pressure at the session’s high the downside risk seems limited for the asset.

- LUNA price edges higher on Monday with remarkable gains.

- A decisive close above $95.0 aims for an all-time high next.

- Downside risk remains limited at $85.0.

As of publication time, LUNA/ USD is exchanging hands at $92.61, up 5.96% for the day. The seventh-largest cryptocurrency by market cap holds 24-hour trading volume at $3,425,875,156 with more than 83% gains as per the CoinMarketCap.

Generally, a rise in price with increased trading volume is a sign of strength in the price.

LUNA price moves north

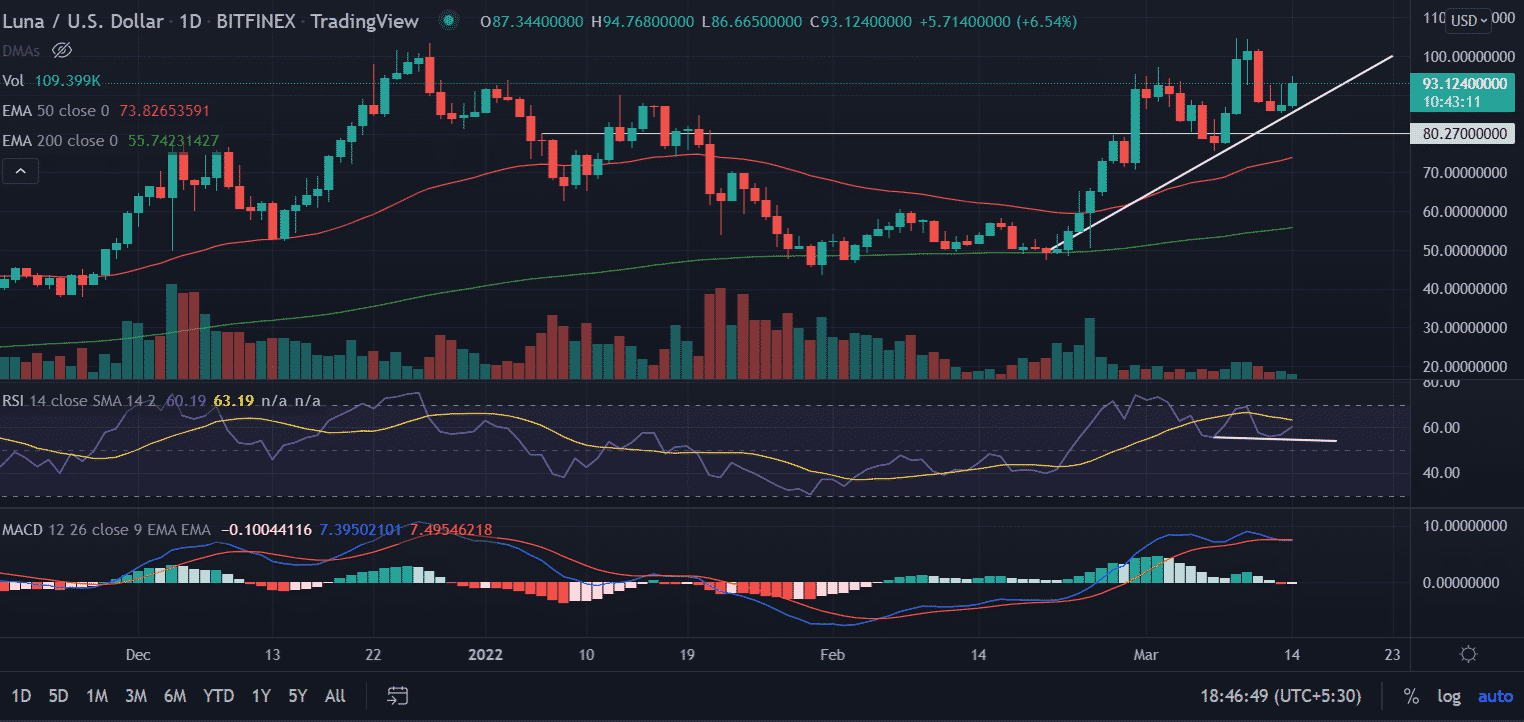

On the daily chart, LUNA price is rising along the ascending trendline, which is extending from the lows of $50.71 that also coincides with the critical-200 EMA (Exponential Moving Average) at $49.65. Further, the asset pierced another crucial hurdle of 50-day EMA at $50.67. LUNA price surged more than 100% since February 20 bucking the broader crypto market trend.

Currently, LUNA’s price is facing some upside barrier near the $93.0-$95.0 zone. A resurgence in the buying pressure would push the price toward higher territories aiming for the first target at all-time highs of $104.57.

Next, an extended buying momentum will attempt to test the next all-time-high level at the psychological $110.0 barrier.

On the flip side, a break of the bullish slop line will invalidate the bullish theory. On the downside LUNA price dive toward the $80.0 horizontal support level. Below that sellers will further collect the liquidity around the $70.0 demand zone.

Technical indicators:

RSI: The Daily Relative Strength index is giving negative divergence and trades below the average line. Any downtick in the indicator could push the price lower.

MACD: The Moving Average Convergence Divergence (MACD) is oscillating above the midline with a neutral bias.

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act