Nearly 40,000 Bitcoins Belonging to US Government Are on the Move

Over the last week, the world’s largest cryptocurrency Bitcoin (BTC) has been under selling pressure. As of press time, Bitcoin is trading 1.59% down at a price of $22,118 and a market cap of $23 billion.

On-chain data provider Glassnode recently reported that nearly 40,000 Bitcoins from wallets linked to the US Government law enforcement seizures are currently on the move. While a majority of them appear to be internal transfers, some of them have also moved to the crypto exchange Coinbase.

Glassnode notes: “approximately 9,861 $BTC seized from the Silk Road hacker have been sent to our Coinbase cluster”.

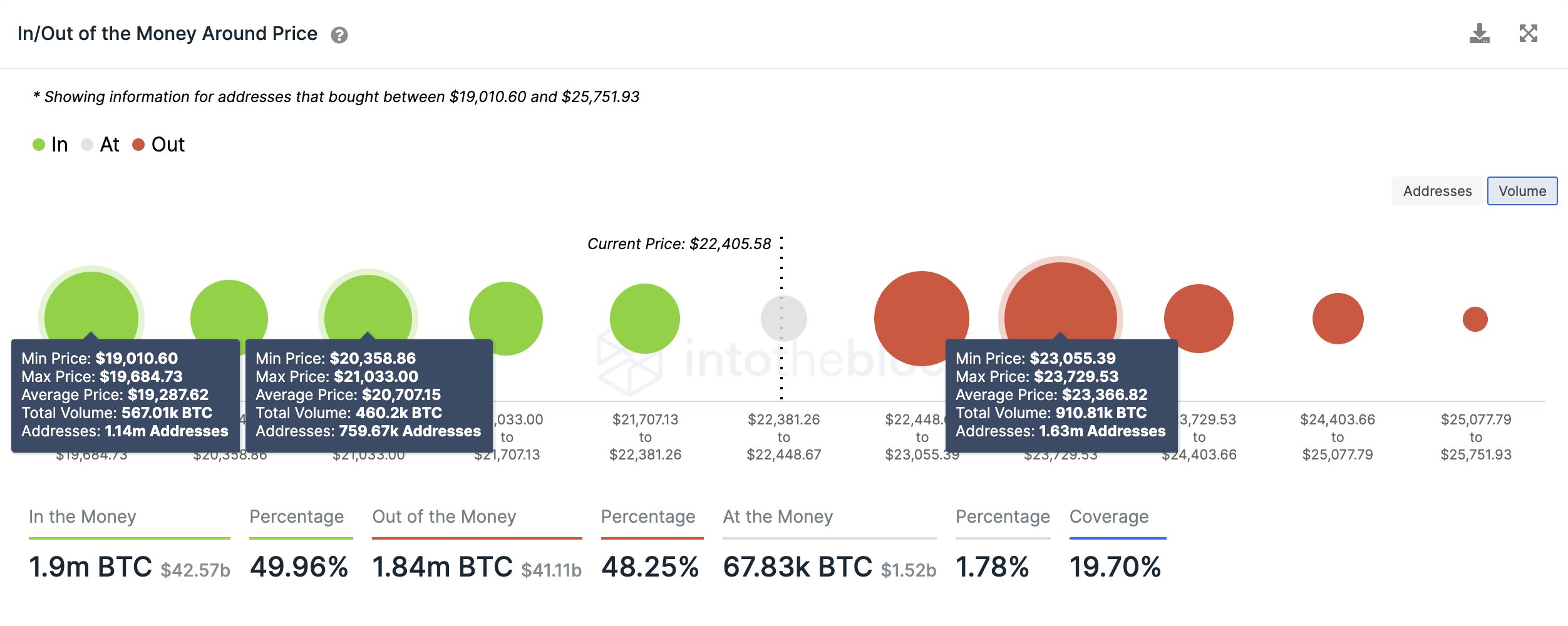

As said, Bitcoin has continued to face selling pressure and shows weakness on the charts as well! Citing data from IntoTheBlock, popular crypto analyst Ali Martinez reported:

Bitcoin dropped below a critical area of support between $23,050 and $23,730, where 1.63 million addresses bought over 910,000 $BTC. Failing to regain this area as support could trigger a sell-off that pushes #BTC to $20,700 or even $19,300.

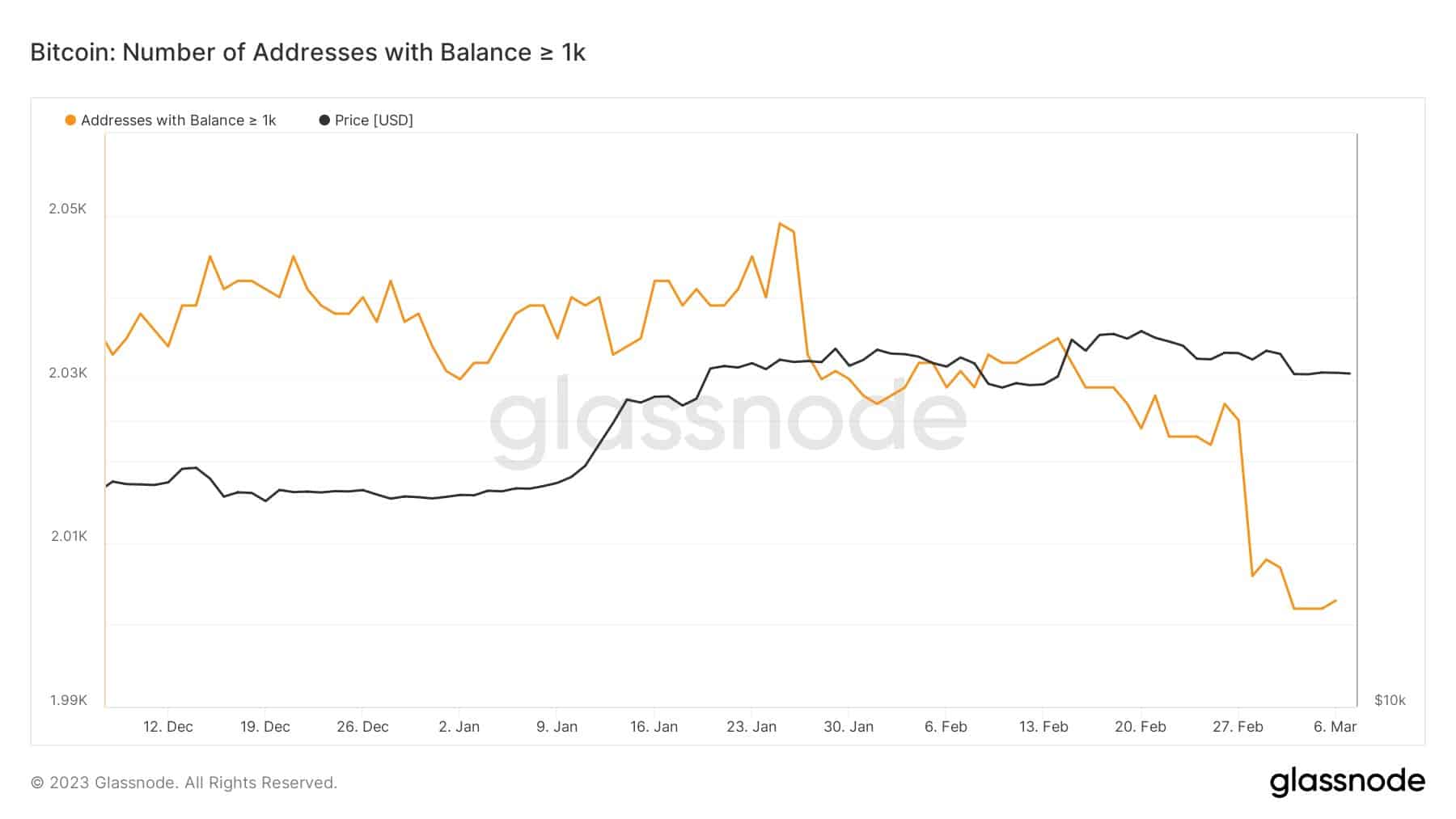

On the other hand, the total number of Bitcoin addresses holding more than 1,000 Bitcoins has also dropped over the last week. Nearly 24 such Bitcoin addresses have redistributed their Bitcoins and dropped from the network over the last week.

Bitcoin and Macros

Currently, Bitcoin bears seem to be in a dominant position over the bulls. As Bitcoin continues to dip under its crucial support levels, some analysts are also predicting that the BTC price can fall further under $20,000.

On the other hand, the macro factors don’t seem to be supporting any further rally as of now. While testifying ahead of the US Congress on Tuesday, Fed Chairman Jerome Powell that the central bank will continue with more rate hikes and is committed to bringing inflation under 2%.

On Tuesday, a judge at the US court grilled the SEC over its denial of the spot Bitcoin ETF. As a result, the GBTC share price rallied further.

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum