Pump.fun Leads LetsBonk With $800M Revenue As Solana Memecoin Battle Grows

Highlights

- Pump.fun surpasses $800 million in lifetime revenue, maintaining dominance over LetsBonk in the Solana memecoin launchpad race

- LetsBonk briefly overtook Pump.fun in July but has since fallen behind as Pump surged back with higher volume and users.

- The platform accounts for 91% of all daily Solana token listings, while LetsBonk dropped to just 3%.

Pump.fun has maintained its lead over LetsBonk, crossing $800 million in lifetime revenue. The competition suggests the growing shift for Solana-based tokens.

Pump.fun Tops LetsBonk, Surpasses $800 Million in Revenue

According to on-chain data from Dune Analytics, Pump.fun has accumulated around $800.6 million in fees since launch. This came primarily through its 1% swap fee on token transactions.

This came after Pump.fun launched a buyback program, purchasing over $33 million worth of PUMP tokens. This purchase limited the supply while boosting the price. This buyback is one of the largest the platform has done, which adds confidence to positive market outlooks.

Recent data also shows that Pump.fun dominates 91% of all daily token listings on decentralized exchanges, while LetsBonk has dropped to just 3%. Many top meme coins creators are now choosing Pump.fun over LetsBonk, which increases Pump.fun’s market share.

Furthermore, with 24,911 tokens launched and a 0.84% graduation rate, Pump.fun’s trading volume reached almost $100 million in a single day. LetsBonk, on the other hand, launched 442 tokens with a graduation rate of 2.26% but much lower volume and participation.

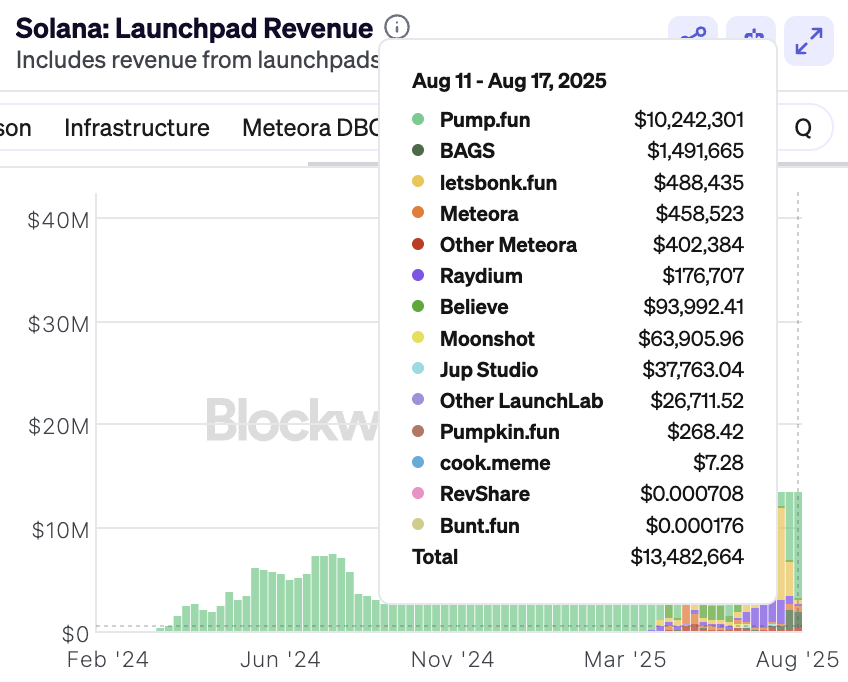

🚨JUST IN: https://t.co/VS31GZ2FXq’s weekly revenue climbed to $13.48M, its highest in six months, after regaining the majority of Solana launchpad market share. pic.twitter.com/vnpIkfrTvR

— SolanaFloor (@SolanaFloor) August 19, 2025

LetsBonk Challenges, But Pump.fun Regains Lead

While Pump led the Solana memecoin ecosystem, LetsBonk briefly overtook it in July. t accounted for almost 74% of the daily launches of Solana tokens. LetsBonk saw a sharp increase in activity and user adoption during that time, while Pump’s daily revenue fell as low as $169,000.

However, Pump.fun recovered swiftly. It regained the lead by early August, generating $1.35 million in revenue per day as opposed to $250,000 for LetsBonk.

According to Dune Analytics data, the platform now boasts over 38,000 active users. Meanwhile, LetsBonk recorded only 633, with transaction counts standing at 548,834 compared to 33,716.

Additionally, for the second consecutive week, the platform has led all memecoin launchpads across key metrics. This includes revenue, token launches, graduations, and active wallets. Meanwhile, LetsBonk unveiled a new rewards system and committed 1% of its revenue to buybacks of BONK ecosystem tokens. This represents a strategy to close down the gap.

It is also worth mentioning that Pump.fun introduced the Glass Full Foundation (GFF), a new initiative designed to inject liquidity into selected projects. By supporting promising tokens, the program aims to reduce the failure rate of new launches in the memecoin market. This update has led to more projects to migrate from LetsBonk into the Pump.fun’s launchpad.

The competition between LetsBonk and Pump.fun continues to be representative of the larger Solana memecoin trend. Both platforms are pushing the limits of what memecoin ecosystems can accomplish through innovation and liquidity incentives.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs