MicroStrategy To Raise $21 Billion To Buy More Bitcoin, MSTR Stock Still Down

Highlights

- MicroStrategy will offer carry out a preferred stock offering to raise the $21 billion for its Bitcoin acquisition plans.

- The company will carry out these share sales in a "disciplined manner" over an extended period.

- The Bitcoin price briefly surged on the back of this announced while Strategy's stock is still down.

In a massive development, MicroStrategy, now known as Strategy, has announced plans to raise $21 billion to buy more Bitcoin. The company intends to offer its preferred stock to raise this capital for its BTC acquisition plans. The MSTR stock price is still in the red despite this recent announcement.

MicroStrategy To Raise $21 Billion To Buy More Bitcoin

In a press release, MicroStrategy revealed plans to raise up to $21 billion to buy more Bitcoin. This followed the company’s announcement that it has entered into a sales agreement, which allows them to issue and sell shares of its 8.00% series A perpetual strike preferred stock at $0.001 par value per share, which sums up to $21 billion.

Strategy revealed that it expects to sell perpetual strike preferred stock pursuant to the at-the-market (ATM) Program in a “disciplined manner” over an extended period. The company will take into account the trading price and trading volumes of the perpetual strike preferred stock at the time of sale.

MicroStrategy specifically mentioned that it intends to use the net proceeds from the ATM Program for general corporate purposes, including acquiring Bitcoin and working capital.

This development comes just a week after Strategy announced that it failed to buy Bitcoin the prior week. This move was out of character, considering that the company has made BTC purchases almost every week since the start of the year. Michael Saylor’s company currently holds 499,096 bitcoins, which it acquired for $33.1 billion at an average price of $66,357 per BTC.

How Prices Reacted Following The Announcement

The MSTR stock price failed to react positively to this announcement and is currently trading at around $271, down over 5% in pre-market trading. The company’s stock is down over 14% in the last one month. Bitcoin critic Peter Schiff also commented on MSTR’s decline, noting that the stock is down over 55% from its November 2024 high.

He claimed that there is no bottom in sight for the MSTR stock and asserted that MicroStrategy’s Bitcoin Strategy isn’t working. In with this, he remarked that the company needs a new CEO and stated that it is time to fire Saylor.

Meanwhile, the Bitcoin price briefly surged to as high as $84,000 on the back of MicroStrategy’s announcement. The announcement undoubtedly provides a bullish outlook for the flagship crypto, although the buy pressure is unlikely to impact prices since the company buys its BTC over the counter.

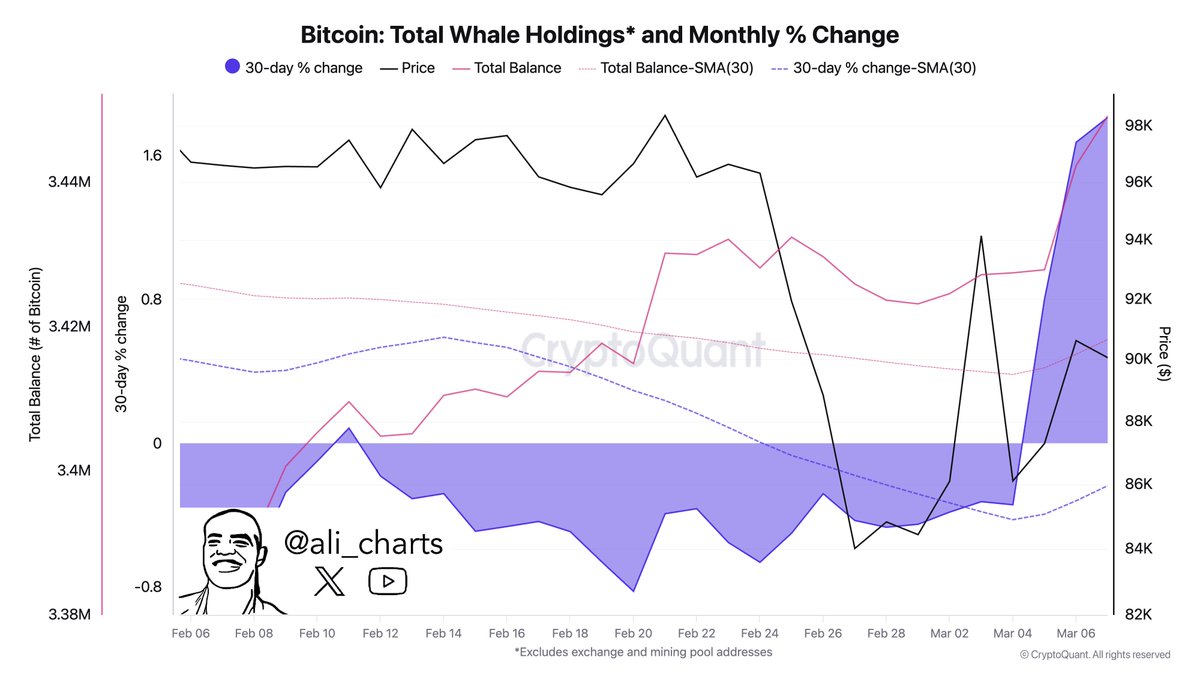

Crypto analyst Ali Martinez revealed that crypto whales, just like Strategy, are using this dip as an opportunity to accumulate more Bitcoin. These whales are said to have bought over 22,000 BTC in the last 72 hours.

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?