This Is Why Ethereum (ETH) Recovered Sharply From Below $1K

Ethereum (ETH) has recovered steadily after slumping below $1,000 earlier this month, as traders rushed in to accumulate the token at lower levels.

ETH is trading at $1,225- up nearly 27% from a low of $897 touched earlier this month. A series of liquidations in big holders had caused a large amount of tokens to be dumped onto the market, causing a major price drop.

But the fall below $1,000 also appears to have attracted bargain hunters, who expect the token to rise substantially after the blockchain moves to proof of stake.

Traders also see lesser sell-side pressure on the token, given that a number of overleveraged positions have now been liquidated.

Data from Coinglass also shows that the pace of ETH liquidations has fallen drastically over the past week, after skyrocketing earlier in the month.

ETH balance on exchanges on a continued downtrend

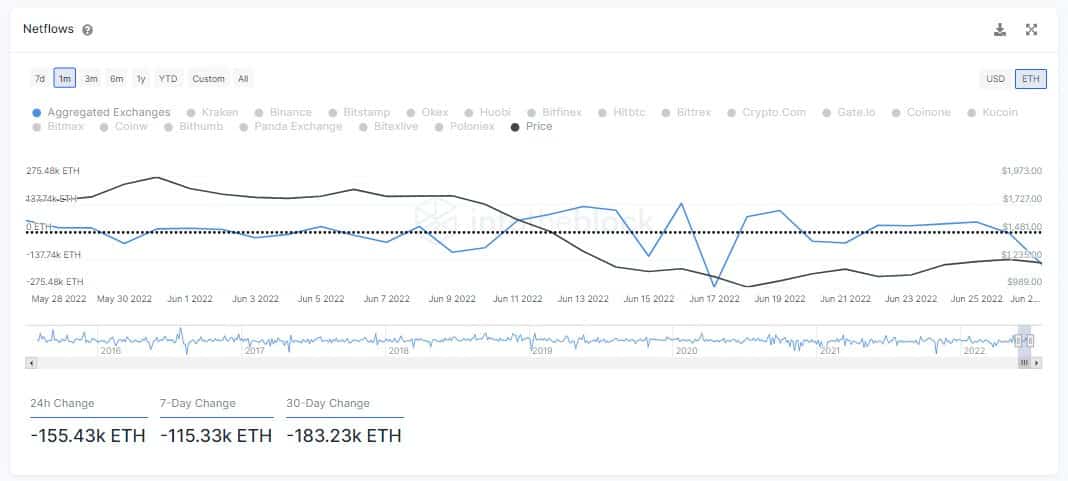

Data from blockchain analytics firm Into The Block shows that ETH balance on centralized exchanges has fallen to new lows. This trend reflects that traders are likely accumulating the token by moving it off-exchange, reducing its active supply.

According to Into The Block, a total of 183.2K ETH- roughly $223 million- has been withdrawn from centralized exchanges in the past 30 days.

Sentiment still shaky despite recovery

But traders remain cautious of any further price headwinds, given that macroeconomic factors are largely detrimental towards crypto markets.

ETH remains sensitive to any more liquidations, especially after hedge fund Three Arrows Capital, a major holder, defaulted on a $660 million loan. The fund may be forced to liquidate more of its holdings to repay its creditors.

ETH prices are also sensitive to any news on the merge. A recent hiccup in deploying the merge on a testnet rattled traders. Focus now turns to an upcoming deployment on the Sepolia testnet in early July.

If successful, the move could help ETH prices recover further. The world’s second largest crypto is trading over 60% down so far in 2022.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

Buy $GGs

Buy $GGs