Why Bitcoin Falls To $58K Today; Further Decline Ahead?

Highlights

- Bitcoin price slipped to $60,000 today, fueling market concerns.

- Despite short-term bullish signals, other market trends seems to have weighed on the investors' sentiment.

- Analysts warns over further liquidation of BTC hits a key price level.

Bitcoin price declined below the $59,000 mark today, sparking concerns in the broader crypto market. Amid the downturn trend in BTC price, several other major cryptos like Ethereum, BNB, and others, also witnessed a significant dip.

However, amid the recent dip, investors are looking for potential reasons behind the dip. Besides, the discussions further intensify, especially after the recent pump in Bitcoin over the weekend.

Why Bitcoin Slips To $60K Today?

The recent decline in Bitcoin price to $60,000 raised eyebrows across the cryptocurrency landscape. However, amid this, a new report by 10X Research sheds light on the key factors driving this sluggish performance in the flagship crypto.

Their report outlines that the weekend pump was likely a technical reset, alleviating oversold conditions in the short term. This reset paved the way for the downtrend to resume as longer-term technical signals point to a potential topping formation.

In addition, the report suggests that despite short-term bullish sentiments driven by factors such as U.S. Presidential Election tailwinds and anticipated interest rate cuts, these were overshadowed by deeper technical and structural concerns. Analysts from 10X Research highlight the significant role of on-chain signals, market flows- particularly from Bitcoin miners’ inventory, and market structure data in this downturn.

These factors collectively contributed to a bearish outlook for Bitcoin, outweighing temporary bullish influences. Besides, one crucial aspect noted was the impact of low trading volumes over the weekend.

During these periods, even modest buying activity can trigger stop orders, leading to liquidations and amplifying price movements. This phenomenon was evident in the recent weekend’s upward surge, which swiftly turned into a correction as the upside risk from short covering diminished and downside pressures took hold.

Also Read: Fidelity & Sygnum Taps Chainlink For Tokenized Asset Data

What’s More?

Another significant driver of Bitcoin’s price decline is the impending expiration of substantial Bitcoin and Ethereum options. Data from Deribit indicates that Bitcoin options with a notional value exceeding $1.04 billion are set to expire on July 5, with a put/call ratio of 0.80 and a maximum pain price of $63,000.

On the other hand, Ethereum options worth $479.30 million, featuring a put/call ratio of 0.38 and a max pain price of $3,450, are also due to expire on the same date. These expiries are generating uncertainty, prompting traders to adjust their positions ahead of the deadline. The approaching expiry date increases market volatility, as participants hedge their bets and recalibrate strategies in response to the significant options contracts that are about to mature.

In addition, the July 2 outflow in the U.S. Spot Bitcoin ETF following a 5-day winning streak also weighed on the investors’ sentiment. According to recent data, the U.S. Spot Bitcoin ETFs recorded an outflow of nearly $14 million on Tuesday, following an influx of about $130 million in the prior day.

Further Liquidation Ahead?

Several market experts appear to have remained bullish despite today’s slump. However, it’s worth noting that the liquidation warning from 10X Research as well as from other prominent analysts have weighed on the sentiment.

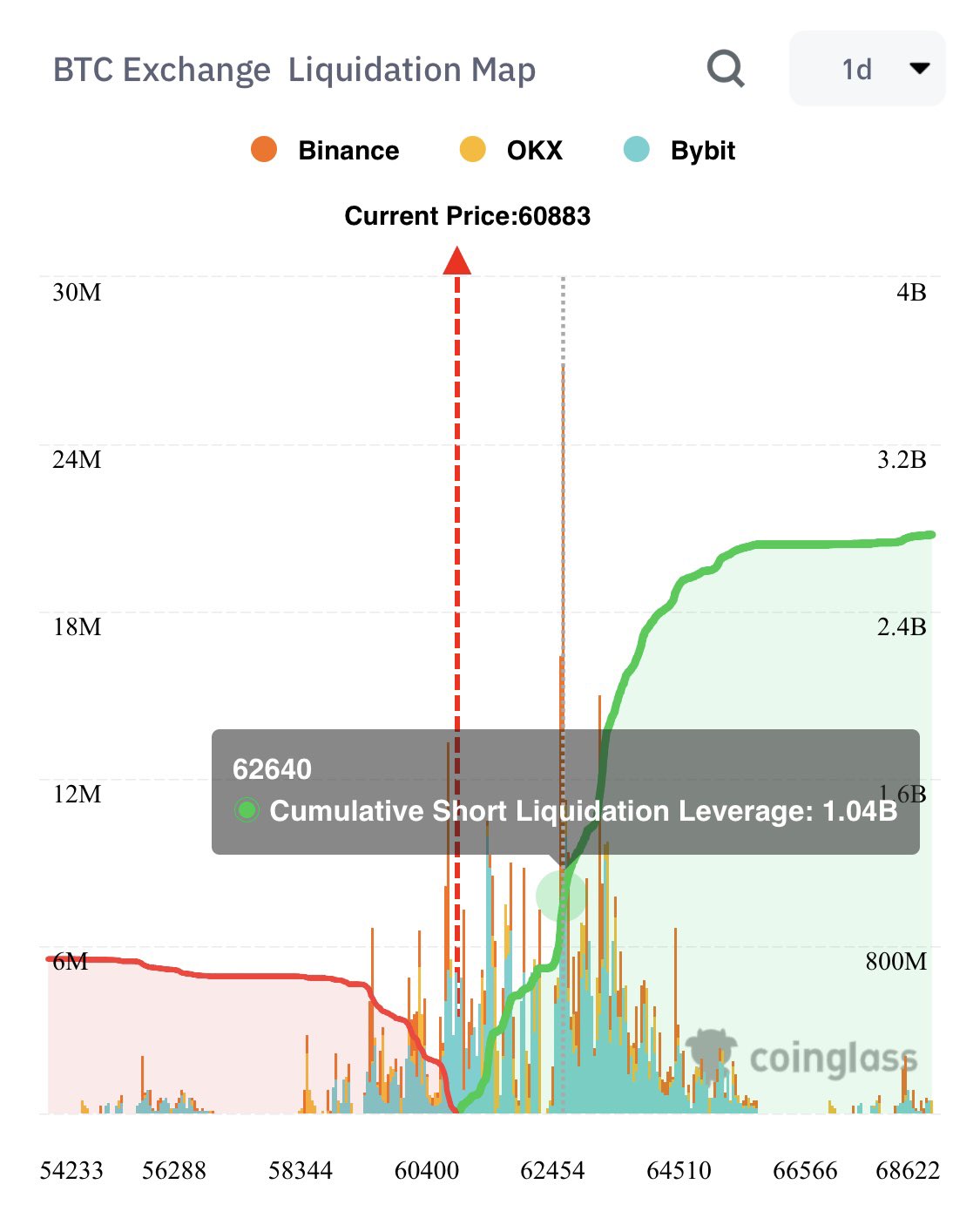

For context, Ali Martinez said that Bitcoin may recover from its current phase while revealing a warning. Martinez, while analyzing the Bitcoin Exchange Liquidation Map, said that BTC risks witnessing over $1 billion in liquidation if it reaches the $62,600 level.

As of writing, Bitcoin price was down more than 3% and hovers near the $58,500 range. Its one-day trading volume rose 48% to $33.67 billion, while the crypto has touched a 24-hour high of $61,079.38. Furthermore, CoinGlass data showed a slump of more than 4% in Bitcoin Futures Open Interest from yesterday.

Also Read: Binance Announces Delisting Of Key Crypto Pairs, Brace For Market Impact

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale