September Fed Rate Cut Odds Fall Ahead of Jerome Powell’s Jackson Hole Speech

Highlights

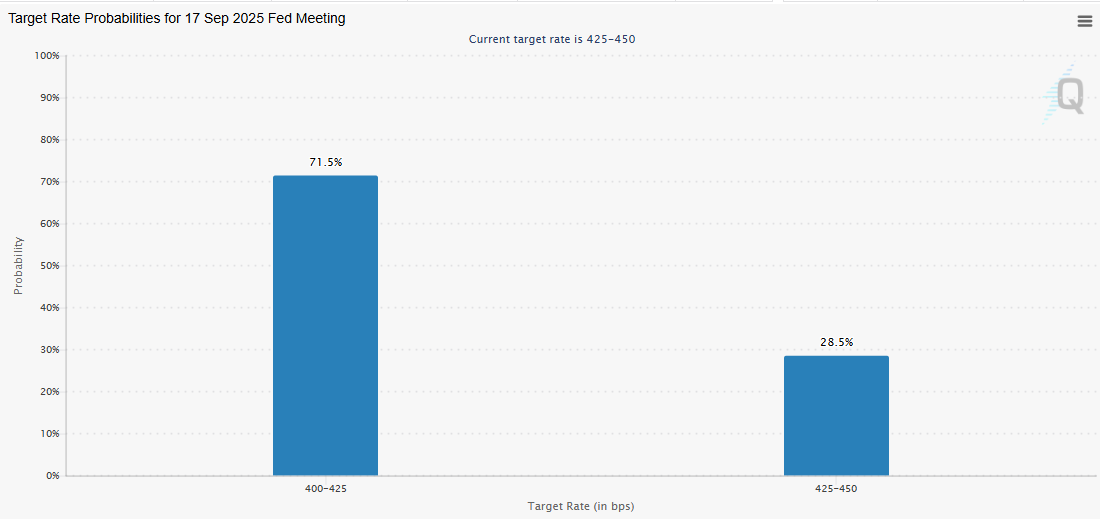

- The odds of a 25 bps September rate cut is currently at 71%.

- This comes ahead of Jerome Powell's Jackson Hole speech tomorrow.

- Fed's Hammack and Bostic have indicated that they aren't in support of a rate cut.

The odds of a September Fed rate cut have sharply dropped, sparking bearish sentiment in the crypto market. This development follows the release of the FOMC minutes yesterday and comes ahead of Jerome Powell’s Jackson Hole speech tomorrow.

September Fed Rate Cut Odds Drop To 71%

CME Fed Watch data shows that the odds of a 25-bps rate cut in September have dropped to 71.5% from as high as 99% just over a week ago. Meanwhile, the odds of a 25 bps cut had stood at around 85% just a day ago.

This drop follows the release of the FOMC minutes yesterday, which showed that the Fed is more concerned about the upside risk of inflation than the downside risk of employment. This indicated that a September Fed rate cut was far from assured, as the FOMC may choose to keep rates unchanged due to the rising inflation as shown in the July PPI data.

Meanwhile, the drop in the rate cut odds comes ahead of Jerome Powell’s speech at the Jackson Hole conference tomorrow. The Fed Chair might signal what their likely step will be at the September 17 FOMC meeting.

Meanwhile, the U.S. jobless claims data, which dropped today, hasn’t been enough to stop the odds of a Fed rate cut from dropping. The weekly jobless claims rose to 235,000, its highest since June, and were above expectations of 226,000.

FOMC Members Comment On Monetary Policy

Fed officials, Federal Reserve Bank of Cleveland President Beth Hammack and Federal Reserve Bank of Atlanta President Raphael Bostic, have both commented on the monetary policy amid the declining odds of a Fed rate cut.

According to a Bloomberg report, Hammack said that she wouldn’t support lowering interest rates if the policy decision were to hold tomorrow. She explained that they have inflation that is too high and has been trending upwards over the past year.

However, it is worth noting that Hammack isn’t a voting member of the FOMC this year. As such, she won’t have a direct say on whether the Fed leaves rates unchanged at the September meeting.

Furthermore, Bostic, who is also not a voting member this year, sounded hawkish, stating that he only sees one Fed rate cut this year as being appropriate. However, he admitted that the labor market trajectory is “potentially troubling” and is worth keeping an eye on.

Federal Reserve Bank of Kansas City President Jeffrey Schmid also sounded hawkish, highlighting how the inflation risk still outweighs the downside risk in the labor market.

He further remarked that a modestly restrictive policy is still appropriate, indicating that he isn’t in support of a rate cut yet. Unlike Hammack and Bostic, Schmid holds a vote on the Committee and could influence whether rates remain unchanged or not.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs