Smart Money More Inclined To Invest In Ethereum Over Bitcoin: Bloomberg

Institutional investors were the major force behind the Bitcoin rally in 2021, realizing its potential use cases in the future. Institutional investors such as JPMorgan, Ark Invest, MicroStrategy, Tesla, Andreessen Horowitz, and others became supporters of Bitcoin and other cryptocurrencies. However, institutional investors are more willing to invest in Ethereum (ETH) than Bitcoin (BTC).

Institutional Investors Prefer Investing in Ethereum Than Bitcoin

The narrative regarding Ethereum overtaking Bitcoin continues to rise after Ethereum Merge and Shanghai upgrade. Traders anticipate smaller swings in Ethereum than Bitcoin in the near term.

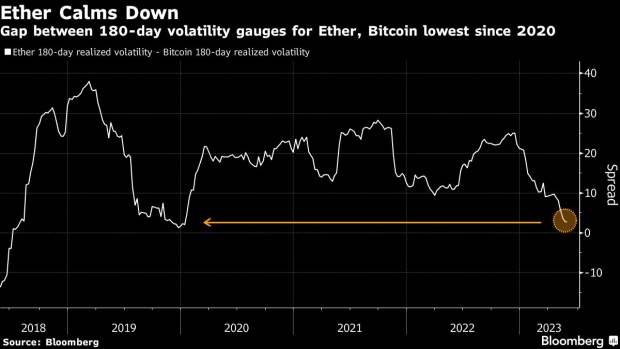

Ethereum’s 30-day volatility index now trails more than Bitcoin volatility index. Moreover, the 180-day realized or historical volatility of Ether relative to Bitcoin has decreased immensely since 2020, according to Bloomberg.

This makes institutional investors more interested in investing in ETH than BTC as lower volatility typically enables institutional investors to allocate more capital to crypto. Long-term investors are more likely to increase exposure to Ethereum.

Bitcoin and Ether implied volatility indexes are based on options pricing. Both indexes fell from recent peaks in March but the Ethereum index dropped more.

Richard Galvin, co-founder at fund manager Digital Asset Capital Management, argues Ethereum staking yields rising after the Shanghai upgrade in April will further suppress volatility. However, the US SEC refuses to consider Ethereum as non-security. SEC Chair Gary Gensler believes Ethereum’s proof-of-stake (PoS) transition converted it into a security.

Meanwhile, Bitcoin blockchain is impacted by Bitcoin ordinals non-fungible tokens and meme coins. Moreover, Bitcoin and Ethereum price correlation fell to its lowest since 2021.

Also Read: Ethereum Client Releases Pruning Update After Vitalik Buterin Updated The Roadmap

ETH Price Remains Stable As compared to BTC Price

ETH price continues to trade above $1800 despite several macro factors, regulatory issues, and the looming US debt ceiling crisis impacting the global market immensely. The price is currently trading at $1813, up 1% in the last 24 hours.

BTC price remains at risk of falling below $25,000. The price is down 1% in the past 24hrs, with the 24-hour low and high of $26,549 and $26,986, respectively.

Also Read: Peter Brandt Predicts Bitcoin Price Fall Below $25K In May

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs