MSTR Stock Crashes As Michael Saylor Takes U-turn on mNAV Policy

Highlights

- MSTR stock sees huge dumping from loyalists As Michael Saylor flips on his word.

- MSTR mNAV collapsed from 3.63x to 1.6x, as Strategy loses premium over Bitcoin.

- Michael Saylor faces public criticism along with employee confidence in the firm.

Strategy stock crashed 7% on August 19, as Michael Saylor announced plans for further MSTR equity dilution, taking a U-turn on its mNAV policy. The MSTR stock price touched a four-month low, closing at $336 on Tuesday. Several company loyalists have dumped their stock holdings, criticizing Saylor for his sudden policy changes.

Michael Saylor Faces Backlash on MSTR Stock Dilution Plan

Amid the recent underperformance of Strategy shares on Wall Street, the mNAV for MSTR stock has crashed from 3.63x in November 2024, to now at 1.6x. Company executive chairman Michael Saylor faces major criticism for backtracking on his decision of no stock dilution below the 2.5x mNAV. Saylor justified the move as Strategy struggles to raise more capital for further Bitcoin purchases.

Josh Mandell, an MSTR stock investor and a popular voice on X and Reddit platforms, dumped his holdings after Saylor abandoned his equity dilution promise. Calling Michael Saylor a “liar,” Mandell accused the Strategy chairman of breaking his earlier commitment not to dilute MicroStrategy’s stock by 1 to 2.5 times except for covering interest and dividend payments. In a strong-worded message on the X platform, Mandell wrote:

“Please stop asking me if or why I sold $MSTR at 1.5 mNAV. You just don’t seem to get it. I actually bought above here and then Saylor sold. He said they wouldn’t … and then he did. I am announcing that I will not speak in support of anything that man does again”.

Ripple CTO David Joel Katz Schwartz , has also joined other critics and has warned investors holding MSTR stock if Bitcoin Pulls back further. He also criticised company’s alleged attempts to intimidate people sharing negative opinions on Michael Saylor’s plans to buy more Bitcoin.

Other loyalists of Strategy have joined Mandell over the recent exodus. They have also called out Saylor’s dishonesty over the stock dilution plans. On the other hand, Strategy employees are also lashing out on the Glassdoor platform. A Strategy employee on Glassdoor described the job as “extremely disappointing,” while an account executive labeled the experience “demoralizing.” During the second quarter, asset manager Vanguard trimmed its stake in Strategy by 10%, amid the recent stock underperformance.

Strategy Stock Eyes Next Stop to $300, Says Analyst

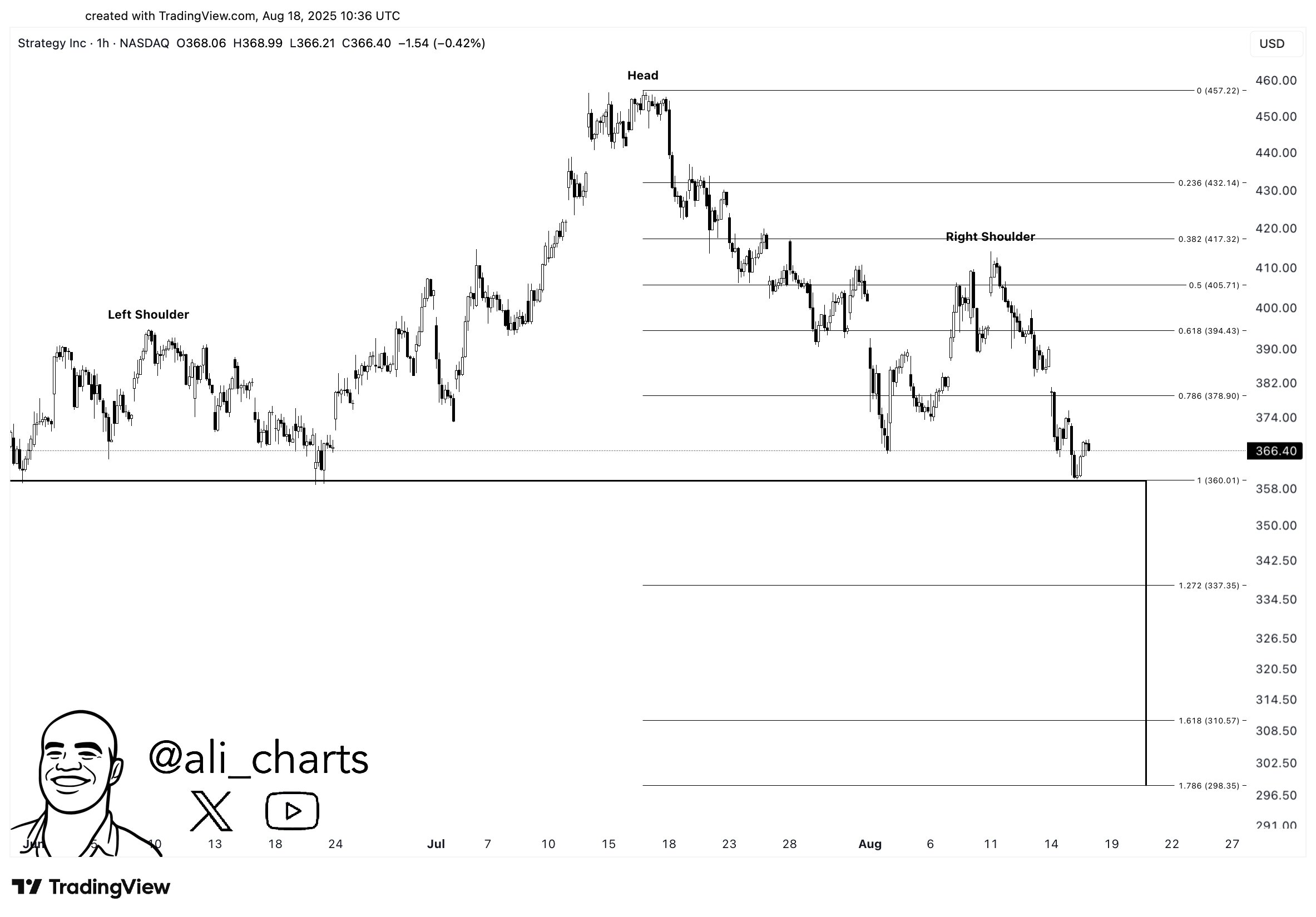

With MSTR stock crashing 7% on Tuesday, it has lost the crucial support at $360, on its head-and-shoulders technical chart pattern, as per recent CoinGape analysis. The next technical support for the stock stands at $300. Interestingly, this would further contract the Strategy premium over Bitcoin, thus making it difficult for Saylor to hold on to stock dilution.

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?