Matrixport Reveals Ethereum ETF Launch Timeline, Bernstein Targets ETH To $6,600

Highlights

- Matrixport reported that the SEC will likely approve Ether ETF this week.

- Matrixport expects swift progress on S-1 approval similar to 19-b approval by the SEC in next three days.

- Bernstein and Matrixport forecast massive rally in ETH price.

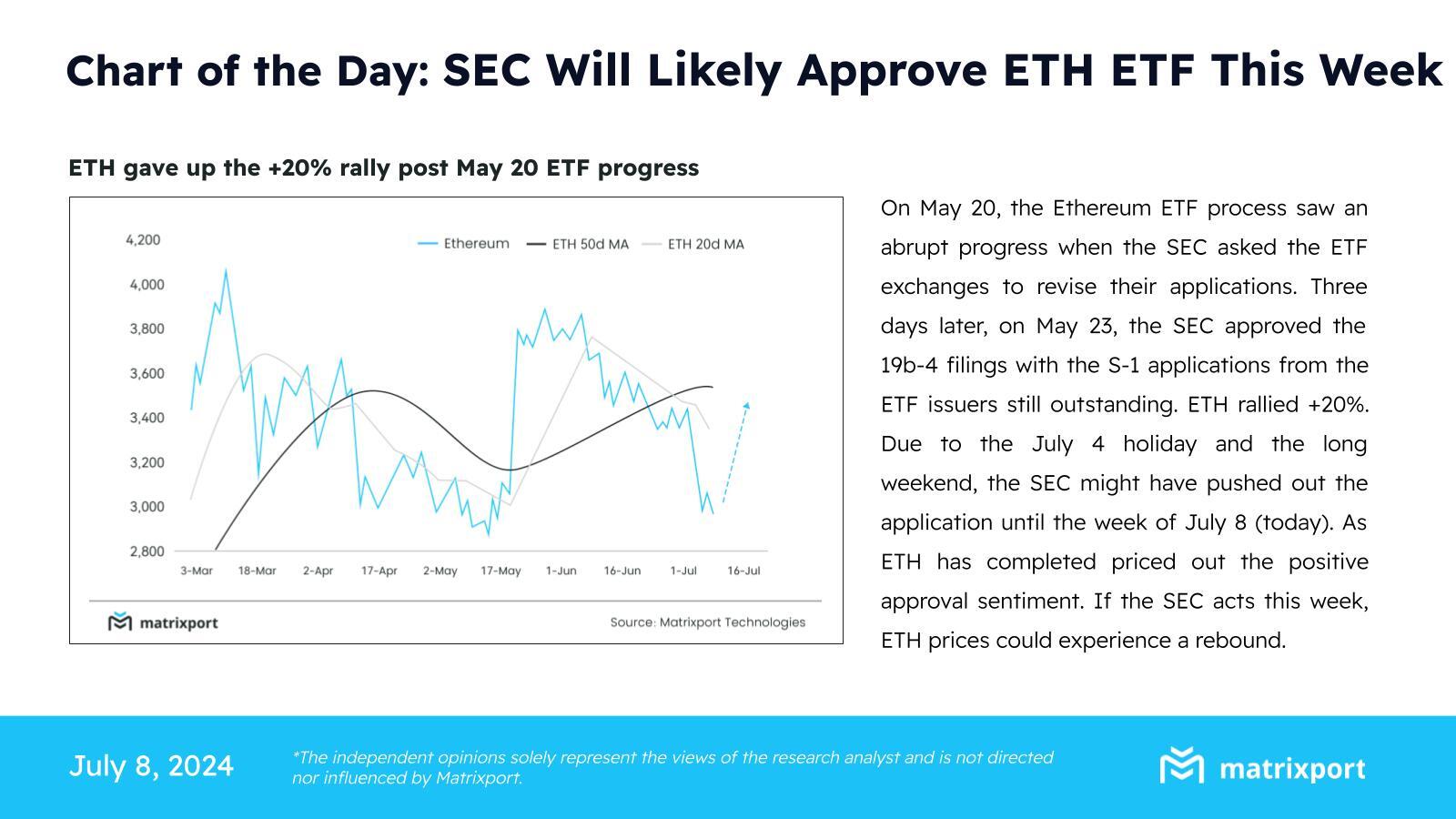

With all eyes on a spot Ethereum ETF approval for listing and trading by the U.S. SEC, experts predict high odds of approval this month. Crypto financial services firm Matrixport believes the Securities and Exchange Commission might approve Ether ETF by this week as the deadline for issuers to submit amended S-1 filings is Monday.

Ethereum ETF Approval Likely This Week

In a new update on July 8, Matrixport reported that the SEC will likely approve Ether ETF this week. The United States will have an exchange-traded fund tracking the spot price of Ethereum.

Matrixport expects swift progress similar to May when the SEC suddenly asked spot Ethereum ETF issuers to revise their applications. After 19b-4 filings by issuers, the SEC instantly approved them in the next three days. The S-1 applications were probably delayed due to the July 4 holiday and the long weekend.

CoinGape reported that the SEC delayed Ethereum ETF launch with a few comments, pushing the S-1 deadline to July 8. ETFstore President Nate Geraci said the last round of S-1 revisions was quite “light” and believes Ethereum ETFs will start trading in the next two weeks.

BlackRock, Fidelity, Grayscale, Hashdex, VanEck, and Invesco are anticipated to submit S-1 filing to the U.S. Securities and Exchange Commission (SEC).

Also Read: EtherFi Foundation Buys ETHFI, Passes Major Staking Proposal On Ethereum Mainnet

ETH Price To Witness Massive Rally?

Matrixport predicts a recovery in Ethereum price to $3,400 after the approval by SEC. The company forecasting a nearly 12% sharp jump based on analysis that ETH price rallied 20% after the SEC approved 19-b filings.

Whereas, $725 billion asset manager Bernstein earlier gave a long-term ETH price target of $6,600. The firm reported that ETH will reach this price after spot Ethereum ETFs approval by the SEC. Notably, the estimate is based on a 75% rally in Bitcoin products in January following weeks of ETFs approval. Bernstein analysts expect a similar price action for Ethereum.

ETH price rose 2% in the past 24 hours, with the price currently trading at $3,068. The 24-hour low and high are $2,826 and $3,090, respectively. Furthermore, the trading volume has increased further by 57% in the last 24 hours, indicating a rise in interest among traders.

Also Read: XRP Whale Moves 37M Tokens As Lawyer Reveals Ripple Vs SEC Timeline

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs