Breaking: Standard Chartered Revises Bitcoin (BTC) Price Prediction To $50000, $120K In 2024

Standard Chartered Bank has revised its earlier prediction of a $100,000 Bitcoin price by 2024-end as the “crypto winter” was over. Now, the bank forecasts that Bitcoin price can reach $50,000 by the end of this year and surpass $120,000 by next year. This upward projection comes as the bank’s analysts anticipate increased hoarding of Bitcoin by miners.

Standard Chartered Raises Bitcoin Price Forecasts To $120K

$800 billion Standard Chartered Bank predicted that Bitcoin may reach $50,000 this year and $120,000 by the end of 2024. The bank predicts that rising BTC prices could encourage bitcoin miners to hold more of the Bitcoin supply.

In April, Standard Chartered released a forecast as “crypto winter” was over. It predicted Bitcoin price hitting $100,000 by the end of 2024. However, the bank’s top foreign exchange analyst Geoff Kendrick said there is a 20% upside to the earlier prediction due to Bitcoin miners holding more BTCs.

“Increased profitability for miners to mine Bitcoin means they can reduce sales while maintaining cash inflow, reducing the net supply of Bitcoin and driving up Bitcoin’s price,” said Kendrick.

In fact, crypto asset inflows for three consecutive weeks and the monthly MACD turning green indicate a positive outlook for Bitcoin price. Crypto asset investment products saw a net inflow of $136 million last week.

BTC price currently trades at $30193, moving sideways in the past 24 hours. The 24-hour low and high are $29985 and $30427, respectively. However, the trading volume has increased by 30% in the past 24 hours, indicating an interest among traders.

Also Read: South Korean Court Holds First Trial Of Terra Co-Founder

Bitcoin Hash Rate Hits ATH

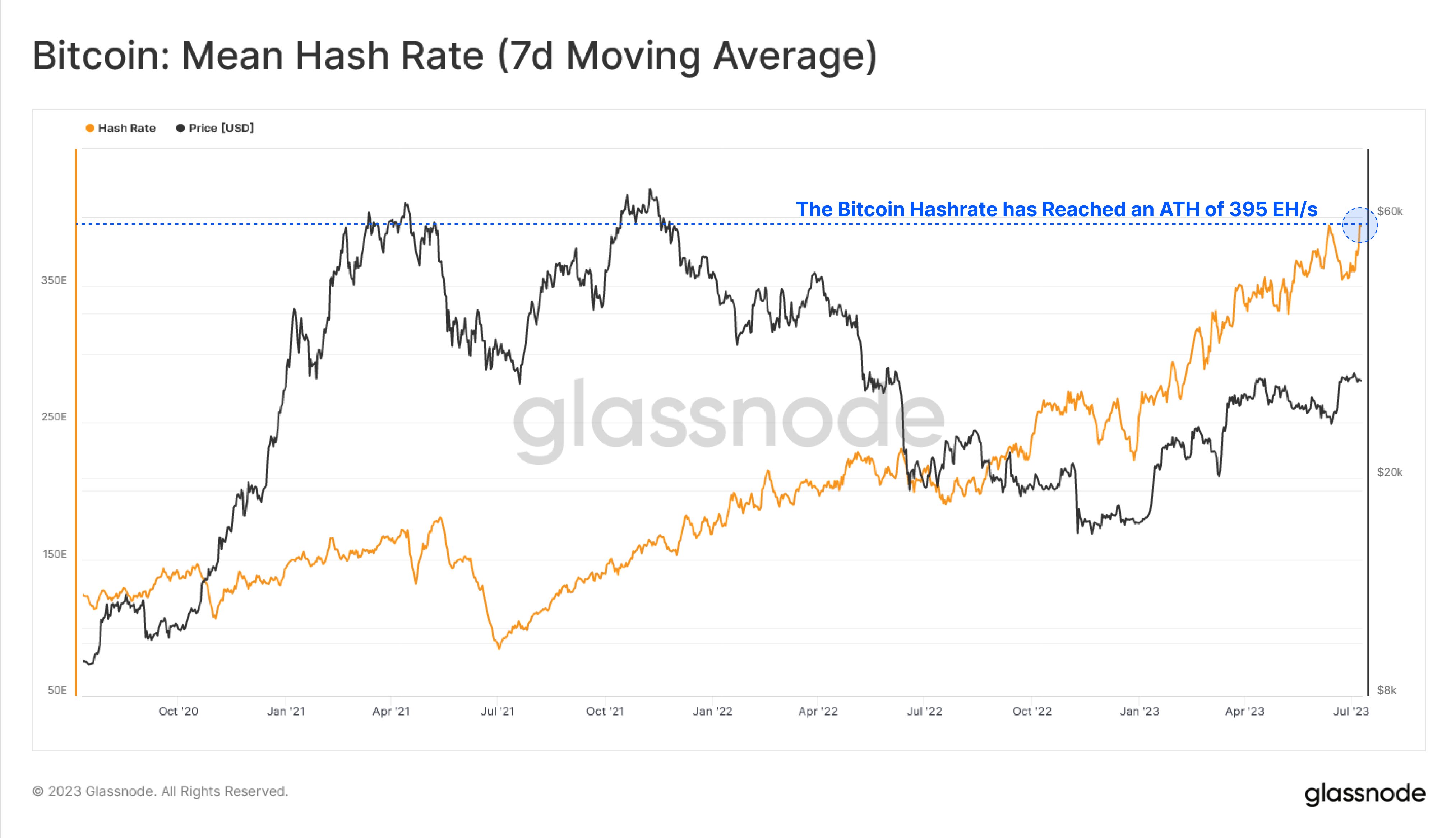

While miners prepare to hold more BTCs, bitcoin mining difficulty remains challenging. On-chain data platform Glassnode reported the Bitcoin Hash Rate (7DMA) continues its upside move, reaching an ATH value of 395 EH/s. This is equivalent to 395 quintillion guesses every second in an attempt to solve a Block.

The U.S. is the largest crypto and Bitcoin mining country globally. While Bitcoin mining requires more electric power, switching to renewable sources of energy opened doors to climate change mitigation by using sources such as methane gas emissions.

Also Read: Bitcoin Price Must Clear This Resistance To Regain Bullish Momentum – Bulls Set Eyes On $48k

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale