These On-Chain Indicators Offer Insight Into the Next Ethereum (ETH) Price Action

The world’s second-largest cryptocurrency Ethereum (ETH) has also been under strong selling pressure moving to $1,200 amid the market shakeout caused by the FTX collapse. As of press time, ETH is trading 4.3% up at a price of $1,282 and a market cap of $156.9 billion.

The on0-chain indicators hint at new interesting developments. Over the last year, the Ethereum shark and whale addresses have been shedding much of their supply. But since the FTX collapse last month, there’s an interesting trend reversal observed.

Since the implosion of the FTX exchange, all the Ethereum addresses holding between 100 to 1m coins have accumulated 1.36% of the overall ETH supply. This jump in the total large addresses of Ethereum hints at a bullish momentum going ahead.

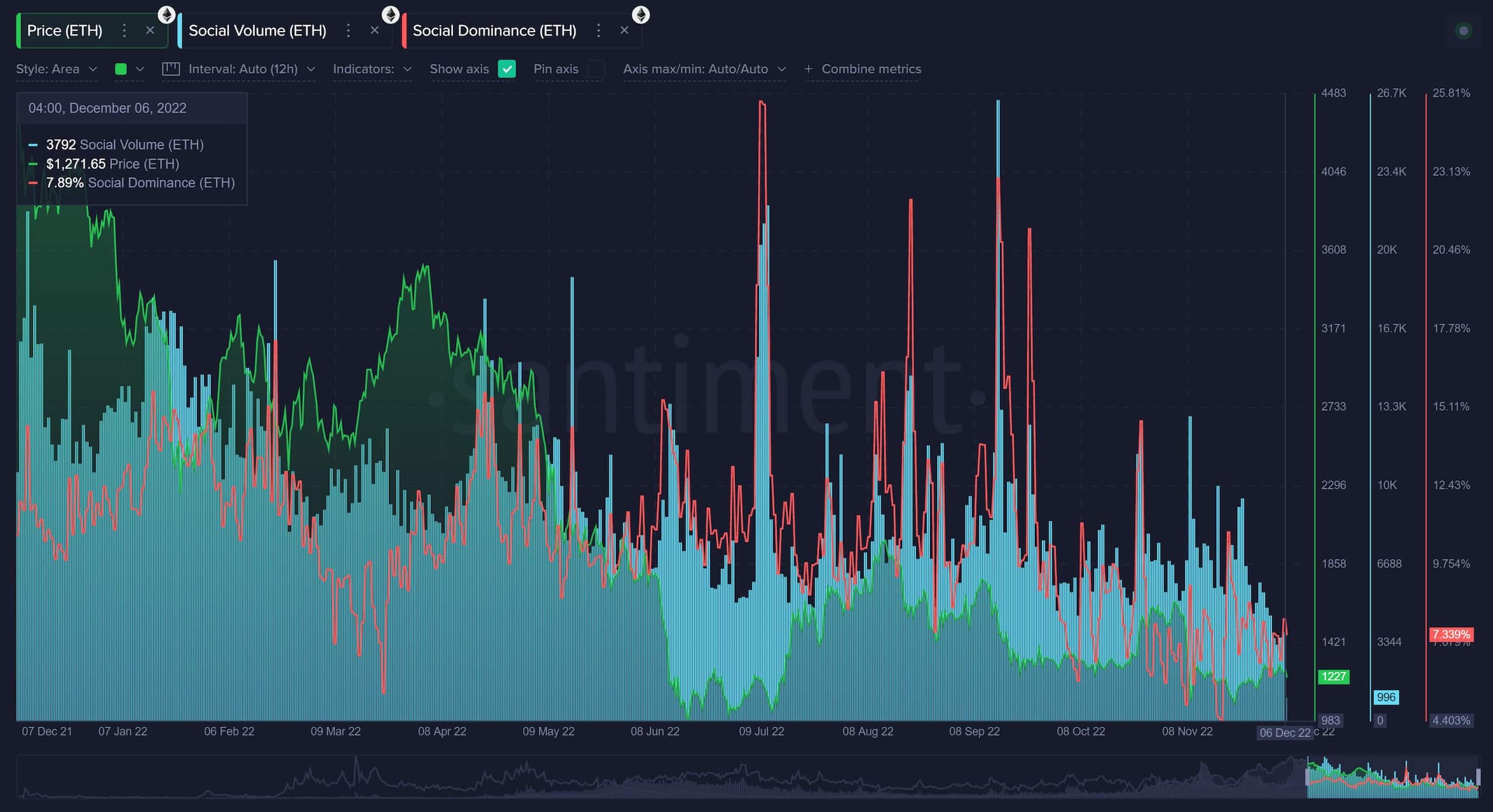

Ethereum (ETH) Social Volume, Dominance, and Exchange Supply

Since the Merge event in mid-September 2022, the discussion around Ethereum has been on a decline. Since late October 2022, the discussions around Ethereum have dropped to the lowest percentage among the top 100 assets. On-chain data provider Santiment notes:

The lack of interest since The Merge event is indicative that whales, could push up prices with little resistance, making this a bullish metric.

