Metaplanet Stock Shoots 17% After $30M Investment from Bitcoin Treasury Firm

Highlights

- Metaplanet stock gains momentum as company raises $1.4 billion for additional BTC purchases.

- The firm has increased its capital reserve allocation to 10%, and aims to add nearly 11,000 BTC more to its kitty.

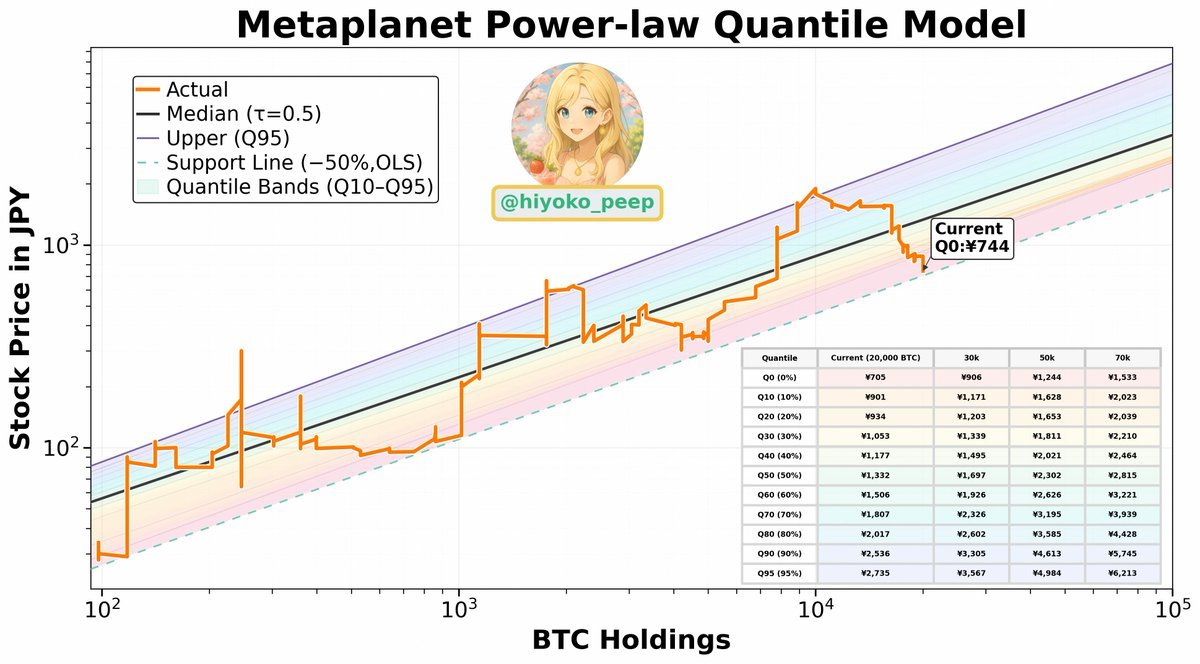

- Technical models say that Metaplanet stock’s bottom is at 705 JPY and fair value at 1,332 JPY.

The Metaplanet stock rallied by a strong 17% on Wednesday, September 10, in a healthy trend reversal after a 26% correction last month. This rally comes after Bitcoin treasury firm Nakamoto Holdings announced a $30 million investment in Metaplanet. Asia’s largest Bitcoin holding public firm has also raised $1.4 billion for additional BTC purchases.

Metaplanet Stock Surge Shows Signs of Trend Reversal

The Metaplanet stock price surged 17% during Wednesday’s trading session on the Tokyo Stock Exchange, soon after the Japanese firm upsized its capital raise to $1.4 billion for additional Bitcoin purchases. Since hitting the highs of 1900 JPY in June, the stock has been on a freefall and corrected nearly 70% since then.

Another catalyst behind the stock rally is Bitcoin Treasury firm Nakamoto Holdings, which announced $30 million investment in the Japanese firm, through its subsidiary KindlyMD (NASDAQ: NAKA). The $30 million commitment forms part of the international equity financing unveiled by Metaplanet.

Nakamoto Holdings will complete the funding on September 16, with the issuance and delivery of common stock set for September 17. Speaking on the development, David Bailey, Chairman and CEO of KindlyMD, said:

“Metaplanet has established itself as a leader in Japan’s Bitcoin landscape through its commitment to advancing financial innovation and driving the global adoption of Bitcoin. We are proud to support their mission and believe this investment will further strengthen the global network of companies placing Bitcoin at the center of institutional finance.”

Boosting Capital Reserve Allocation for Bitcoin

Japanese firm Metaplanet has boosted its capital reserve allocation to 10%, up from 5%, to strengthen its Bitcoin income-generation strategy. The company confirmed it currently holds 20,136 BTC, following its fresh Bitcoin purchase earlier this week, with an mNAV of 1.5.

With its latest $1.4 billion fundraise, the company can add an additional 11,000 BTC to its kitty, raising its total holdings by 50%. Amid these developments, interest in the Metaplanet stock has recently spiked. The Japanese firm said that earnings from its Bitcoin strategy will be directed toward dividend payments.

Furthermore, the Power-law Quantile model shows that the Metaplanet stock bottom is at 705 JPY, and that its fair value is at 1332 JPY.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs