Popular Analyst Reveals Trading Alert for Bitcoin ETF, BTC Price To $80K?

Highlights

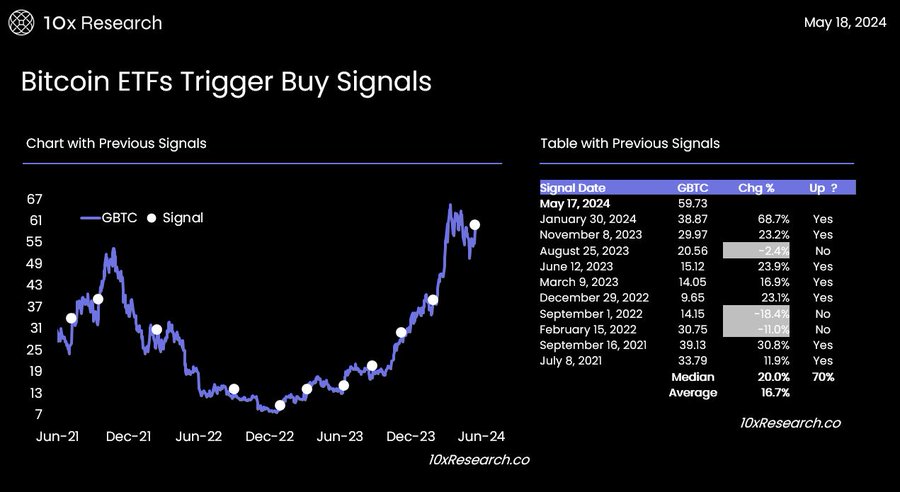

- Markus Thielen revealed a new trading alert for Bitcoin ETFs has been triggered for Bitcoin price rally.

- GBTC flashed a buy signal that could led to massive inflow in spot Bitcoin ETF.

- Bitcoin price likely to hit new ATH after bull flag breakout.

Popular analyst Markus Thielen, who accurately predicted BTC price ATH timeline and crash below $60K, has forecasted another key event, this time for Bitcoin ETFs. In a new research report, he revealed that a new trading alert for Bitcoin ETFs has been triggered. Thielen, who is also the CEO of institutional crypto research 10x Research, said Bitcoin price to rally faster soon amid massive buying by institutional and retail investors.

Markus Thielen Says Bitcoin ETF Signals About BTC Price Rally

Markus Thielen, CEO of 10x Research, on May 18 revealed that a new trading alert for Bitcoin ETFs has been triggered. The last time the model was triggered on January 30 this year, following which spot Bitcoin ETFs in the U.S. saw massive inflow. In fact, Bitcoin holdings of BlackRock ETF surpassed Grayscale’s GBTC.

“Many have asked us to run our trading signals for crypto-related stocks, such as Bitcoin miners, and diversified crypto stocks, such as Coinbase. Not every trading signal will be successful, but generally, with a 70-80% probability, they provide us with timely reminders when a dull trading range might end” he added.

GBTC flashed a buy signal on Friday, similar to past events that saw massive buying. After the GBTC saw inflows this week, it has renewed bullish sentiment for Bitcoin price, coupled with cooling CPI inflation in the U.S. Moreover, the trading signals for GBTC should also be effective for the newer ETFs such as BlackRock’s IBIT. This could give institutional investors and analysts a clue as to where the price of Bitcoin might be going.

Also Read: Binance Pushes For SHIB, USTC, AGIX Liquidity and Trading Boost

Bitcoin Price to Rally?

BTC price surpassed $67,000 this week amid bullish sentiment, with a weekly run of more than 10%. The 24-hour low and high are $66,289 and $67,459, respectively. Moreover, the upsurge amid low trading volumes indicates whales and big investors turned bullish on Bitcoin, along with the short liquidation of high-leveraged positions.

CME Bitcoin futures open interest saw a 5% increase in the last 24 hours, indicating huge buying from futures traders. The total BTC futures open interest soared by 2% in the past 24 hours.

Another popular analyst Rekt Capital predicts Bitcoin price only needs to drop 1% to perform the post-Bull Flag breakout retest attempt in an effort to secure trend continuation to the upside.

Also Read: BlackRock CIO Hints At Fed Rate Hike But There’s A Positive Note

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs