Sui ETF Nears Approval as Grayscale Amends S-1 with US SEC

Highlights

- Grayscale files updated S-1 form for Sui ETF with the U.S. SEC.

- Grayscale Sui Staking ETF seeks approval to list and trade shares on NYSE Arca under ticker GSUI.

- SUI derivatives trading data shows massive buying activity.

First spot Sui ETF launch moves closer as Grayscale amends its spot Sui Staking ETF application with the U.S. Securities and Exchange Commission (SEC). Multiple issuers, including Bitwise and Canary Capital, seeking regulatory approval could trigger a rebound in SUI price.

Grayscale Updates Sui ETF Filing with the US SEC

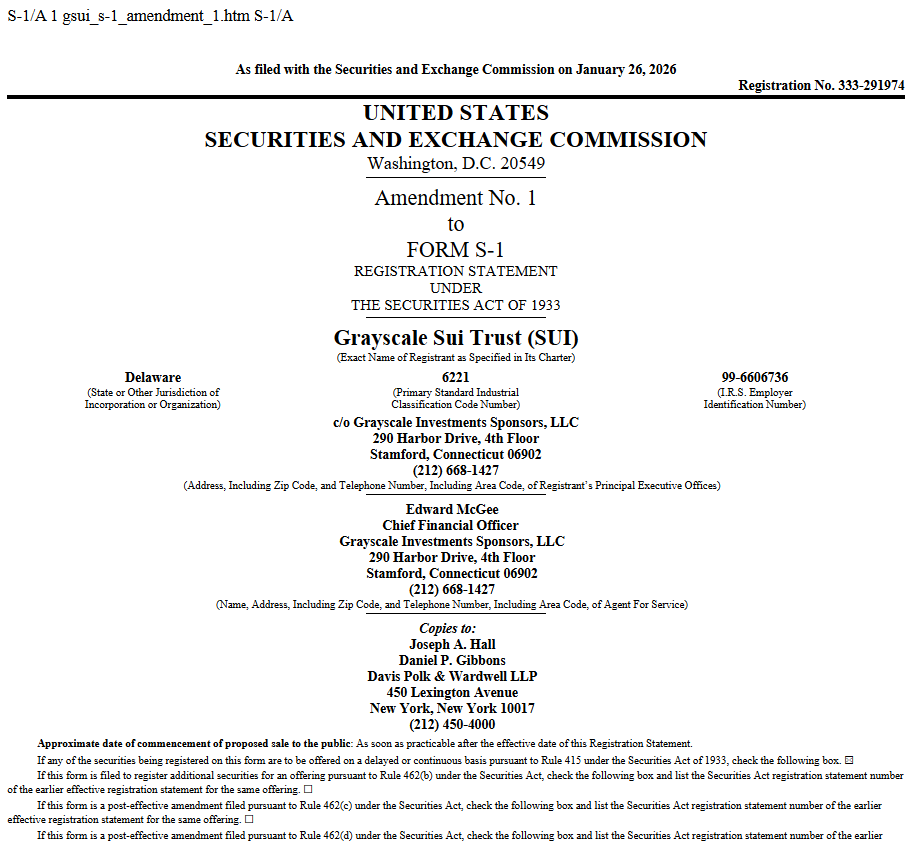

According to the latest US SEC filing, crypto asset manager Grayscale submitted a first amendment to its S-1 form for its Sui ETF. If approved, the trust will provide investors with exposure to SUI price while generating yields through staking.

In the latest filing, Grayscale mentioned more details regarding staking, risk factors, and regulatory events. The issuer has yet to reveal the management fees, the staking provider, and any fee waiver.

The issuer intends to rename the trust as Grayscale Sui Staking ETF. It seeks approval to list and trade shares on NYSE Arca under the ticker GSUI. At present, Grayscale Sui Trust shares trade on OTCQB.

The Bank of New York Mellon will serve as the transfer agent and the administrator of the Grayscale Sui Staking ETF. Meanwhile, Coinbase is named as the prime broker and Coinbase Custody Trust Company as the custodian of the trust.

As CoinGape reported earlier, Bitwise also filed for Sui ETF with the US SEC. It comes as the commission approved multiple ETFs tracking altcoins such as XRP, DOGE, and SOL.

Will SUI Price Gain Upside Momentum?

SUI trades near $1.44 with a $5.46 billion market cap, down from highs but bouncing back amid network demand such as 616,000 daily active users and 4.3 million transactions per day.

The 24-hour low and high are $1.43 and $1.46, respectively. Furthermore, trading volume has decreased by 32% over the last 24 hours, indicating a decline in interest among traders. However, a 54 million token unlock worth almost $80 million next week could increase selling pressure.

The derivatives market showed massive buying activity in the last few hours, as per CoinGlass data. The total SUI futures open interest jumped 7.30% to $728.66 million in the past 24 hours. At the time of writing, 4-hour XRP futures OI climbed 2.60%, up nearly 1% on Binance, OKX, and Bybit.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs