MicroStrategy Halts Bitcoin Purchase, MSTR Stock Slides 13%

Highlights

- MicroStrategy didn't buy any Bitcoin between March 31 to April 6.

- The company bought 80,715 BTC worth $7.66 billion in Q1.

- The company held an unrealized loss of $5.91 billion on digital assets for Q1.

- MSTR stock price is down over 13% on the day.

MicroStrategy has halted its Bitcoin purchases amid this recent market crash, with the flagship crypto dropping below $80,000. The MSTR stock is also in bear territory at the moment, thanks to the widespread market crash due to Donald Trump’s tariffs.

MicroStrategy Halts Bitcoin Purchase Amid Market Crash

MicroStrategy, now Strategy, has halted its Bitcoin purchase, failing to acquire any BTC between March 31 and April 6. This is significant as the company has developed a knack for purchasing BTC every other week, thanks to its capital raise through stock sales.

Last week, Coingape reported that Michael Saylor’s firm bought 22,048 BTC for $1.92 billion the previous week, one of their largest purchases to date. Meanwhile, the company purchased 6,911 BTC a week earlier for $584 million.

Meanwhile, it is worth mentioning that MicroStrategy bought 80,715 BTC for $7.66 billion in the first quarter of this year at an average price of $94,922. The company currently holds 528,185 BTC, which it bought for $35.63 billion, at an average price of $67,458 per Bitcoin.

Thanks to the recent drop in the Bitcoin price, Strategy risks watching its BTC investment return to its entry price or even run into a loss. The company revealed in a filing that its unrealized loss on digital assets for the first quarter was $5.91 billion.

The company’s Bitcoin investment dropping into the red is significant as it could force them to offload some coins, which could negatively impact the market.

Although Saylor and his firm would carry out this sale over the counter, news around it could dampen investors’ confidence and spark a bearish sentiment. For context, the software company currently holds over 2% of Bitcoin’s total circulating supply.

MSTR Stock Slides Over 13%

Nasdaq data shows that MicroStrategy’s stock is down over 13% and is currently trading around $256. The drop in the MSTR stock price isn’t only due to the Bitcoin price decline, although both assets share a strong positive correlation.

MSTR has mainly declined thanks to Donald Trump’s tariffs, which have put the US stock market close to bear market territory. According to a Bloomberg report, the S&P 500 lost 3.5% at the open and is now on the brink of entering a bear market. The Nasdaq is also not far off.

As a result, MSTR has lost all its gains from earlier in the year and currently boasts a year-to-date (YTD) loss of 8%. The stock is still at risk of suffering more declines as Trump’s trade war heightens.

BTC Whales Still Accumulating

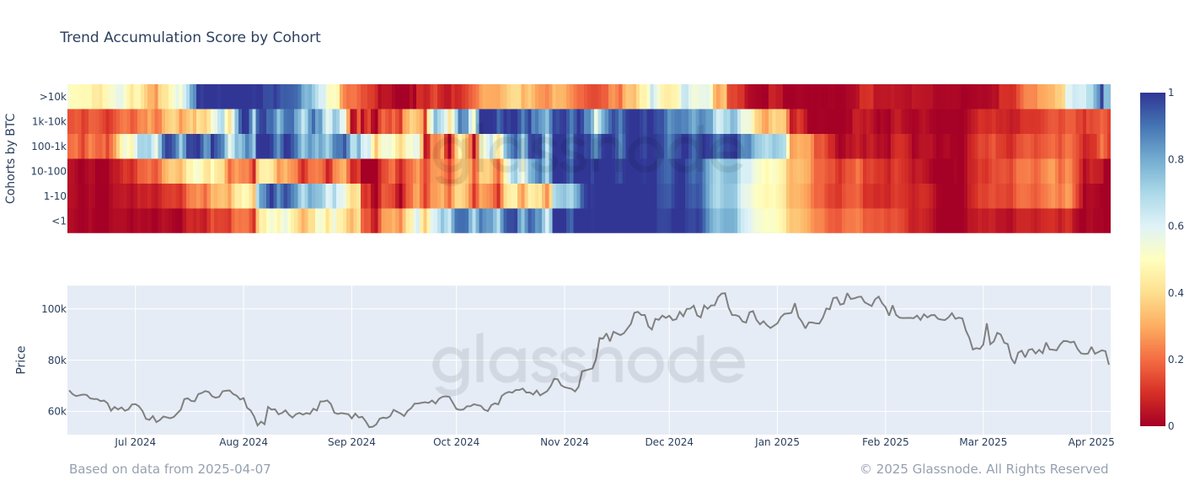

While MicroStrategy has halted its Bitcoin purchase, other BTC whales are still accumulating. Onchain analytics platform Glassnode revealed that whales holding over 10,000 BTC briefly hit a perfect accumulation score at the start of the month, reflecting intense 15-day buying.

Although the accumulation score has dropped to 0.65, Glassnode stated that this signals steady accumulation. However, these whales might have to be careful, as CryptoQuant CEO Ki Young Ju warned that the Bitcoin bull market is over.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise