XRP Price Prediction as Daily Active Addresses Spike 1,609% in 24 Hours

Highlights

- XRP price eyes gains as daily active addresses surge by 1,609% within 24 hours.

- XRP's current performance also mirrors the 2017 bull fractal that triggered a massive price surge to all-time highs.

- If history rhymes as interest surges, XRP price may be poised for a 287% rally to $8.82.

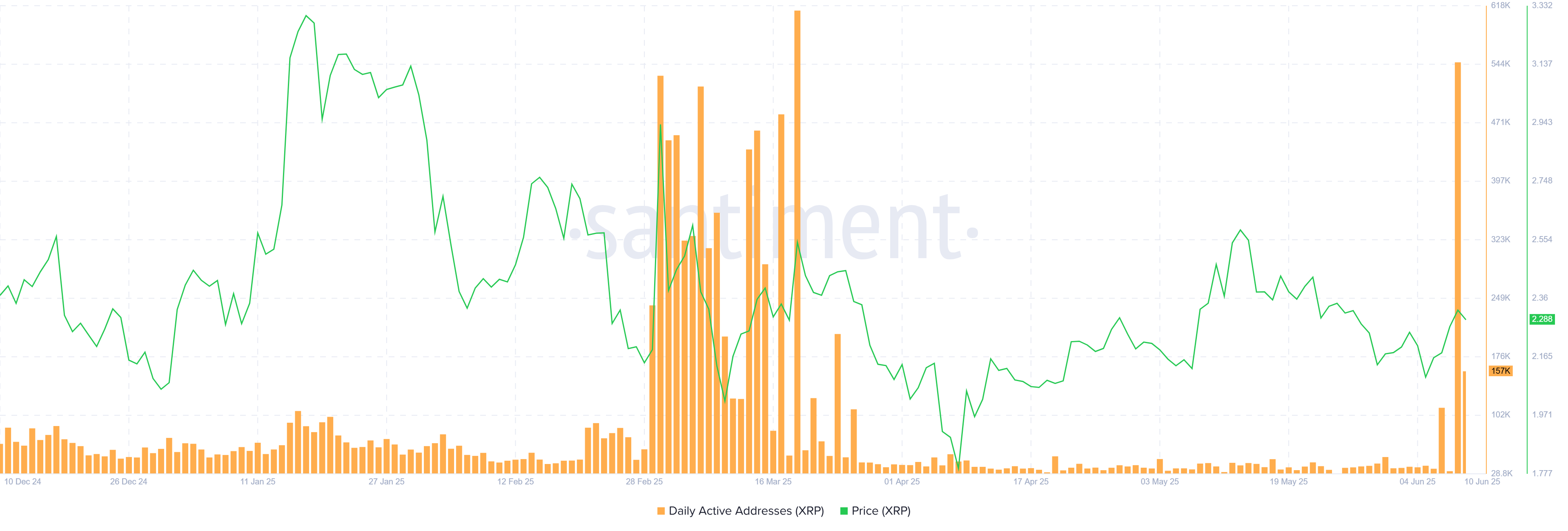

XRP is up 4.59% in the past two days, but the daily active addresses have surged 1,609% in just 24 hours. This spike in user engagement indicates that investors are interested in the token at the current price level of $2.28. Will this uptick in investor interest translate into an uptrend for the XRP price, ending the ongoing multi-month consolidation?

XRP’s Daily Active Addresses Skyrocket to 547,000 in 24 Hours

According to blockchain analytics firm Santiment, the number of daily active addresses (DAAs) interacting with the XRP blockchain has increased from roughly 32,000 on June 9 to 547,000 on June 10. This represents a 1,609% increase in 24 hours, suggesting a significant surge in investor interest, potentially accompanied by a capital inflow. This marks the highest single-day surge in user activity this year.

The DAA metric shows the number of unique wallets conducting XRP transactions or interacting with Ripple’s network within a 24-hour period. Therefore, a surge may reflect increased interest from retail traders and institutions. It could also show increasing XRP Ledger usage after Ripple partnered with Japan’s Web3 Salon to support growth and innovation on the blockchain.

Historically, massive spikes in the DAA often precede a shift in market sentiment. Between late February and early March 2025, the DAA spike was followed by a short-term XRP price rally. If history repeats, the current spike could serve as a foundation for a bullish breakout

This spike could also lead to price volatility due to surging capital inflows. As more active addresses interact with XRP, it may translate to greater volatility and trigger a breakout, which will likely be bullish based on the magnitude of this surge.

If this surge is indeed bullish for price, how high will Ripple’s token rally? Will it kickstart the next bullish leg to an all-time high as the broader crypto market flips bullish?

XRP Price Mirrors 2017 Bullish Setup

The weekly XRP price chart shows similarities between its current performance and the 2017 bull fractal. Between 2017 and 2018, Ripple recorded one of its most impressive bull runs that culminated in the formation of an all-time high of $3.84. However, this bull run had been in the making for roughly three years.

The first stage of the 2017 bull run began in 2014 as XRP made a series of lower highs. In 2016, the price entered a range-bound consolidation before breaking out to $0.32. The rally then stalled within a second consolidation range before the next breakout pushed the price to the 161.8% Fibonacci level of $3.91.

XRP price is repeating this pattern and has completed the first stage between 2021 and 2022, as evidenced by the lower highs. In Q4 2024, it broke out of the first consolidation range with a 580% surge. It is now stuck within the second consolidation range, and if history rhymes, the next bullish leg could push the price to the 161.8% Fib level of $8.82, marking a fresh record high.

This bullish setup becomes more convincing if combined with the 1,609% surge in daily active addresses. XRP whales are also accumulating, and if the above bullish pattern holds, the price could be on the verge of another explosive upside move.

Therefore, as the market interest towards XRP rises and Ripple’s network activity increases, a rally may be on the way. With on-chain data and the technical structure flipping bullish, buy-side pressure could begin to surge.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why are XRP daily active addresses up 1,609% today?

2. Will XRP price rally as active addresses surge?

3. Can XRP repeat the 2017 price fractal and surge to $8.82?

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs