Shiba Inu Price Risks 35% Crash Despite 103,222% Surge in SHIB Burn Rate

Highlights

- Shiba Inu price could drop 35% if it breaks a key inclined support level.

- The daily SHIB burn rate jumped by 103,222% to 102,141,121.

- On-chain metrics show that Shiba Inu network activity and active addresses are falling while whale selling is increasing.

Shiba Inu (SHIB) price has dropped to a crucial support level this week as whale selling and network activity fall. Losing this support will increase the risk of the token falling by 35% to its lowest level in 2023, even after the sudden 103,222% surge in its burn rate. As of June 12, SHIB price today trades at $0.00001263, down by 27% from its highest point this year and 62% lower than its November high. This descent can be attributed to the recent drop in crypto market valuation due to BTC’s drop. SHIB’s 24-hour volume dropped by 9% to $200 million.

Shiba Inu Price Technical Analysis

The three-day chart shows that the Shiba Inu price has dropped 28% since the May 10 high of $0.00001758. This crash has pushed SHIB to revisit the ascending trendline connecting the swing lows formed on October 23, March 2025, and April 2025. The recent bounce shows the importance of this support.

Additionally, the aforementioned SHIB price crash pushed it below the 50-day moving average at $0.00001476, indicating that bears are in control. The Relative Strength Index (RSI), which measures the speed and change of price movement, is pointing downwards below the neutral point at 50, highlighting the bearish momentum .

Similarly, the two lines of the Relative Vigor Index (RVI) have formed a bearish crossover pattern and moved to their lowest level since March this year. The RVI indicator compares the closing price of an asset to its trending range and then smooths the result.

Therefore, a volume-supported move below the ascending trendline could triggera 35% crash to $0.0000084, the lowest level since January last year.

The alternative scenario is where Shiba Inu price bounces back above the ascending trendline. If this happens, the initial support will be at $0.00001754, its highest point in May. A move above that level will confirm the bullish breakout. In such a case investors can refer to a previous CoinGape article that outlines a potential 20% rally for Shiba Inu token.

SHIB Burn Rate Surges But Risks Remain

One key catalyst for Shiba Inu price is that the burn rate has staged a strong comeback today. Shibburn data shows that the burn rate jumped by 112,839% to 102,141,121 SHIB on Thursday. This increase was due to one user moving 97,560,806 million coins to a burn address.

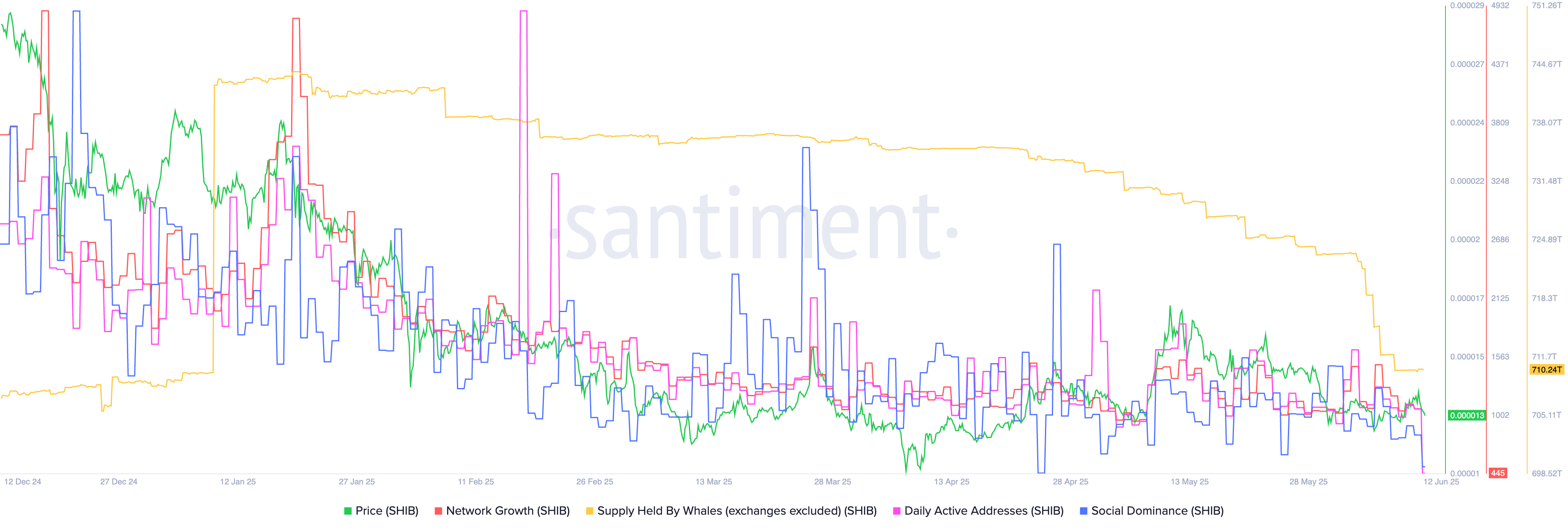

Most of the other on-chain metrics are not bullish on Shib Inu. For example, Santiment data shows that the supply of SHIB tokens held by whales has been in a free fall this year. It has dropped to 710 trillion, down from 736 trillion in March.

Another data shows that the network growth has plummeted to the lowest level in over a year. It dropped to 445, down from 4,812 on January 19. This metric examines the number of new addresses created within a specified period.

More metrics, such as social dominance and daily active addresses, have been in a downward trend. In most cases, cryptocurrencies rally when these metrics are rising.

Summary

Shiba Inu price has been under pressure in the past few months. While the surge in burn rate is a positive catalyst, it may not be enough to propel it higher, given the weak on-chain metrics and technicals. For a long-term outlook, read Shiba Inu price prediction 2025.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Will Shiba Inu price crash by 35% soon?

2. Is the rising SHIB burn rate a bullish catalyst?

3. Which are the bearish on-chain metrics?

- Top U.S. Banks Weigh Lawsuit Against OCC Over Crypto Firm Charters

- CLARITY Act: Key Democrat Says Banks May Have to Compromise as Senate Eyes Crypto Bill’s Markup

- XRP News: Brad Garlinghouse Predicts ‘Defining Year’ For Ripple With XRP At The Center

- Dogecoin Rockets as Elon Musk Confirms X Money Early Public Access Launch in April

- Just-In: Trump Says Talks With Iran “Possible” Even as Tehran Rules Out Negotiations

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

Buy $GGs

Buy $GGs