Render Price: Whales Bag $61M Profit As RNDR Price Rallies

Highlights

- RNDR's price surges, attracting attention as whales pocket $61M profit, per recent reports.

- Six whales capitalize on RNDR's rebound, depositing tokens worth $77.9M on major exchanges.

- Concerns arise over potential price impact following a significant sell-off by whales.

Render (RNDR) has experienced a significant uptick in its price, witnessing a nearly 3% surge today. However, what’s grabbing attention is the substantial profit garnered by whales, amounting to $61 million, as per recent reports. Notably, this surge and profit-taking strategy has ignited discussions within the crypto community, prompting speculation about the future trajectory of RNDR’s price.

Whales Book Profit As Render Price Soars

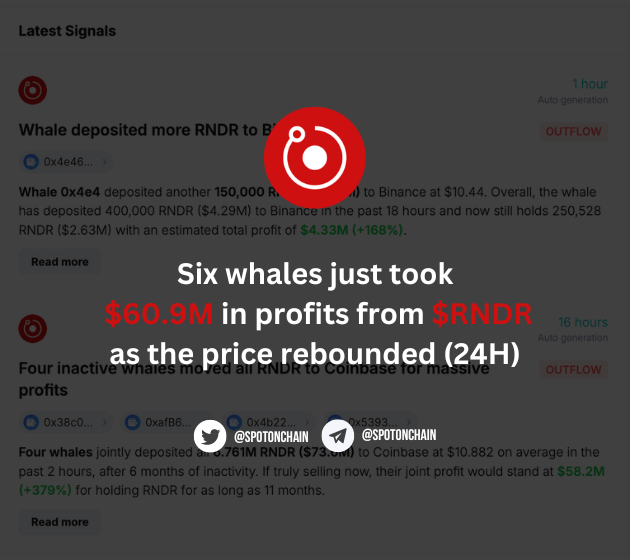

According to a recent report by Spot On Chain, six whales have capitalized on the recent rebound in Render’s price. Notably, the whales have booked profit by depositing 7.16 million RNDR tokens, valued at approximately $77.9 million, onto major crypto exchanges Coinbase and Binance.

Meanwhile, this move has allowed them to pocket an impressive $60.9 million in profit by trading Render, showcasing the profit-taking strategy employed by large investors in response to price surges.

In addition, the influx of RNDR tokens onto crypto exchanges and the subsequent profit-taking by whales reflect the dynamic nature of the cryptocurrency market. Usually, the large holders strategically leverage price movements to maximize gains when the price of an asset soars.

While this strategy can lead to short-term price fluctuations, it also underscores the confidence of investors in RNDR’s potential for growth.

Also Read: Bitpanda Expects Record-High Profit In 2024 As Over $100M Revenue In Q1

Concerns Over Price Impact

Despite the bullish sentiment surrounding Render, the massive sell-off by whales has raised concerns about its potential impact on the token’s price in the near future. Such significant transactions often lead to increased volatility and could temporarily dampen investor sentiment.

However, it’s essential to recognize that price fluctuations are a common occurrence in the crypto market and do not necessarily reflect the underlying fundamentals of a project. Meanwhile, the RNDR community and investors will closely monitor market developments in the coming days to gauge the extent of the price impact resulting from the Render whales’ profit-taking activity.

Additionally, factors such as overall market sentiment, project developments, and external market dynamics will likely influence RNDR’s price trajectory in the medium to long term.

Meanwhile, as of writing, the Render price soared 2.81% during writing, and exchanged hands at $10.22, while hitting a high of $11.12 in the last 24 hours. Amid the substantial transfers, the one-day trading volume of the crypto also jumped 68.30% to $682.08 million.

Notably, the RNDR price has added more than 24.50% in the last 30 days, while soaring over 450% over the last 12 months. During writing, the Render Futures Open Interest (OI) also advanced 8.59% to $177.92 million, as per CoinGlass data.

Also Read: Binance Unveils New Spot Trading Pairs, Here’s All

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs