Nasdaq-Listed Lion Group to Convert SOL, SUI Holdings Into HYPE

Highlights

- Lion Group plans to make this conversion as part of a "strategic treasury reallocation."

- The company plans to make this conversion over time and not all at once.

- This comes as the HYPE price rallied to a new ATH.

Lion Group Holding Ltd. has revealed plans to convert its Solana and Sui holdings to Hyperliquid (HYPE) over time. The firm revealed that this move forms part of a strategic reallocation following BitGo’s launch of custody solutions for HYPE EVM.

Lion Group To Swap SOL, SUI For Hyperliquid (HYPE)

In a press release, the company announced that it plans to exchange all of its current SOL and SUI assets for HYPE. It noted that this follows the launch of institutional HYPE EVM custody solutions in the U.S. by crypto custodian BitGo.

Lion Group is aiming to optimize its crypto portfolio by “leveraging Hyperliquid’s high-performance Layer 1 blockchain and decentralized perpetual futures exchange capabilities.” As part of this strategic reallocation, the company stated that it will implement an accumulation strategy to convert its SOL and SUI holdings into HYPE over time.

With this, it aims to lower the average acquisition cost of its potential Hyperliquid position, thereby accumulating the DEX token below the current market price. The company added that this reflects its “commitment to prudent risk management and long-term value creation in the evolving digital asset landscape.”

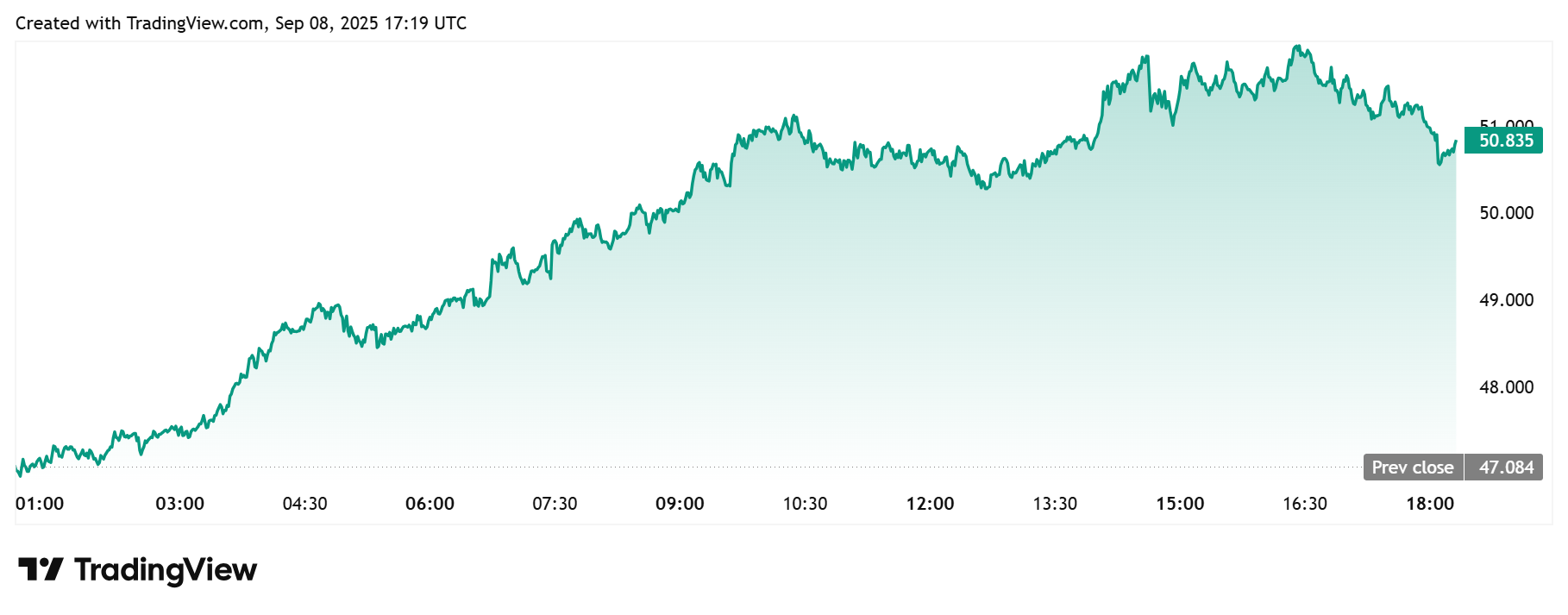

Furthermore, it is worth mentioning that this move comes amid the HYPE price rally to a new all-time high (ATH) today. TradingView data shows that the token reached almost $52 today, representing a gain of over 7% in the last 24 hours.

Meanwhile, the rally comes amid Hyperliquid’s move to launch its native USDH stablecoin. Stablecoin issuers like Paxos have tabled their proposal to deploy the USDH stablecoin, promising to inject some of the revenue into the token’s ecosystem.

How The USDH Stablecoin Could Boost The DEX Token’s Price

The launch of the USDH stablecoin could serve as a catalyst for higher prices for the HYPE token. Notably, stablecoin issuer Paxos has proposed to allocate 95% of its interest revenue from reserves to buy back the token.

Interestingly, Agora is proposing that 100% of its revenue share from the interest on its reserves for the stablecoin will accrue to the Hyperliquid ecosystem. This is similar to what Frax Finance is proposing.

Regardless of which proposal validators vote in favor of, the launch of the USDH stablecoin could lead to significant buying pressure for the HYPE token. Therefore, the market is likely pricing this in, which has led to the recent surge to a new ATH.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs