This Stablecoin’s Market Cap Skyrockets Amid FUD In Tether, UST

The crypto market crash last week has vastly shaken the crypto industry, with volatility witnessed in stablecoins too. The de-peg of TerraUSD (UST) and a brief decline in Tether (USDT) saw redemptions of more than $30 billion in top stablecoins in a week. Interestingly, the only stablecoin thriving from the volatility is Circle’s USD Coin or USDC.

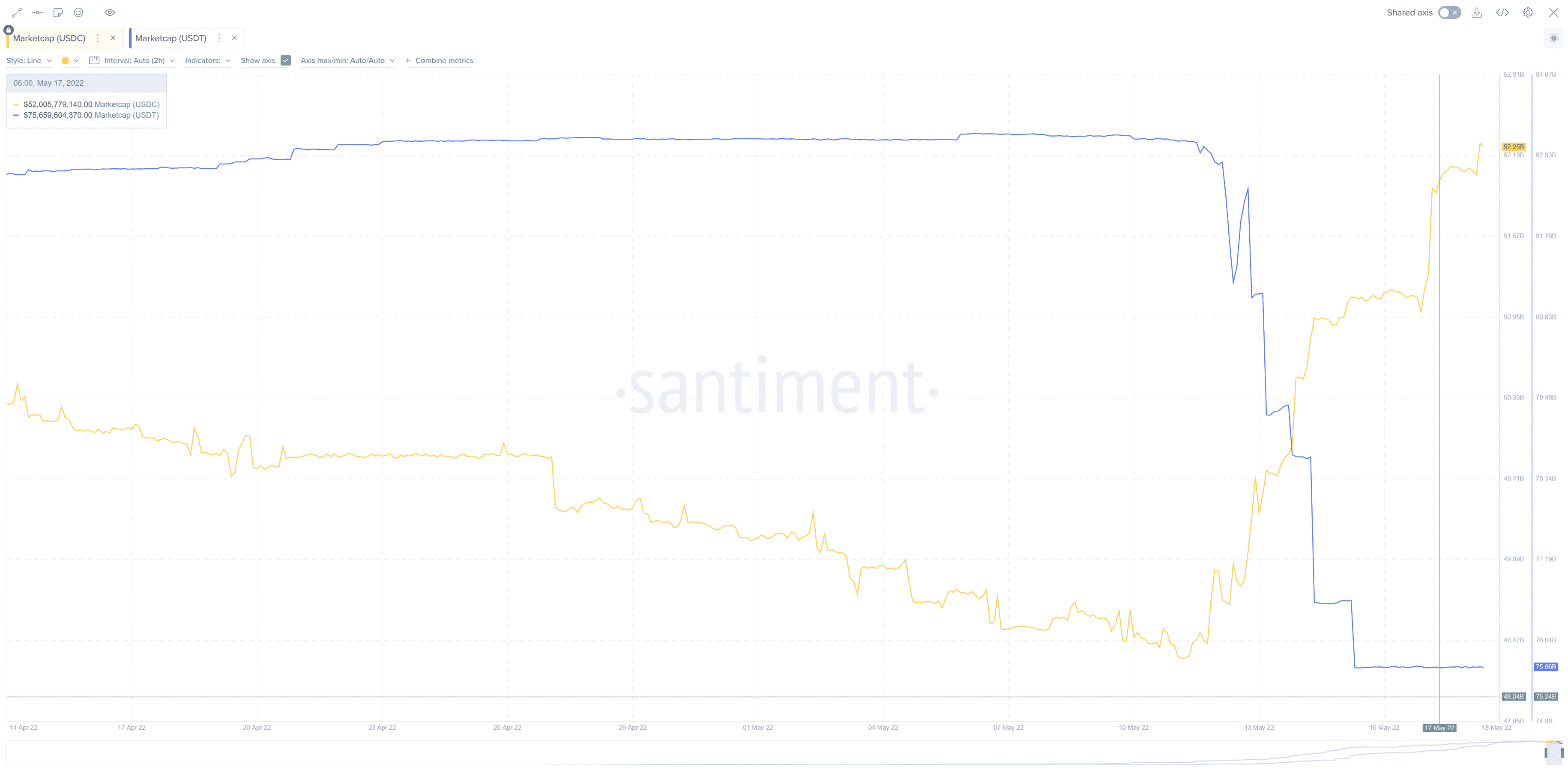

The USDC’s market cap skyrocketed more than 10% from $48 billion to $53 billion since May 11th. The decline in other stablecoins led Circle to mint more than 10 billion coins in the last two weeks.

USDC Becomes Preferred Stablecoin Over Tether (USDT)

Tether (USDT) and USD Coin (USDC) are collateralized stablecoins that rely on a reserve of US dollar and dollar-equivalent assets to support their supply. On May 9, Terra’s algorithmic stablecoin UST lost its peg with the US dollar. It resulted in massive sell-offs in the crypto market and redemptions in stablecoins.

On May 12, Tether’s USDT stablecoin declined to $0.95, losing its peg to the stablecoin despite being a collateralized stablecoin. This wreak havoc and USDT along with other stablecoins started losing their market cap.

Meanwhile, USD Coin’s market cap started to rise as traders shifted from the largest stablecoin USDT to USDC. Till now, USDT is trading below $1 despite major support from the Tether team.

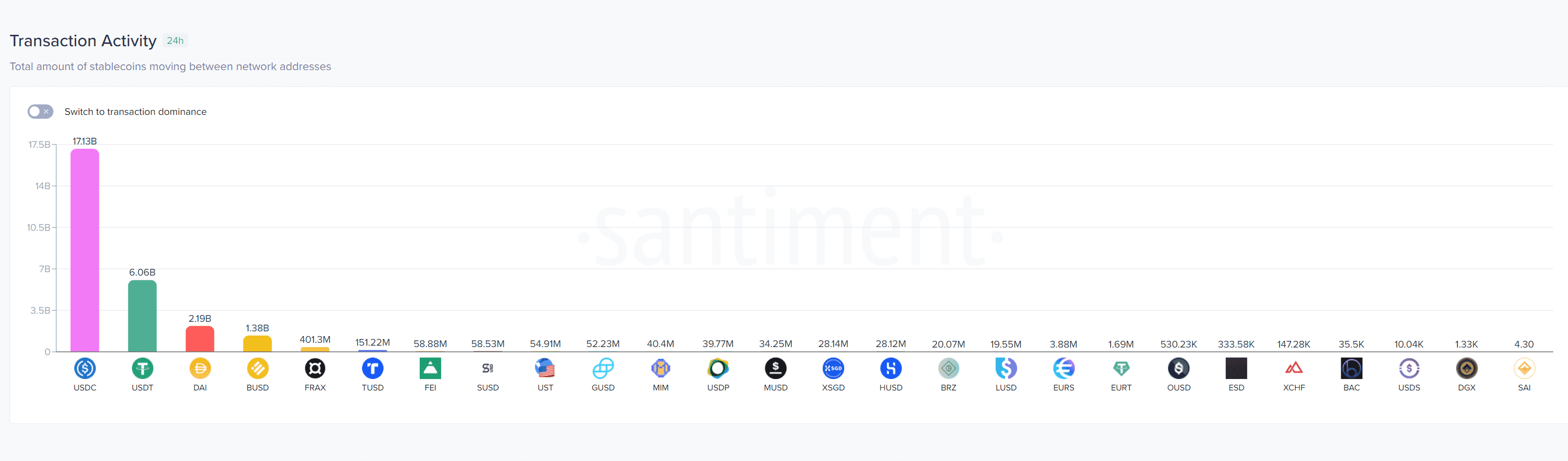

The data on USDC and USDT market by Santiment shows how the USDC has benefitted from the fall in USDT. The redemptions of USDT have continued to date. Meanwhile, the USDC transactions have also increased significantly in comparison to other stablecoins.

Stablecoins Transaction Activity. Source: Santiment

Whales’ accumulation of USDC has increased since the USDT and UST FUD. In fact, Circle’s USDC stablecoin has become the top purchased token by 500 biggest ETH whales in the last 24 hours.

Circle’s USD Coin Sees Massive Adoption

USD Coin is witnessing massive adoption due to its transparency and stability. Exchanges such as Kucoin and OKX are adding USDC trading pairs as the market demand booms.

Commenting on the USD Coin stability amid the bear market, Circle’s CEO Jeremy Allaire said:

“We’re doing a lot of what we’ve always done, which is try and build the most trusted, most transparent, most compliant model possible for this. There’s a reason why there’s been a flight to quality. There’s a reason why over the past week, USDC has seen strengthening, material strengthening.”

In fact, the leading crypto exchange FTX has also announced allowing customers to fund their accounts with the USDC stablecoin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs