Breaking: Strategy Adds 525 BTC as Michael Saylor Says Bitcoin Deserves ‘Credit’

Highlights

- Strategy bought more Bitcoin between September 8 and 14.

- This marks the company's seventh weekly consecutive purchase.

- The MSTR stock is trading flat amid this development.

Strategy, previously MicroStrategy, has made its seventh consecutive weekly Bitcoin purchase. This comes amid the dip in the BTC price and MSTR stock, while Michael Saylor credited the flagship crypto for his company’s outperformance over the years.

Strategy Acquires 525 BTC For $60 Million

In a press release, the company announced that it had acquired 525 BTC for $60.2 million at an average price of $114,562 per Bitcoin. It has also achieved a BTC yield of 25.9% and now holds 638,985 BTC, which it acquired for $47.23 billion at an average price of $73,913 per Bitcoin.

This follows Michael Saylor’s conventional Sunday X post, in which he hinted at another Strategy Bitcoin purchase. In his post, he simply said “Bitcoin deserves credit” while spotlighting his company’s BTC portfolio tracker. Saylor had also earlier credited BTC for MSTR’s outperformance over the ‘Mag 7’ stocks.

Bitcoin Deserves Credit pic.twitter.com/PN92eSDfNf

— Michael Saylor (@saylor) September 14, 2025

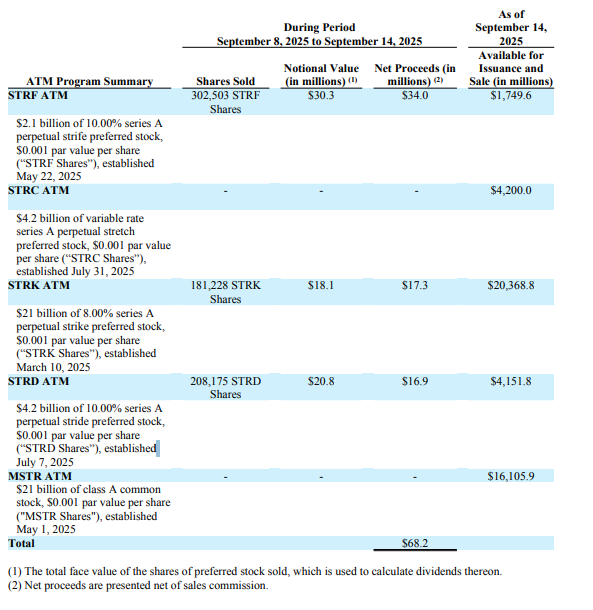

The SEC filing shows that the company didn’t sell MSTR shares this time around to fund this Bitcoin purchase. Instead, it sold STRF, STRK, and STRD shares, raising $34 million, $17.3 million, and $16.9 million, respectively.

Meanwhile, this marks Strategy’s seventh consecutive weekly purchases. Last week, the company announced its acquisition of 1,955 BTC for $217.4 million, which came amid the S&P 500 snub.

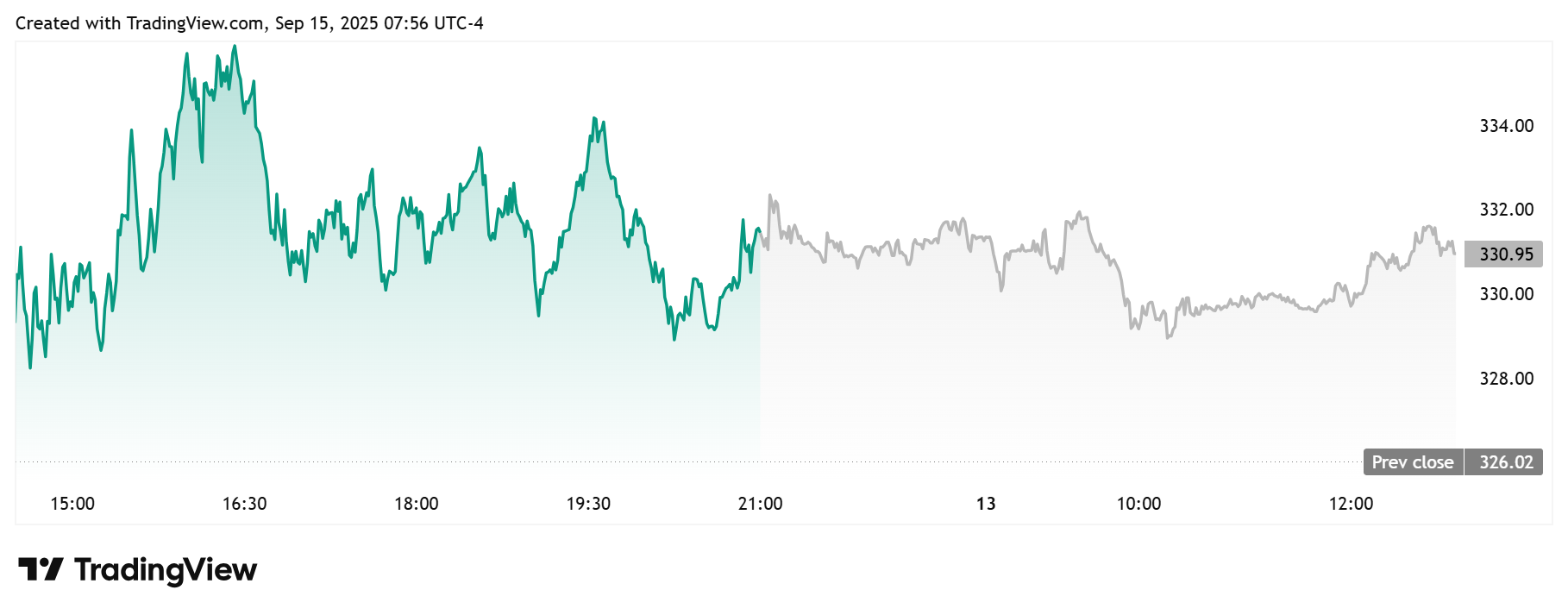

MSTR Stock Drops Over 2% Today

The Strategy stock is down amid this development. TradingView data shows that the stock is currently trading at around $325, down almost 2% from last week’s closing price $331..

The MSTR stock is also down in the last five days and by over 16% in the last month. This has come amid the sideways movement of Bitcoin, which is down from its all-time high (ATH) of $124,000, which it hit last month.

The MSTR stock could also be at further risk given its correlation with the flagship crypto due to Strategy’s Bitcoin exposure. Interestingly, BTC critic Peter Schiff recently warned that Bitcoin is topping out ahead of a potential rate cut this week. It is worth noting that Schiff has stated several times that MSTR will crash once the ‘BTC bubble’ busts.

The Bitcoin price is currently trading at just below the psychological $115,000 level, down in the last 24 hours. This comes amid fears that a rate cut could end up being a ‘sell the news’ event.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k