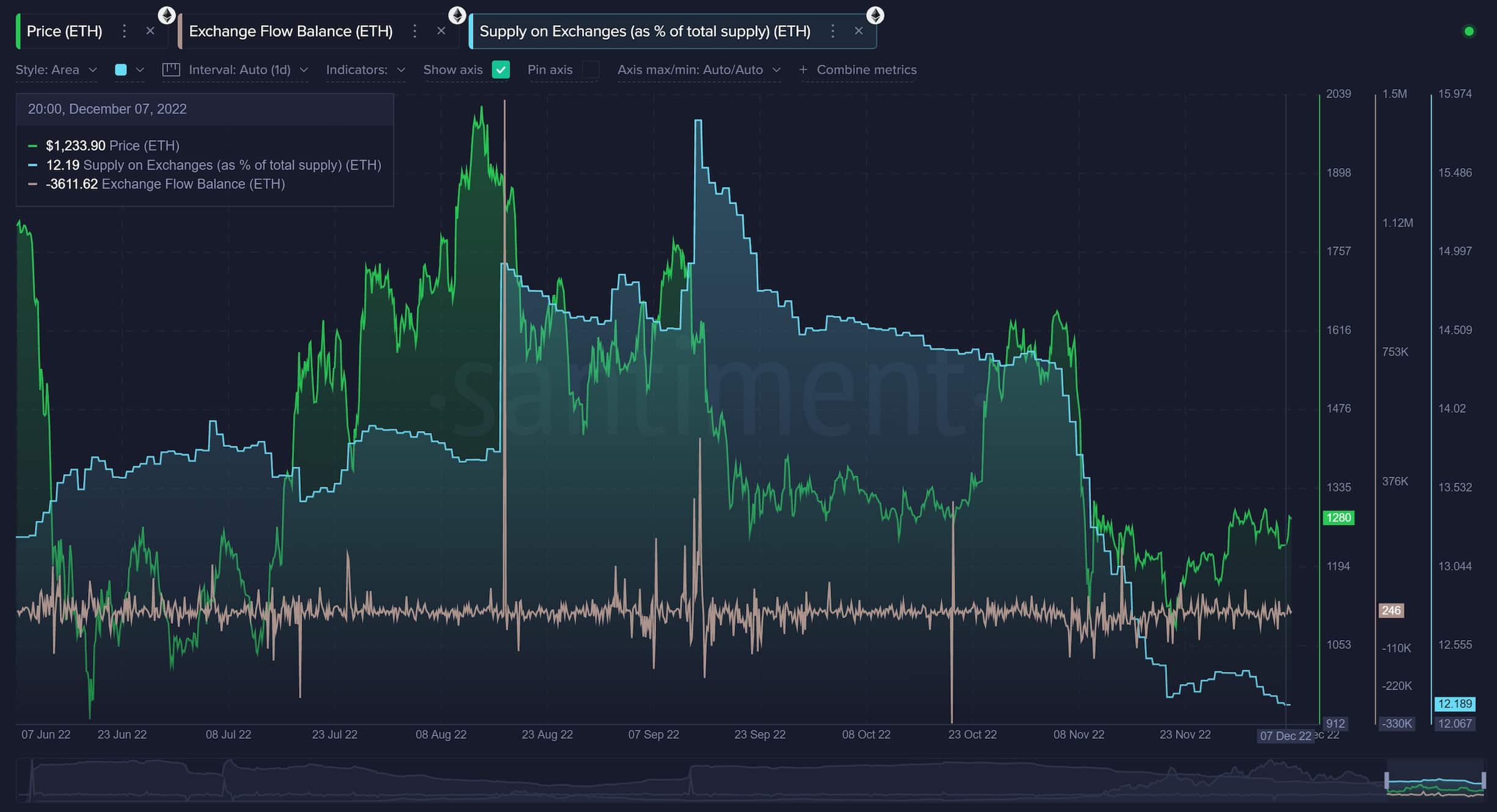

Another bullish indicator is that the ETH supply sitting on exchanges has dropped massively over the last month. Only 12.1% of the total ETH supply sits on the exchanges which is now at a four-year low.

There’s been a 75% drop in the ETH supply on exchanges in the last 13 months. However, if all these ETH start coming to exchange, it could trigger more sell-offs. But indicators for the same are not round the corner.

The Santiment report notes: the more the supply of ETH on exchanges declines, the better of a case that can be made that we’re nearing a bottom. For that reason, we certainly have to consider this metric as a bullish indicator for Ethereum.

During the FTX collapse, there were a large number of shorts by the trader. This led to ETH short liquidations on the exchanges, leading to a 17% price jump in ETH, as expected. Currently the funding rates are neutral and we can’t say in which direction the next liquidations would happen.

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Launches Euro Stablecoin On XRPL With Ripple Support

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum