Solana Price Prediction: How High Could SOL Go in January 2026?

Highlights

- Solana price breakout nears as volume and momentum significantly increase.

- $130 remains a critical resistance for further upside confirmation.

- Derivatives data show rising open interest and bullish sentiment.

Solana price showed signs of strength in early January 2026, hovering near $127 after a minor recovery in the broader market.

The token remains supported within the $120–$130 demand zone, a level traders are watching closely for potential upside.

The technical indicators on various timeframes indicate that the bullish momentum has the potential to accumulate.

In the last 24 hours, Solana increased by 3%, which is higher than the performance of the general crypto market of 1.92%. The volume of trading shot to $3.81 billion and which is 143% higher, meaning that investors are interested again.

In the meantime, Bitcoin price hovered above $89,000, and Ethereum fluctuated around $3,000 and also adding to the optimism in the altcoin market.

Solana Derivatives Activity Gains Momentum

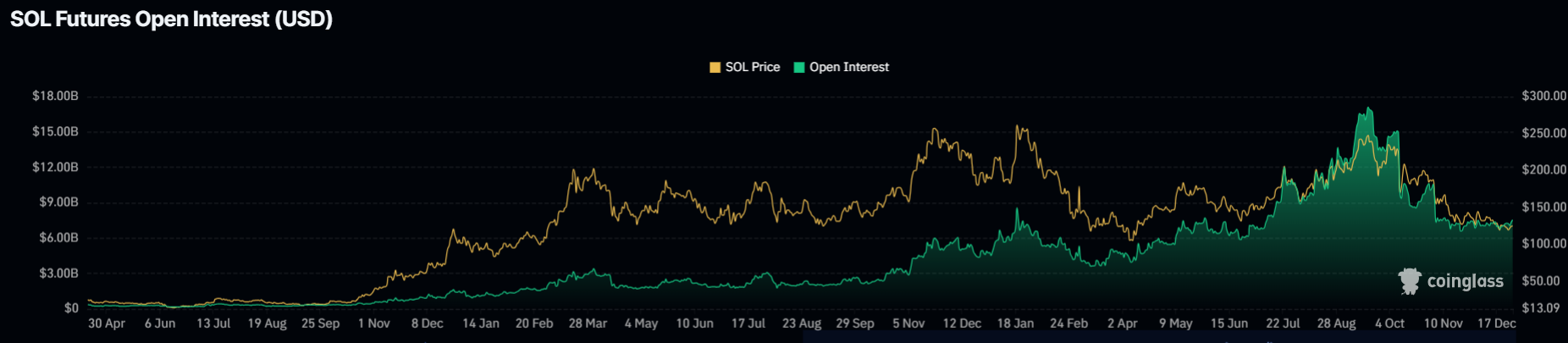

As of the time of writing, Solana derivatives data pointed to a strong rise in trading participation.

The derivatives trading volume nearly doubled and reached nearly up to $11.63 billion in the last period.

The open interest rose by 6.8%, to about 7.89 billion. The combination is an indicator of increasing market participation, and traders were putting on fresh positions in a high short-term activity.

Solana Price Eyes Breakout From Falling Wedge

Crypto analyst suggests Solana is showing signs of a breakout from a falling wedge on the 4-hour chart. There seems to be technical momentum in place with the volumes increasing to support short-term bullish pressure.

The trend, reinforced by a tightening price action and historic areas of volatility, is in line with a possible upward trend.

breaking out on the LTF’s

another fakeout or will we see $150+ $SOL this week?#SOLANA ⚡️ pic.twitter.com/OyXfqgvt0g

— curb.sol (@CryptoCurb) December 29, 2025

Additionally, another analyst sees the breakout on lower timeframes, and the level to which the momentum will drive the market is above the $150 target.

Both of them emphasize a critical area where buyers need to be fatigued to prevent a fakeout. The breakout attempt of Solana will most probably be put to the test this week, and traders will be keen on the price response above $130.

SOL Price Near Key Levels: Will Recovery Momentum Continue?

As of the time of writing, the SOL price climbed to $127.92, posting modest gains of 3% the four-hour chart.

Solana was a buyer following a rebound after the support zone of $123-$125. Which buyers have defended several times during the pullbacks. Solana’s price behavior was in a range where SOL was consolidating at a price of less than $130.

The Chaikin Money Flow remained profitable, indicating that capital flows into Solana markets persisted. The MACD line was to the right of the signal line, and the histogram became positive.

If Solana long-term price outlook clears $130 with strong closes, upside targets sit at $140 and $150.A sustained move above $150 could open the door toward the $160 region.

On the negative, missing the hold of $123 can subject the next support of $120. A decline under $120 may cause the short-term structure of the market to be bearish at $110.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Is Solana showing signs of a breakout?

2. What is the key resistance level for Solana now?

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs