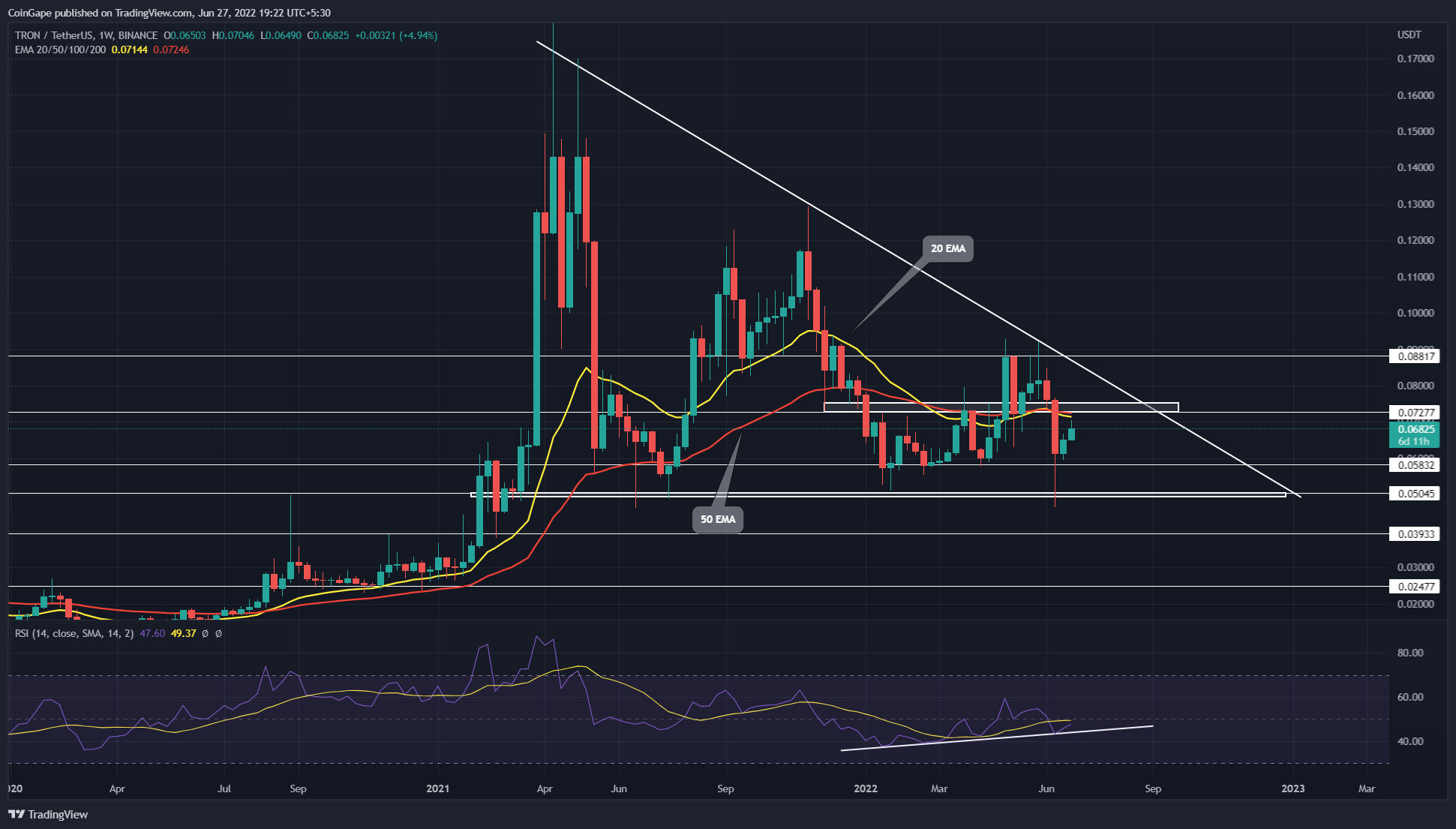

Tron Price Analysis: Triangle Pattern Governs the TRX Price Action; Should Coin Holders Worry?

For more than a year, the Tron (TRX) price bounded within a descending trendline pattern. Furthermore, on June 15th, the coin price rebounded from the $0.5 neckline and triggered a new bull cycle. The recovery rally aims for a 24% rise before hitting the descending trendline.

Key points

- The TRX buyers are trying to rise above the $0.065 resistance

- The TRX chart shows a bearish crossover of the 20-and-50-weekly EMAs

- The 24-hour trading volume in the TRON coin is $793.6 Million, indicating a 10.15% hike.

Since the TRX/USDT pair reverted from the $0.18 high in April 2021, the price action has been wavering within a descending triangle pattern. The coin price has thrice tested the descending resistance trendline and $0.05 neckline support, indicating the traders respect the pattern’s levels.

Amid the second and third-week sell-off, the TRX price gave its third retest to the $0.05 mark and bounced back immediately as the market sentiment started to ease. The current bulls cycle initiated from the mentioned support propelled the altcoin 48.63% higher to its current level of $0.0694.

The sustained buying should allow the TRX price to surpass the $0.073 mark and retest the dynamic resistance trendline. A possible trendline reversal would encourage the resumption of the consolidation phase within the pattern.

Furthermore, the descending triangle pattern is a bearish continuation pattern and could threaten a $0.05 support breakdown to continue the prevailing downtrend.

Technical indicator

EMAS: The 20-and-50-weekly EMA’s wobbling around the $0.075 resistance puts additional selling pressure on TRX traders and could stall the upward rally to the resistance trendline.

RSI indicator: However, the daily-RSI slope shows a bullish divergence concerning the last two retests to $0.05. This divergence may indicate the pattern holds the possibility of trendline breakout.

- Resistance level- $0.075 and $0.088

- Support levels- $0.058 and $0.05

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs