Solana Price Could Surge 55% After $8B Manager’s Bold Stablecoin Forecast

Highlights

- Solana price could jump by 55% and reach its all-time high.

- REX Financial CEO believes that Solana will dominate the stablecoin industry.

- He sees it beating Ethereum in this industry in the long term.

Solana price is falling today, August 26, as the sentiment in the crypto industry worsens. SOL token dropped to $188, moving further away from the psychological point at $200. Still, technical analysis points to a 55% surge to an all-time high as a fund manager delivered a bold forecast on its stablecoin growth.

Solana Price Could Surge as Expert Predicts its Stablecoin Growth

Solana price has done well in the past few years as it because of its domination in the meme coin industry. Now, Greg King, the chief executive of REX Financial, has predicted that it could become the next big thing in the booming stablecoin industry.

He believes that Solana’s technology is superior to that of Ethereum, which currently dominates the sector today.

His statement is notable because REX, the company he runs, has accumulated over $8 billion in assets. Some of those assets are the recently launched Solana Staking ETF, which has accumulated over $177 million in assets under management, a month after its launch.

Data shows that Solana has a long way to go to catch up to Ethereum in the stablecoin industry. According to Artemis, its stablecoin supply has jumped by 5.60% in the last 30 days to $12 billion, making it the second-biggest chain in the sector.

Solana’s stablecoin transaction volume soared by 90% in this period to over $192 billion. This growth in transactions will boost its network fees, which are averaging $1.4 million a day.

Strong stablecoin growth on Solana gained after the recently signed GENIUS Act, which is now governing these coins in the United States.

Solana price has other potential catalysts that may push it to a record. 9 companies have applied for spot SOL ETFs, which will likely be approved by the end of the year. These funds will likely attract more inflows from American investors as Bitcoin and Ethereum have demonstrated in the past two years.

More data shows that the Solana network is doing better than other chains. The network’s transactions stood at over 2.25 billion in the last 30 days, much higher than most other layer-1 and layer-2 chains.

SOL Price Technical Analysis

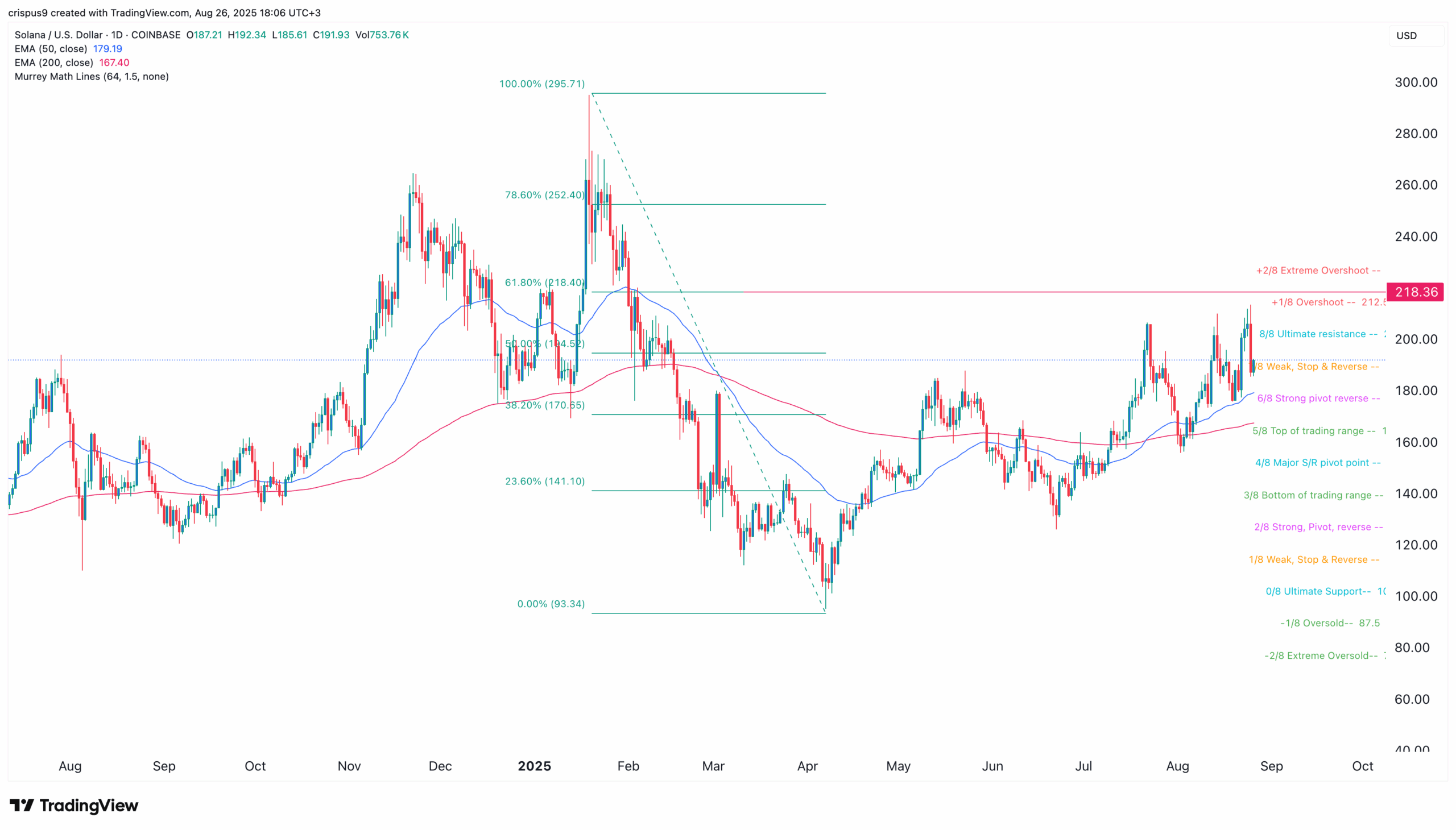

The daily timeframe chart shows that the Solana price has been in an uptrend after falling to $93.35 in April as the trade war started. It formed a golden cross pattern on July 22. This pattern forms when the 50-day and 200-day moving average cross each other while pointing upwards.

SOL price has found substantial resistance close to the 61.8% Fibonacci Retracement level and the overshoot point of the Murrey Math Lines. A surge above that level will point to more gains to its all-time high at $295, which is about 55% above the current price.

On the other hand, a drop below the strong pivot reverse level will cancel the bullish SOL price forecastfor 2025.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely Solana price forecast?

2. What is the main catalyst for the SOL price this year?

3. When will SOL token hit its all-time high?

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

Buy Presale

Buy Presale