This Dapp Rocked in 2017 But Now Has No Users; Is DeFi Dapps Next?

In 2017-2018, at the height of the crypto mania, fueled by ICOs, dapps, or decentralized dapps were the in-thing. They rocked.

And supporters were over the moon considering the number of solutions Ethereum and blockchain applications, immutable, secure, and valuable, offered to end users.

The Dapp Field is broad

Dapps encompassed more than “normal” applications—games, gambling sites, and digital valuables, but also entails the futuristic oracle and prediction markets, sites, and more.

The list was endless.

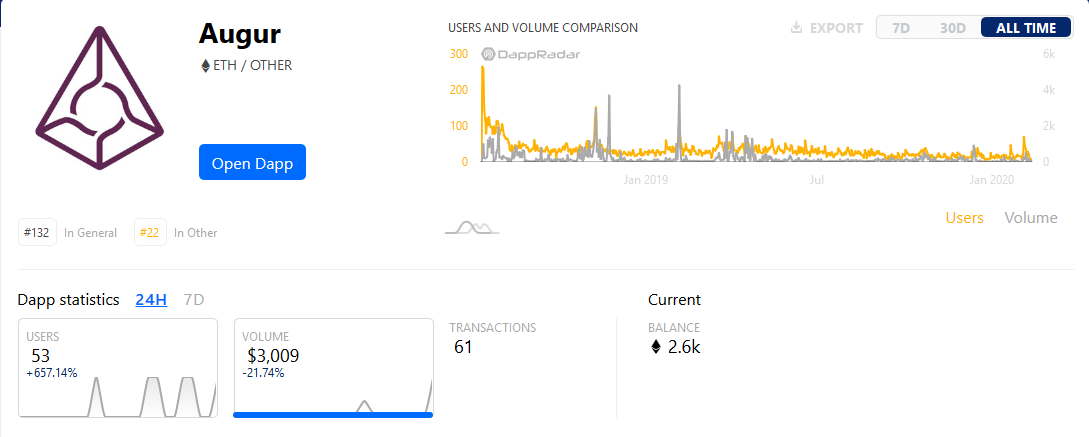

However, barely three years down the line, they are struggling to retain users, with the most promising of them all, Augur, averaging roughly 16 people per day according to statistics from DappRadar.

The case of Ethereum and Augur

Augur is a predictions market that dominated headlines back, drawing funding, and highlighting Ethereum’s capabilities.

There, as a prediction market, it describes itself as a “world’s most accessible, no-limit betting platform.” Augur version 2 was designed from the ground up, and there one can “bet how much he/she want, from anywhere in the world, on sports, politics, finance and more.”

These opportunities, it appears, are not being exploited to full, and the platform under-utilized.

Augur Users is Extremely Low for its Valuation

Data from DappRadar reveals that in the last week, there have been 117 users, generating trade volumes of $75,454 from 251 transactions.

But it gets worse. In the past day, only 53 users are active, and up 6.5X meaning on average, the platform attracts 8 users.

This is dismal performance, and reveals a multi-million platform that is struggling to retain users despite being valued over $174 million.

This was captured by one observer, who highlighted the troubles faced by dapps, not only in Ethereum but in other smart contracting platforms:

“2017’s buzzword was Dapp 🙂 One of the most promising Dapp’s according to Eth people was Augur. Last 7 days it had 78 users, averaging 11 user per day. Still valued at $174 million. Defi buzzword will follow a similar path.”

2017's buzzword was Dapp 🙂 One of the most promising Dapp's according to Eth people was Augur. Last 7 days it had 78 users, averaging 11 user per day. Still valued at $174 million.

Defi buzzword will follow a similar path. @udiWertheimer pic.twitter.com/WgNkYvxelj— Stackmore?⚡️? (@1971Bubble) February 11, 2020

Is DeFi Dapps Next?

While argument is that the field is still “nascent” and largely experimental, it begs the question of whether we will observe this boom and bust cycle in the wildly popular DeFi. Note, the amount of ETH currently locked in DeFi is over $1 billion.

So far, Ethereum’s are popular, and users have a new way of borrowing and lending at above market rates.

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- XRP Seller Susquehanna Confirms Long-Term Commitment to Bitcoin ETF and GBTC

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards