Ripple Lawsuit Update: XRP Dips As SEC Battle Intensifies, What’s Next?

Highlights

- XRP price slips amid escalating tensions of the Ripple Vs. SEC lawsuit.

- SEC seeks a hefty $2 billion penalty and injunction against Ripple's XRP sales.

- Analyst Dark Defender outlines key XRP price levels and potential support and resistance points.

The XRP price slips below the $0.49 mark today, amid ongoing legal battles between Ripple and the U.S. Securities and Exchange Commission (SEC). Notably, the recent XRP slip also reflects investor apprehensions amid regulatory uncertainty. As the lawsuit unfolds, investors seek further clarity on the future of Ripple’s native cryptocurrency, XRP, amid the legal turmoil.

Investor Uncertainty Fuels XRP Downturn

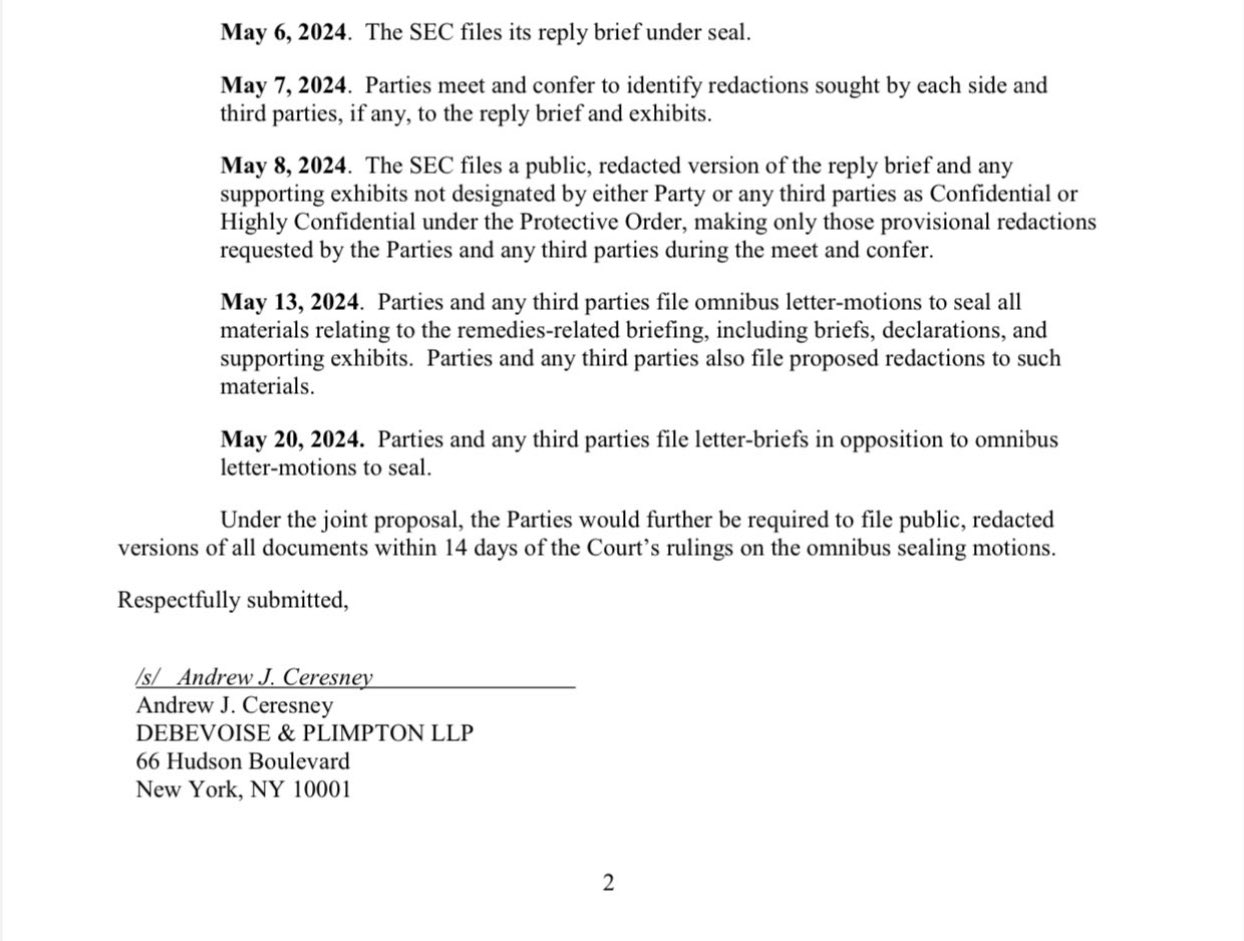

Investor sentiment surrounding XRP grows increasingly cautious as legal proceedings of Ripple Vs. SEC intensifies. Today, May 13, marks a pivotal moment in the lawsuit, as parties and third parties are set to file omnibus letter motions to seal all materials related to the ongoing legal briefing, including briefs, declarations, and supporting exhibits. However, both parties will have the time to file the motion by May 20.

As legal complexities mount, XRP experiences a significant decline, signaling investor unease over the cryptocurrency’s future trajectory. The looming uncertainty surrounding Ripple’s legal fate casts a shadow over XRP’s market performance, with investors anxiously awaiting clarity amidst the legal quagmire.

For context, against the backdrop of legal filings and counterarguments, the courts are poised to deliberate on the penalty Ripple may face for alleged violations of U.S. securities laws. Besides, the SEC seeks an imposing $2 billion penalty and an injunction barring Ripple from selling XRP to institutional investors, highlighting the high stakes involved in the lawsuit’s outcome.

However, Ripple’s defense centers on disputing the SEC’s claims, emphasizing sales to accredited investors and the nature of ODL (On-Demand Liquidity) contracts. However, the SEC remains steadfast in its allegations, underscoring the potential legal ramifications of Ripple’s actions in the eyes of the court.

Also Read: Tether CTO Slams Ripple Chief Garlinghouse on USDT Remarks

What’s Next?

As legal proceedings progress, industry experts anticipate the SEC’s potential appeal regarding the XRP Programmatic Sales ruling. This move underscores the enduring uncertainty surrounding Ripple’s legal saga and its implications for the broader cryptocurrency market.

Meanwhile, amid regulatory scrutiny and investor apprehensions, the fate of XRP hangs in the balance, awaiting clarity amid a turbulent legal landscape. However, let’s take a look at the current XRP price and some key levels suggested by a prominent analyst in the industry.

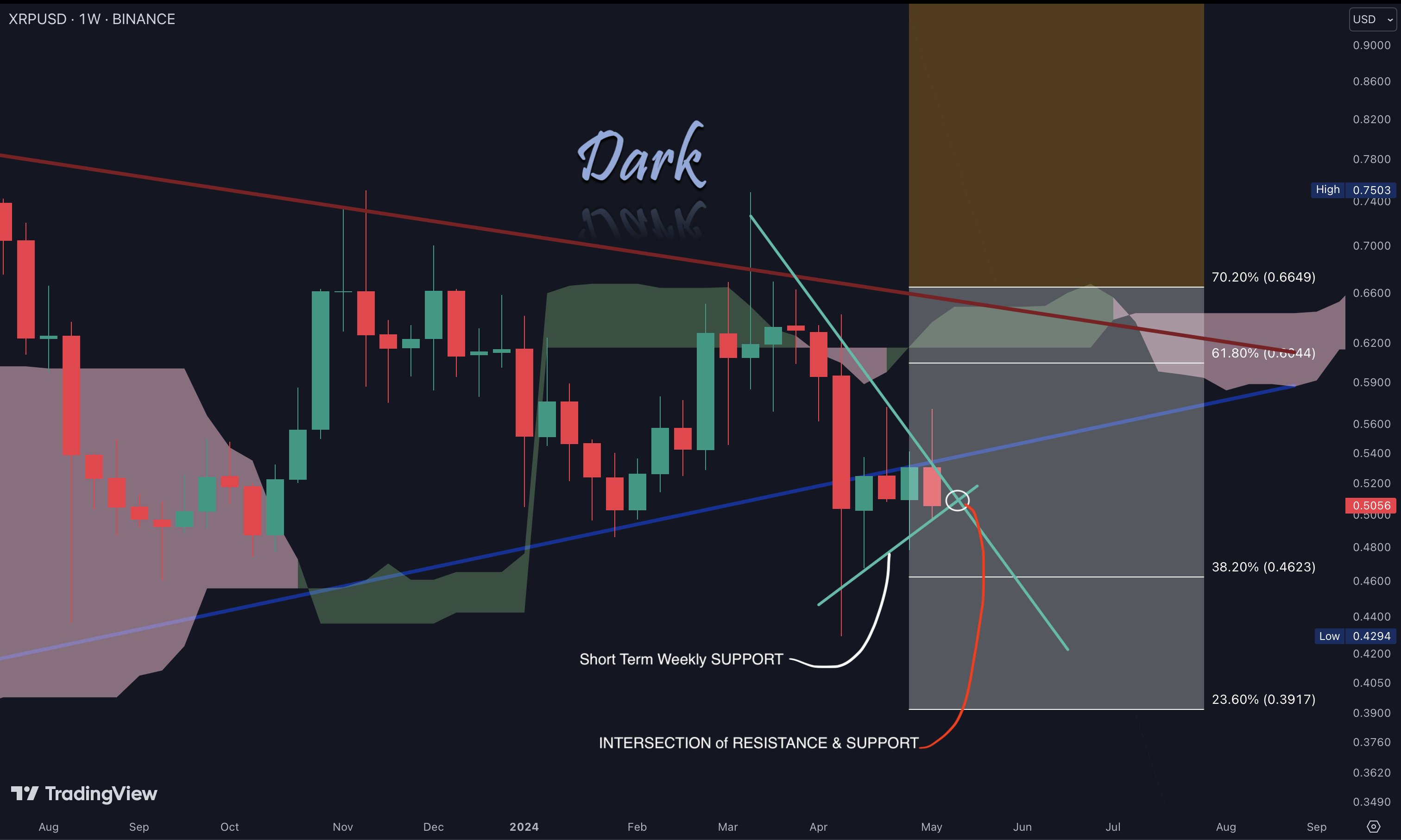

In a recent analysis shared by prominent crypto analyst Dark Defender, XRP’s price dynamics are poised for action. With the coin staying below the crucial support level this week, attention turns to upcoming levels.

Notably, Dark Defender said that the key support levels to monitor are $0.4975 and $0.4623, while resistances stand at $0.5330 and $0.6044. The analysis outlines the waves of XRP’s price movements, targeting $1.88, $5.85, and $18.22.

However, the ultimate support line at $0.3917 remains a point of consideration. Whether XRP revisits lower levels depends on closing above $0.4975 and the blue level (as mentioned in the price chart below) this week.

Meanwhile, the XRP price has noted a slight recovery as of writing, and traded at $0.5011, down 0.53%, while its trading volume rose 93% to $766.05 million. Over the last 24 hours, the crypto has touched a high of $0.5066, while slipping to a low of $0.4879. Despite the recent decline, the CoinGlass Data showed that the XRP Open Interest was up 3.71% from yesterday and stood at $569.15 million.

Also Read: China Cracks Down On $300M Crypto Exchange Fraud, Arrest 6

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?