Shiba Inu Coin: Top 3 Reasons Why SHIB Is Primed For A Rally

Highlights

- According to market experts, SHIB price is poised for a rally despite the recent setback.

- The recent developments in the Shiba Inu ecosystem signals at a potential rally ahead.

- Shiba Inu price dipped over 4% amid broader market downturn.

The dog-themed Shiba Inu coin has been on the investors’ radar lately, especially amid a meme coin frenzy. However, amid the recent downturn momentum noted in the broader crypto market, the meme coins also noted significant dips. Despite that, there are some potential factors that could trigger a rally in the Shiba Inu price in the coming days.

3 Reasons To Trigger Shiba Inu Price Rally

Amid the recent dip in SHIB price, let’s explore the potential reasons that could fuel a price surge in the meme coin.

Technical Analysis

The recent technical indicators signal a potential rebound in the SHIB price, sparking market optimism. For context, in a recent analysis, prominent crypto market analyst Ali Martinez shared a potential bullish momentum for the Shiba Inu coin in the coming days.

Ali Martinez, in a recent post on X, said that the recent TD Sequential chart indicates that the Shiba Inu coin is likely to witness a positive momentum in the coming days. In addition, he also said that the chart shows a “buy signal” on SHIB’s daily chart.

This analysis has bolstered market confidence while sparking discussions over a potential surge in the SHIB price.

Also Read: Shiba Inu Exec Spotlights BONE Listing In Indonesia, Price To Rally?

Shiba Inu Coin Burn Rate Frenzy

The Shiba Inu burn rate has increased significantly over the past few days, removing a massive amount of SHIB from the supply. This burning move is usually seen as a positive move, as it typically decreases the overall supply which in turn leads to a surge in the crypto prices.

However, in the last 24 hours, the SHIB burn rate noted a slump of 62.5%, with 39.87 million SHIB burnt. Despite that, the weekly burn rate skyrockets 667.17% to 398.53 million SHIB, indicating the increasing participation of the SHIB community significantly decreases the overall supply.

As of writing, the total circulating supply of SHIB was 583.18 trillion, with 410.72 trillion tokens burnt from the initial supply.

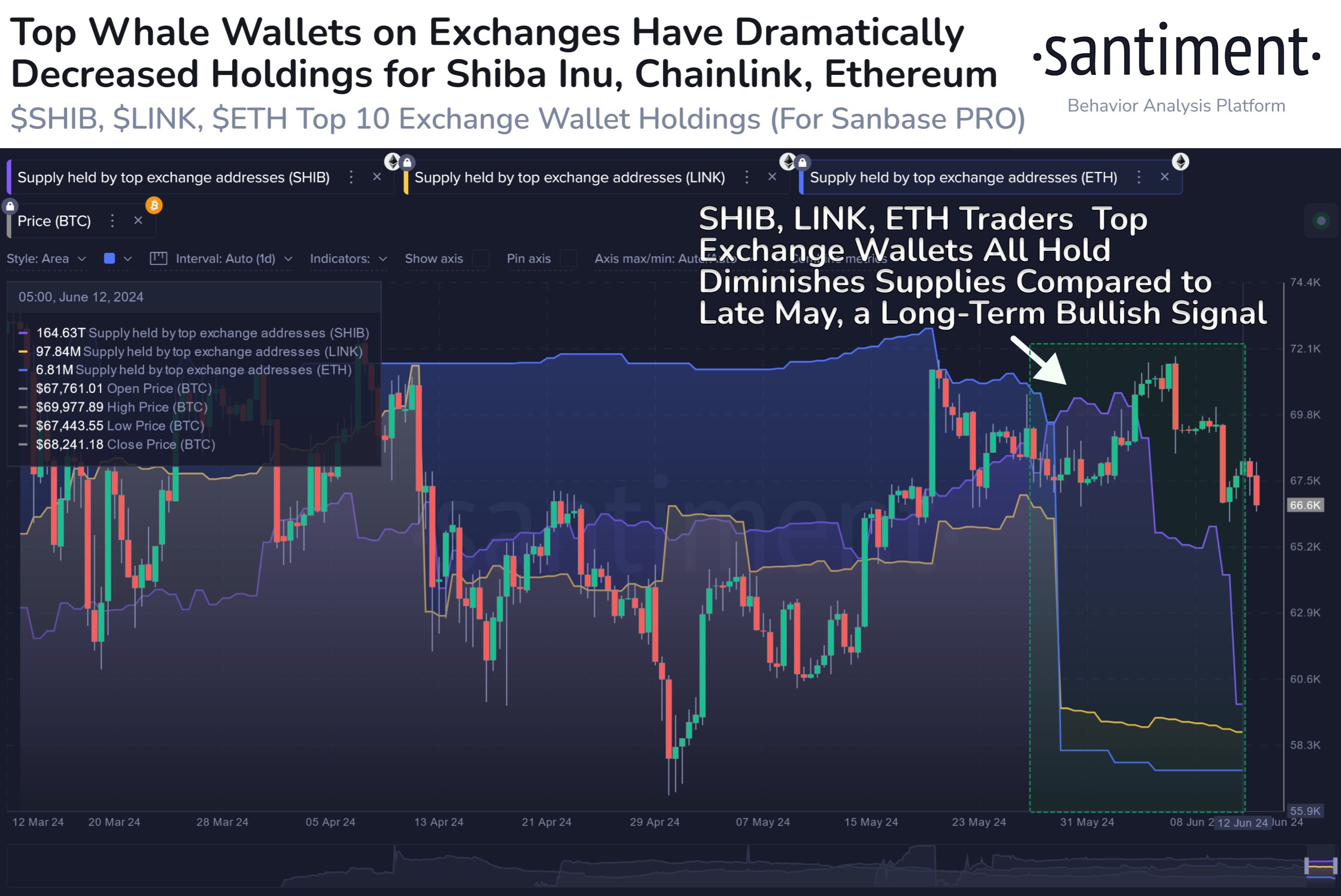

Reduced Supply In Exchange Wallets

A recent report from on-chain analytics firm, Santiment, showed that Shiba Inu, Chainlink, and Ethereum have noted significant dip in supply from the top 10 exchange wallets. As per the report, SHIB’s supply reduced by 2.4%, while LINK and Ether’s supply slipping 2.9% and 8.9%, respectively.

Usually, these decreases in exchange reserves supply signals a bullish momentum for the cryptos. Considering that, along with the robust burn rate, market experts anticipate a potential surge in the SHIB price.

SHIB Price & Performance

Despite all these positive indicators, Shiba Inu price fell 4.69% to $0.00002077, while its trading volume rose 42% to $476.37 million in the last 24 hours. From yesterday, the leading meme coin has touched a high of $0.00002076 and a low of $0.00001965, indicating the volatile scenario in the digital asset space.

On the other hand, the Shiba Inu Open Interest also noted a slump of 8.90% to $75.5 million, CoinGlass data showed. Besides, the SHIB’s relative strength index (RSI) stood around 36, which reflects the ongoing selling pressure over the meme coin.

However, it’s worth noting that the price dips, and a lower RSI often allows investors to buy at a lower price, potentially bumping up the prices.

Also Read:

- Ethereum & UNI Price Soars Amid $20M Accumulation, Rally To Sustain?

- Australia Spot Bitcoin ETF To Start Trading On ASX Stock Exchange

- Bitcoin Price Struggles At $66K But These 4 Crypto Stocks Shine

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Vitalik Buterin Offloads $3.67M in ETH Amid Ethereum Price Decline

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards